The profit & loss statement is the go-to report for many trade and construction business owners to understand the health of your business and see how they’re going.

Each week, month or quarter, they log in to their accounting software, generate a profit & loss report, and make a judgement of their performance based off what’s written in the top-line (sales revenue) and the bottom-line of the report (net profit).

But while this report can be a handy insight into your performance from a profit perspective, it doesn’t tell you much at all about how to put more money in your bank account, or more importantly, if you’re making any money in the first place!

And this is because CASH and PROFIT aren’t the same thing.

Cash and Profit Aren't The Same Thing

If you want to earn more money in your trade business, you don’t want more profit… You actually want more CASH!

And there’s a massive, massive difference between profit, and cash.

One of my favourite sayings is revenue is vanity, profit is sanity, and cash is reality.

Cash is what funds the business, not profit. And cash is also what hits the bank account, not the paper profit you see on the profit and loss statement.

This is why so many business owners look at their profit and loss and wonder why that profit isn’t sitting in the bank account.

The only real fact in your business is cash. You can’t pay bills or pay wages with profit; you need cash!

Without cash, it’s game over.

This is why you cannot make decisions solely based off what your profit and loss statement is telling you because it only tells you how much profit you’ve made.

And profit is purely paper based. It’s the paper-based result of the profit and loss statement. Revenue, minus COGS, minus overheads, minus tax, equals Net Profit.

But the problem with that formula is it tells you nothing about assets purchased, how much money you’re owed, when you’re paying suppliers, works in progress, director loans… all factors that impact cash.

And they’re not found on the profit and loss, they’re found on the balance sheet.

So, to get the full picture of your business (and your money), you also need to understand your balance sheet.

Understanding The Balance Sheet

Understanding the balance sheet can be a challenge because it can seem more complex than the profit and loss statement.

And in some regards, it is, because it doesn’t have that natural flow that the profit and loss statement has that makes it easy to understand.

But you still need to understand it because profit on paper doesn’t pay bills, cash does. So, to uncover how much cash you’ve made, you do this by looking at both your profit and loss statement and your balance sheet.

And our goal in this article, is to help make this really simple.

The Story Of Trade Business Cash Flow

If you want to earn more money, you need to make more cash, and to understand your cash, you need to see it as a story that is told over 4 chapters.

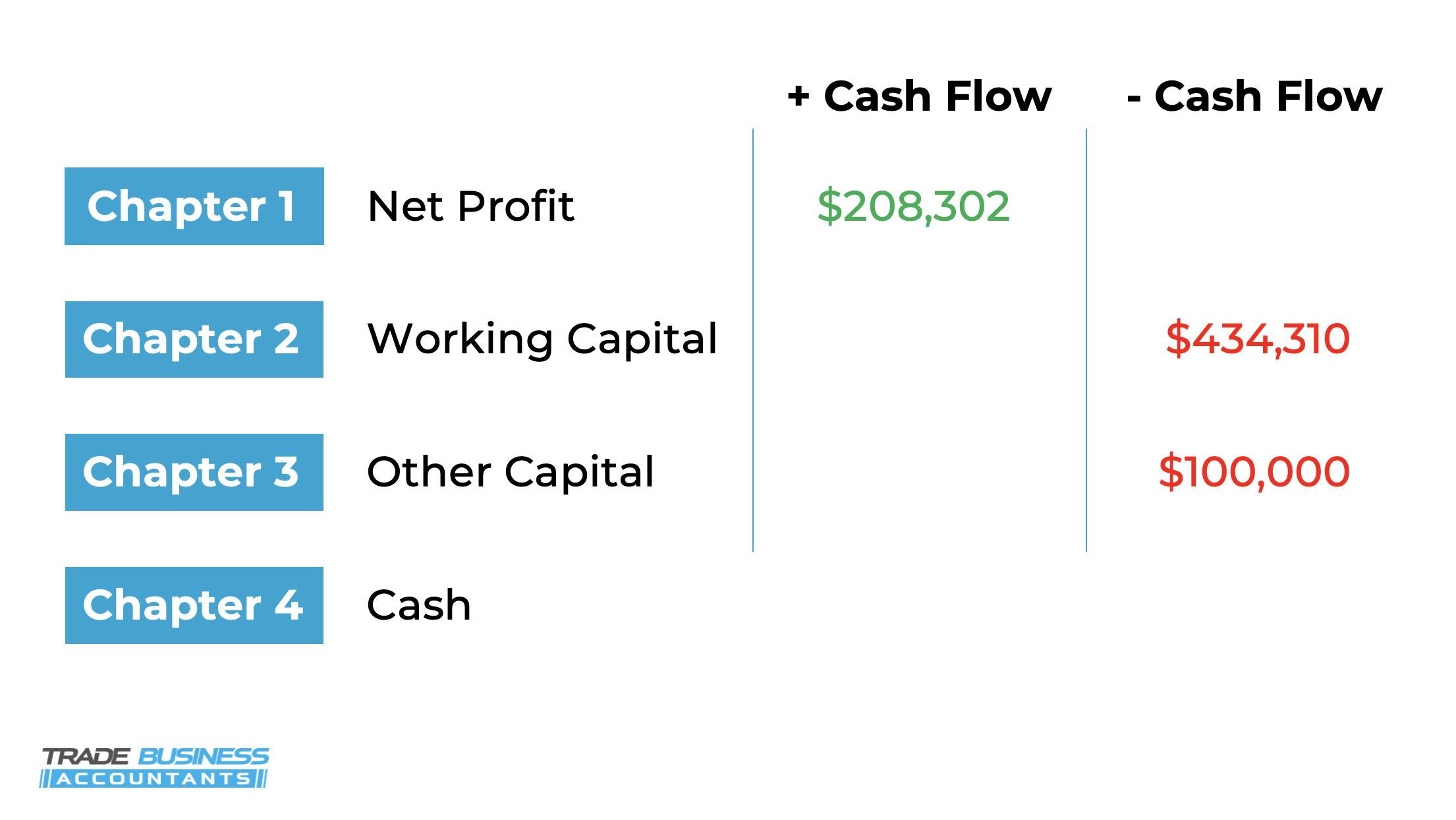

Net Profit – Working Capital Invested – Other Capital Invested = Cash

Now, if you’re not quite sure what this means, bear with me, because I’m going to break all 4 chapters down one step at a time… starting with chapter one.

Chapter One: Net Profit

Net Profit is the profit your business makes after every cost has been factored in. You’ll find this at the bottom of your profit and loss statement.

As we’ve outlined, this is where most trade business owners live.

But as the famous Alan Milts explains, understanding the cash in your business is like reading a murder mystery. You cannot read chapter one of the book and then expect to uncover who the killer is. If you want to know what’s really going on, you have to read the whole story.

And the same is true for Cash!

Revenue might be growing, margins might be up, profit could be increasing, but this does not tell you how much cash you’ve made… you have to keep reading.

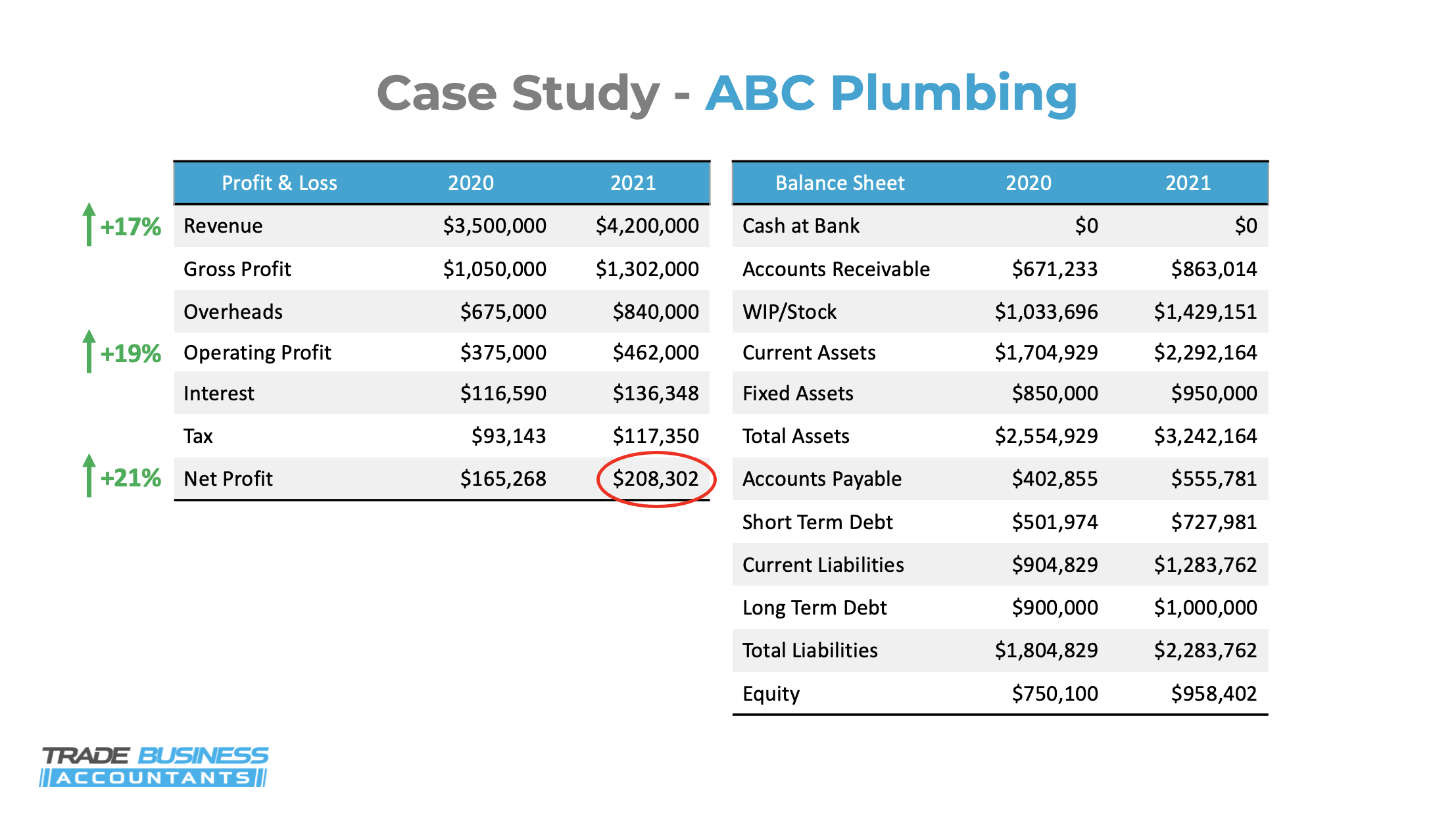

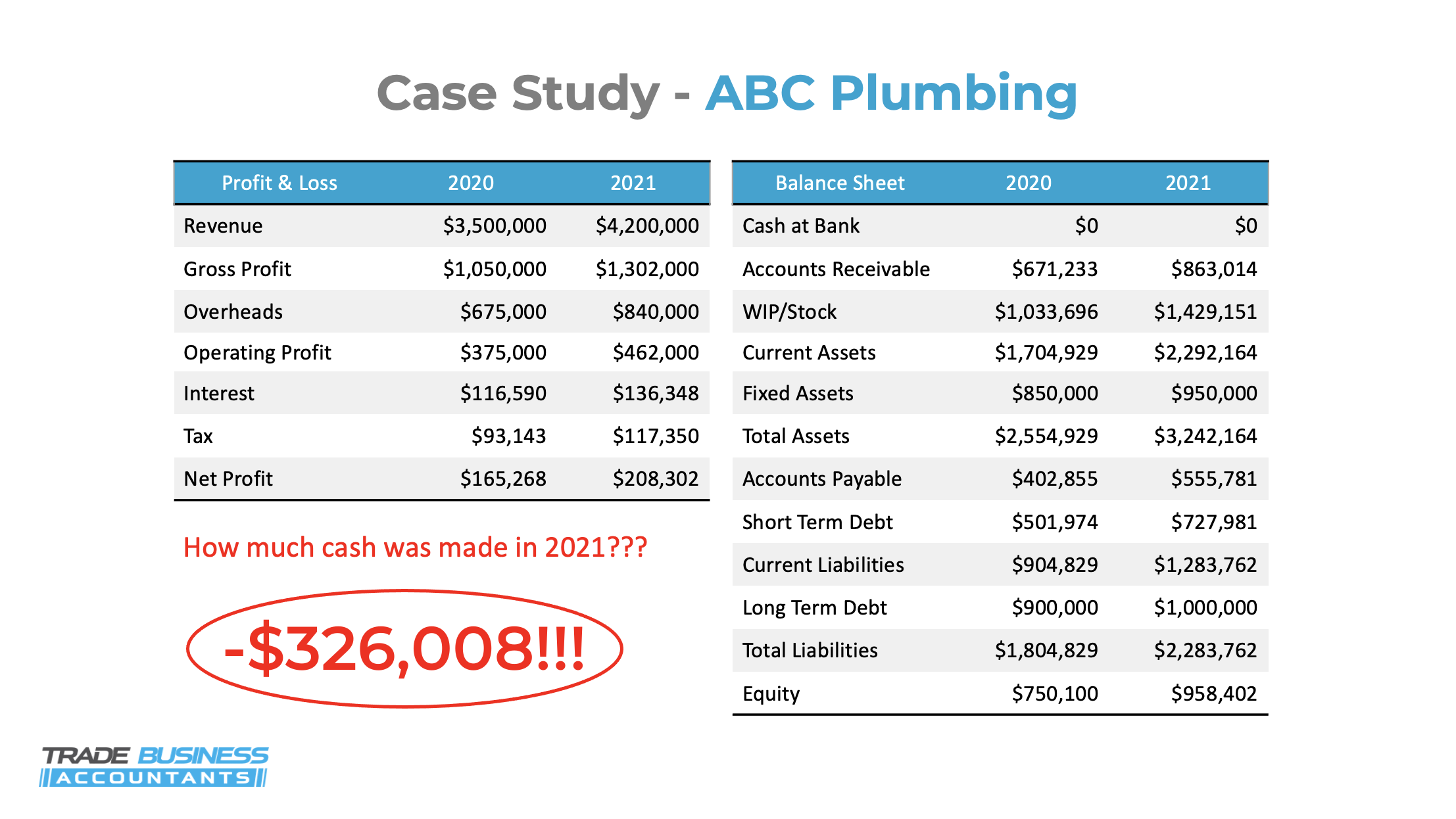

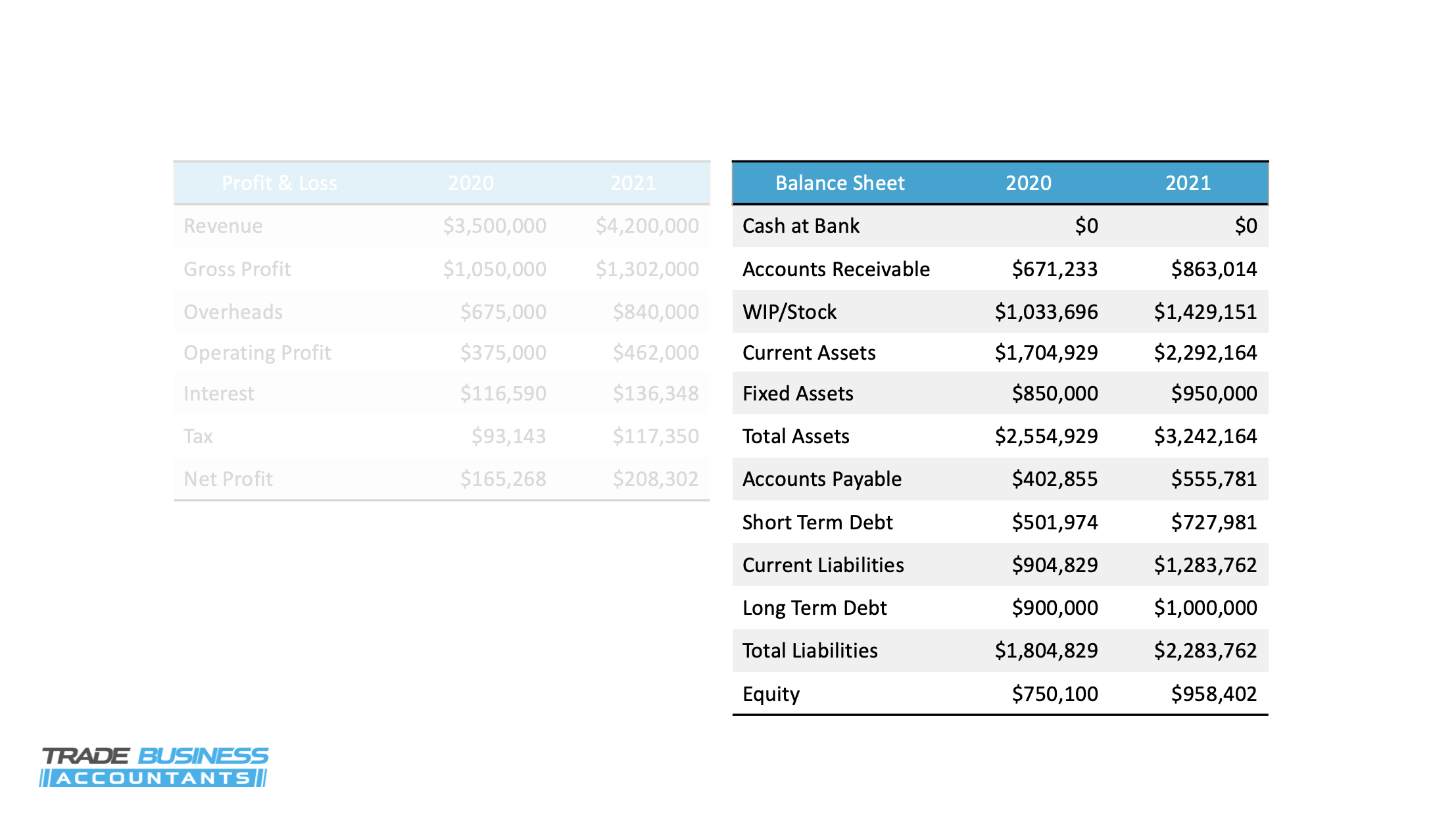

To prove this point, let’s look at an example. In 2021, ABC Plumbing had grown revenue by 17%, operating profit by 19%, and net profit by 21%. Business appeared great…

But looking at these financials from a cash perspective, not just paper profit... how did they go? How much cash was made?

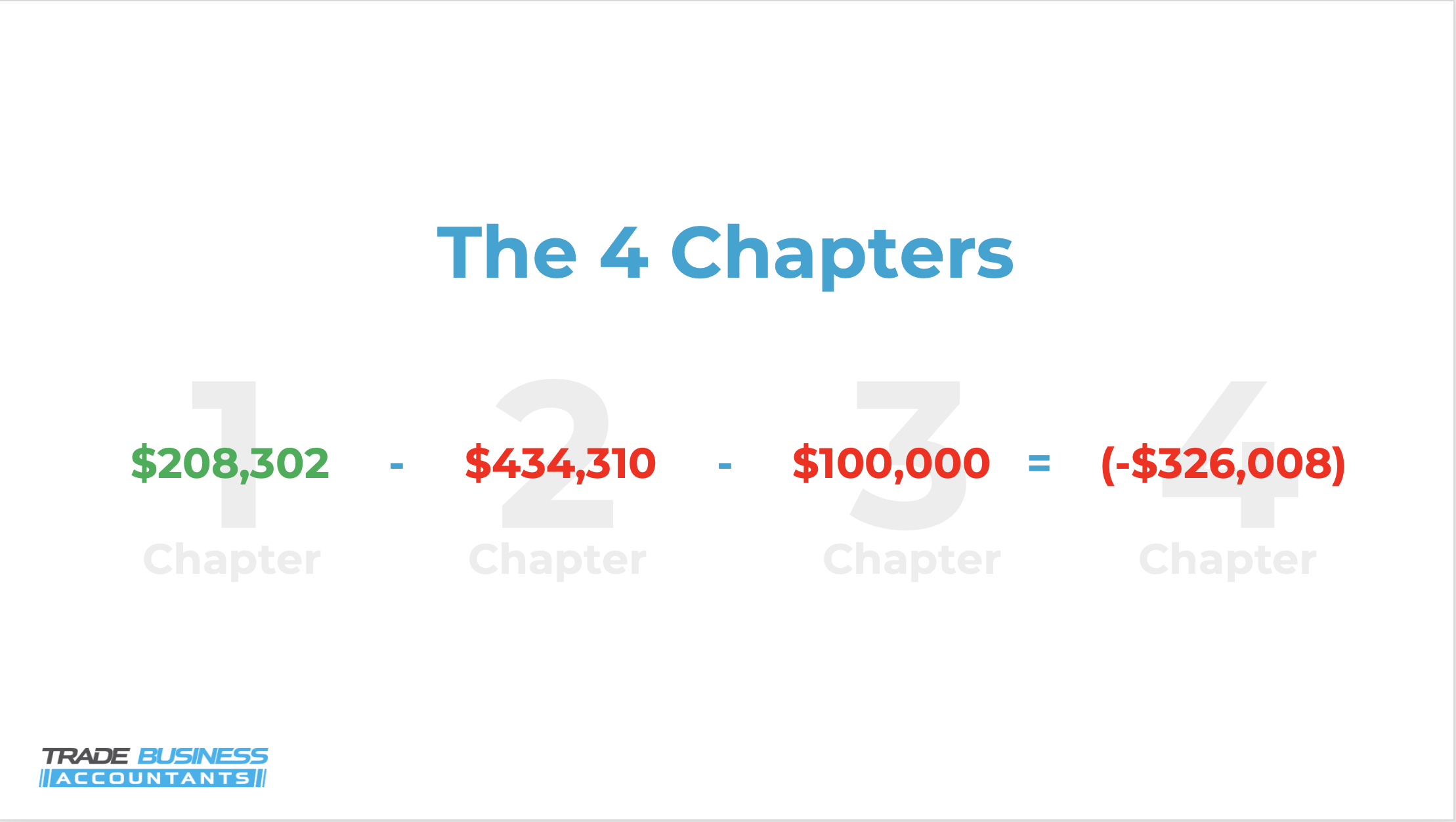

Well despite what the profit and loss was telling them, they actually LOST NEGATIVE $326,000 in cash!!!

This is why we must read the whole story… not just chapter one.

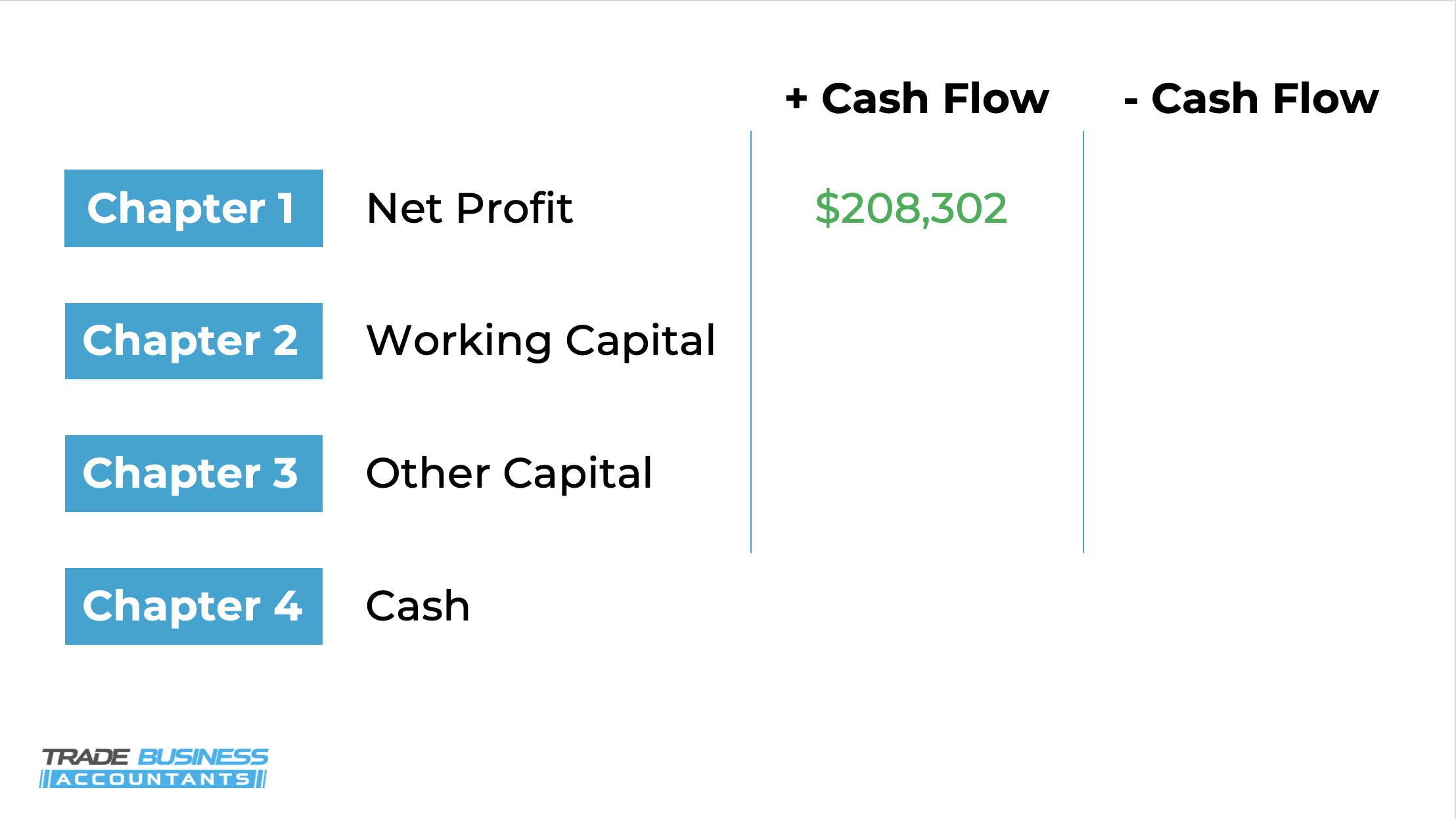

Chapter one net profit in this instance, was $208,302.

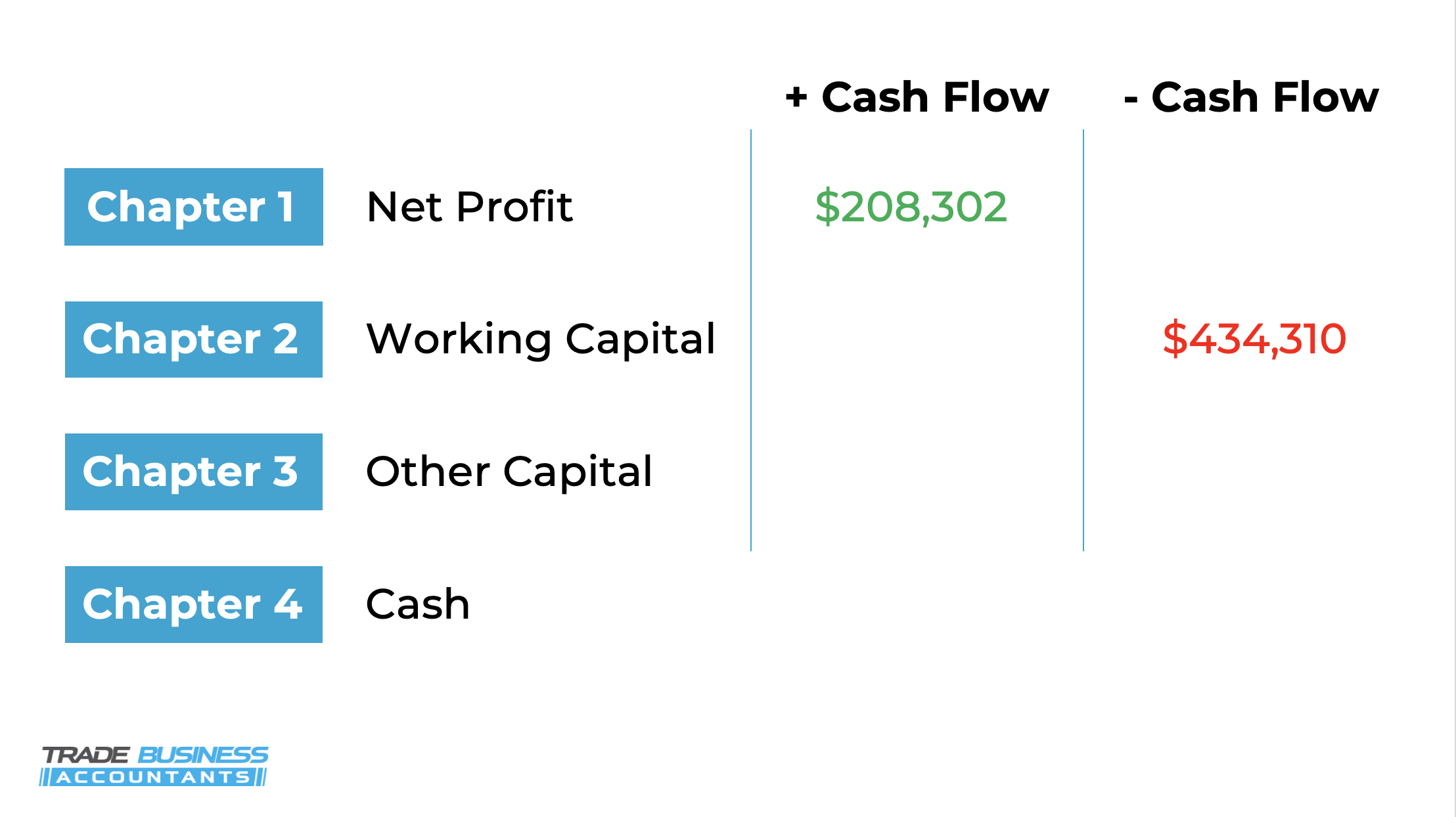

And looking back at the 4 chapters, this is where it sits in the equation.

You can also see that it’s sitting in the left-hand column that positively effects cash flow.

This is because increases in profitability have a positive effect on the cash flow of your business.

The more profit you make (assuming you’re collecting all of it), the more cash you’ll generate in your business.

We now look at chapter two.

Chapter Two: Working Capital Invested

The next chapter we need to look at… is chapter two, working capital invested.

Working capital is simply the amount of cash needed to run your business over the short-term. This is where the balance sheet now comes in.

There’s a lot going on here, but out of everything listed in the balance sheet, there are only three lines that you need to worry about when it comes to working capital:

1. Accounts receivables

2. Works in progress (WIP) or Stock

3. Accounts payable

Your accounts receivables is just a fancy word accountants like to use to explain the money owed to you from your customers.

Your WIP or works in progress are the work you’ve done at your expense that you’ve not yet invoiced for.

Your stock is similar to this, it’s just the supplies you have on hand that are waiting to be allocated to a job, to then be invoiced.

And then finally, there’s your accounts payable, which is the money you owe to your suppliers.

These 3-line items make up your working capital because they largely determine the amount of cash coming in and going out of your business from an operational perspective in the short term.

For chapter two of your story, you want to calculate the working capital INVESTED this year on top of last year because this will show if the profit made this year was used to fund any increase in working capital from the year before.

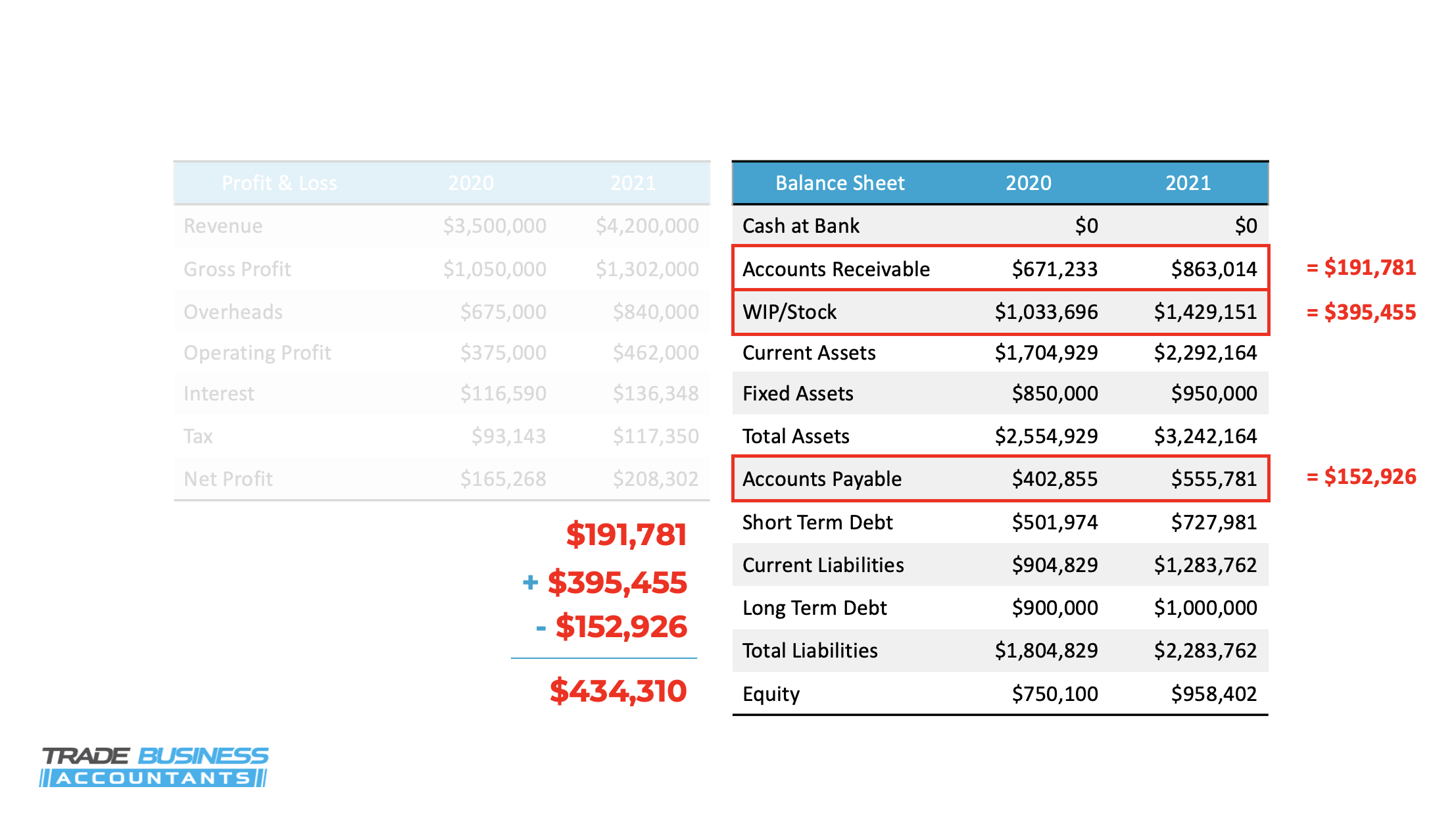

To do this, the formula is: Difference in accounts receivable (that is the difference between 2020 sand 2021), plus the difference in WIP or Stock, minus the difference in accounts payable, equals the working capital invested.

So, if we look back at our balance sheet:

Accounts receivable has increased $191,781 ($863,014 minus $671,233).

WIP or stock has increased by $395,455.

And accounts payable has increased by $152,926.

That means, all up, the business has invested an extra $434,310 in working capital in 2021 compared to 2020.

So, looking back at the 4 chapters again, this is where Working Capital Invested sits in the equation:

Now, you can see here that it’s sitting in the right-hand column that negatively effects cash flow.

This is because the more working capital, the more cash your business needs to fund operations.

Once we know the total increase in working capital, we then arrive at chapter three.

Chapter Three: Other Capital Invested

Anything outside of working capital on the balance sheet, we just call 'other capital'.

These are complicated accounting terms like accruals, repayments, provisions, deferred tax, other current assets, and liabilities, etc. that have little to do with the operational management of your business. So, just leave that for your accountant and group them together as other capital.

To calculate other capital, we again need to look at the balance sheet.

To calculate other capital, we again look at the balance sheet.

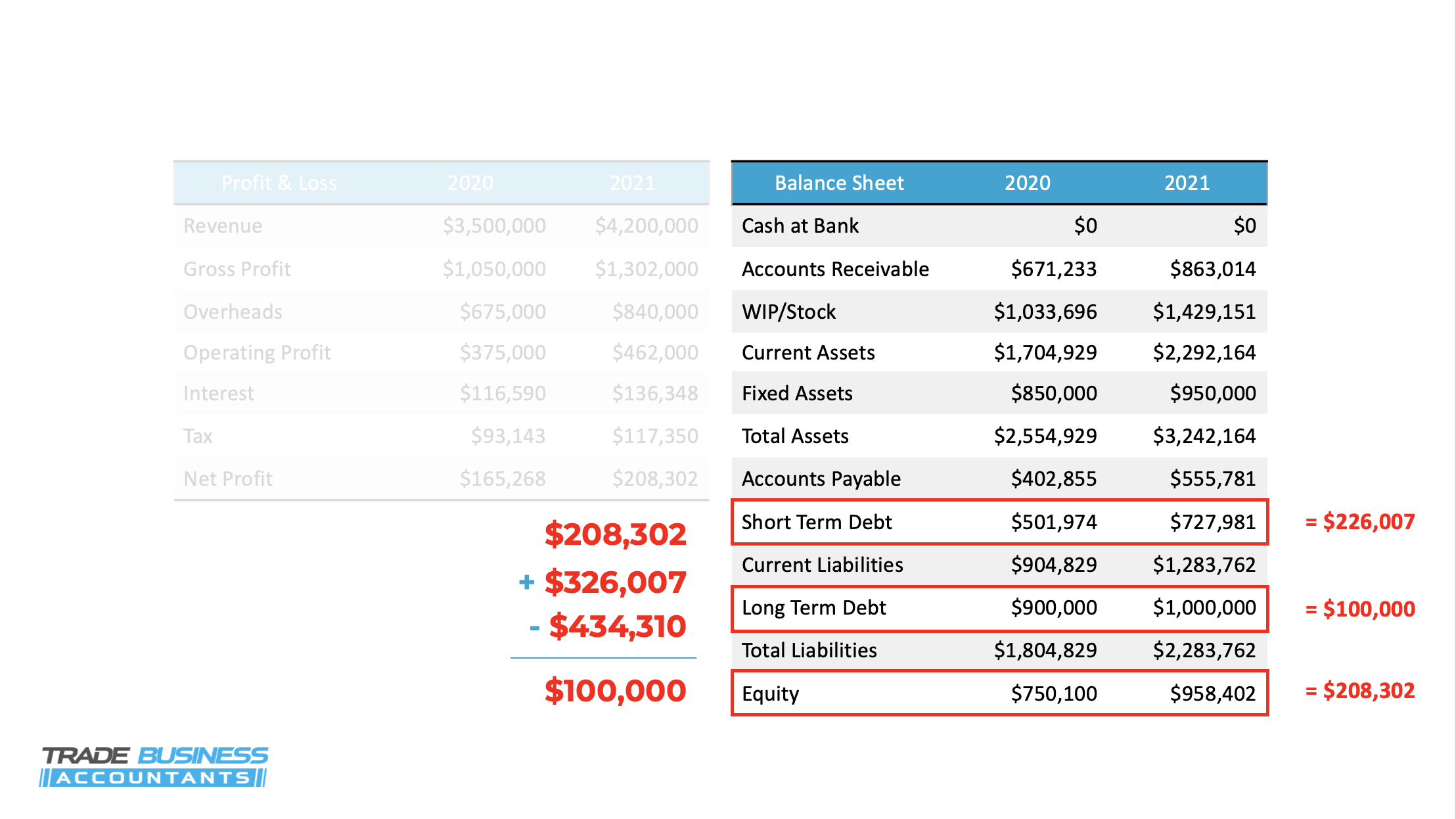

The formula is: Difference in equity (the value returned to shareholders if all assets were sold and all debts were paid off), plus difference in debt (the value that is owed to creditors like banks), minus Working Capital Invested.

The combination of the debt and equity represents the total increase in funding, or capital, in the business in 2021, used to fund the increasing cost of operations in 2021.

So, by subtracting the working capital invested figure from this total, we can calculate the leftover, which is other capital invested in 2021.

So, looking at the balance sheet:

Equity has increased by $208,302.

The combination of short term and long-term debt has increased by $326,007.

That means, all up, once we subtract the working capital amount of $434,310, the business has invested an extra $100,000 in other capital in 2021.

So, looking back at the 4 chapters again, this is where Other Capital Invested sits in the equation:

Now, you can see here, it’s also sitting in the right-hand column, negatively effecting cash flow.

This is because, like working capital, the more you invest in other capital, the more cash that is getting drained from your bank account.

Which brings us to the final chapter of our story.

Chapter Four: Cash.

The final chapter is cash.

Cash is what matters most. The money left over after everything else has happened.

To calculate Cash, we now just revisit our original formula:

In this example, as I said, after making $208,302 in Net Profit, ABC Plumbing had actually lost $326,000 in cash.

Which hopefully proves just how important understanding the entire story of your numbers is.

If ABC Plumbing were to continue just living in their profit and loss statement and focusing on what chapter one was telling them, they would have been fooled into thinking that business was great.

And they wouldn’t have known where all their money was going and things could have gotten much, much worse.

So, while chapter one, net profit, in this case was up $208K… we needed to read the entire story to get the full picture of their cash and how much they were earning.

Cash Is What Matters Most In Business

You cannot afford to only make decisions based off what you see on your profit and loss statement because it’s only one chapter in the four-chapter story of your numbers.

If you get your head around this, it will change the way you operate forever.

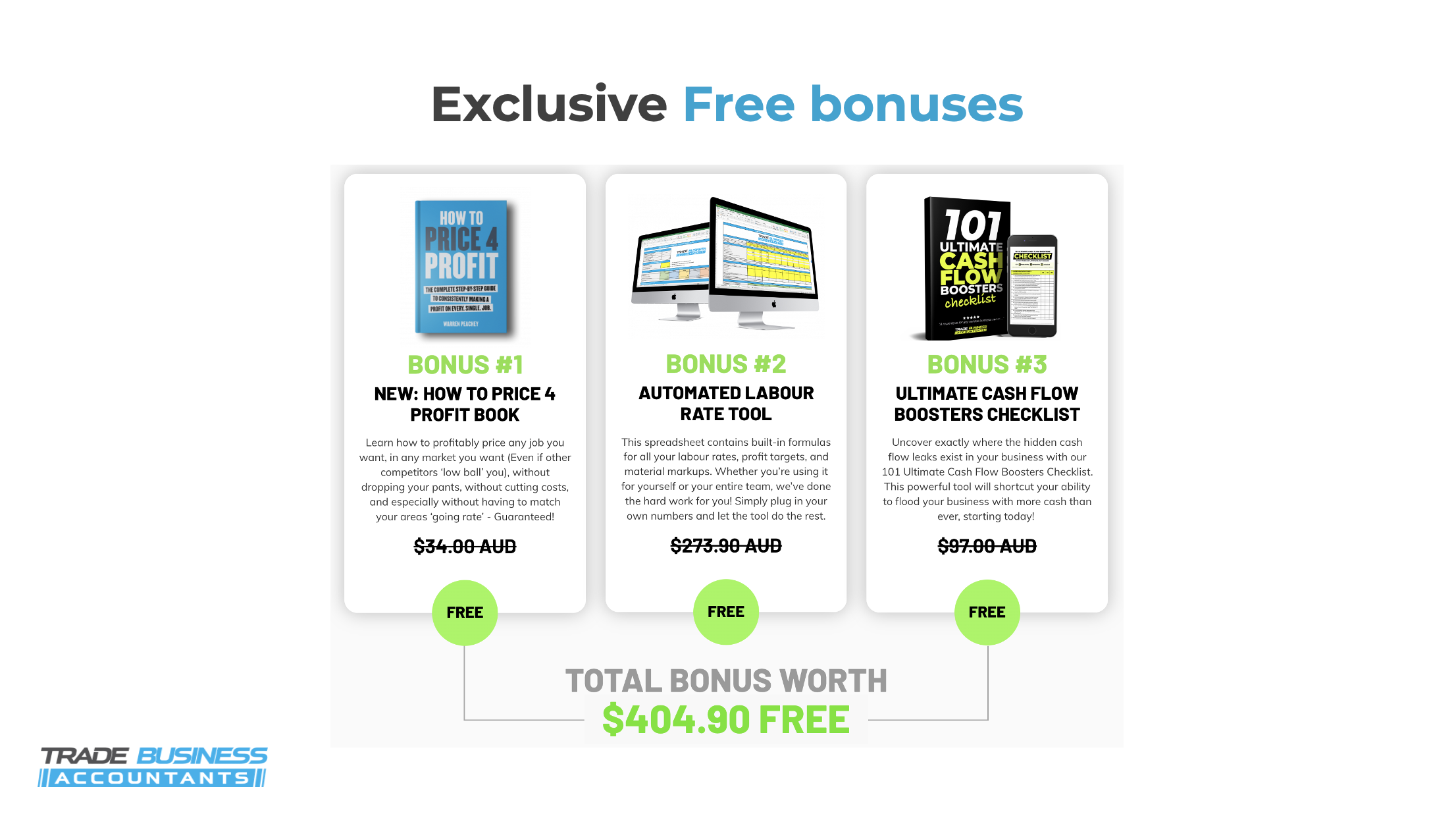

Now, if you’d like to see more on this topic, I’ve just launched a brand-new masterclass where I take the time to run through exactly how all of this works in step-by-step detail, with real client case studies, and I also give a whole bunch of actionable strategies that you can use to skyrocket the cash in your business pretty much straight away…

And there’s even a bunch of exclusive free bonuses:

If this interests you CLICK HERE TO LEARN MORE.

If you're an electrician, plumber, painter, carpenter, or any other tradie business owner turning more than $1M a year looking for assistance with your tax, accounting, bookkeeping, and business advisory - click here to learn more!