If you want to learn how to flood your bank account with more cash.

Then this article was tailor made for you.

Because today we’re getting SEAL Team 6 level tactical.

Giving you an exclusive sneak peek into our closely guarded vault of highly coveted money-making secrets.

But first… something you may not know about me.

While my professional qualifications label me as an accountant.

My family have run multiple 7 and 8 figure trade businesses for over two generations now.

Through all the highs and sometimes extreme lows.

I’ve witnessed firsthand the importance of mastering cash flow…

You’re flat out.

Plenty of jobs on the run.

Working your ass off.

Doing all the right things to grow your business.

But the bottom-line figure on your profit and loss doesn’t reflect what’s actually sitting in your bank account.

So despite being really busy…

Cash comes in. Cash goes out.

Like a rollercoaster ride through a financial amusement park…

Unexpected dips and climbs leave you feeling exhilarated one moment and queasy the next.

And there never seems to be enough money leftover once you pay your bills, team, taxes.

(and hopefully yourself).

*shakes fists at the sky*

Where’s all the money going!?

9 little words…

Revenue is vanity, profit is sanity, cash is reality.

All the profit and loss tells you is sales made, minus expenses, and the paper profit left over.

Nothing about assets purchased, how much you’re owed, when you’re paying suppliers, works in progress, loan movements etc. that all have a real dollar cost attached to them that effect your cash.

Put simply, not every expense in your business shows up on the profit and loss statement. And not every dollar you see has been collected.

Which means you’re not getting the whole story of how much money you’ve really made.

Pretty scary right?

To understand your cash flow, you also need the balance sheet.

Particularly:

(1) Accounts Receivable

(2) Works in Progress (WIP) or Stock, and

(3) Accounts Payable

i.e. How quick do your customers pay you? How quick do you invoice customers or sell your stock? And how slow do you pay supplier invoices?

This makes up your ‘working capital’.

(everything else on the balance sheet we’ll group as ‘other capital’)

Why does this matter?

The golden rule of cash flow is that profitability must be GREATER than working and other capital.

And no matter what business you run there are only 8 ways to do this.

Increase lead flow, increase conversion, increase job value, reduce job costs, or reduce overheads.

Levers all found within the profit and loss statement.

Or decrease accounts receivable days, decrease WIP or stock days, or increase accounts payable days.

Levers all found within the balance sheet.

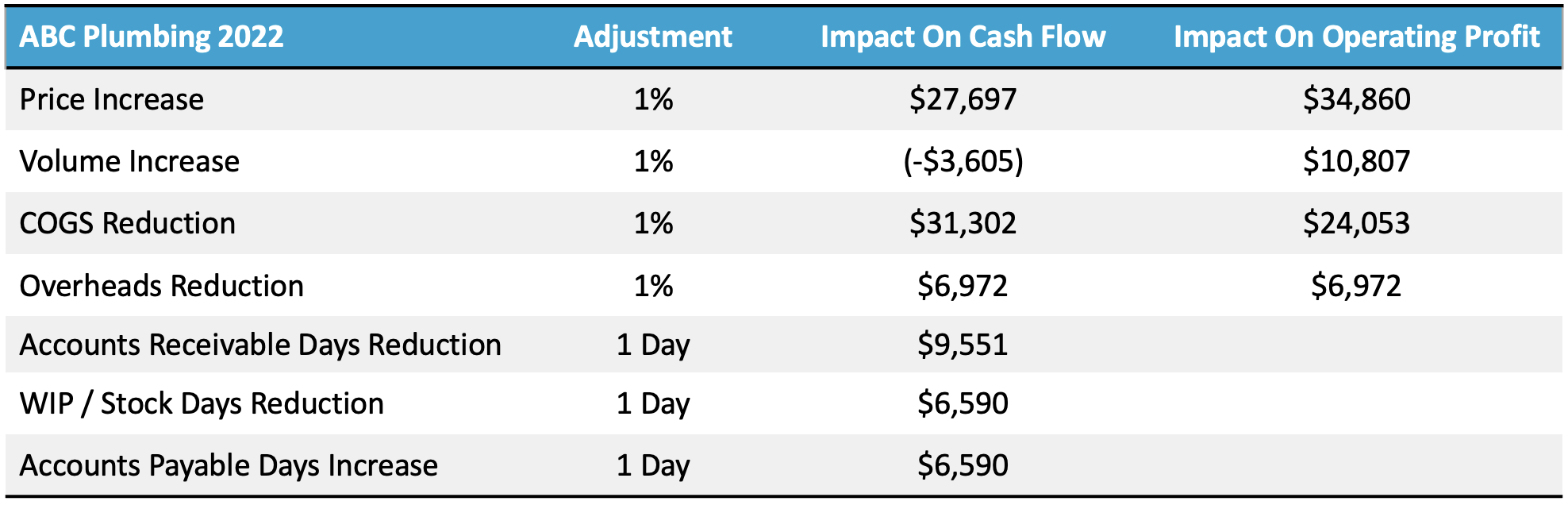

Take our client Ben for example, his business does over $3M a year in sales.

Here’s how his cash flow would change if he improved each of these levers by just one.

A 1% increase in price = $34,860 in profit and $27,697 in cash flow.

A 1% increase in volume = $10,807 in profit but -$3,605 in cash flow.

Sound counter intuitive? Volume is up, profit is up, but cash is negative?

This is why you’re profit and loss could be lying to you.

Working capital and other capital (balance sheet) in Ben’s business is greater than profitability (profit and loss).

Meaning volume is detrimental to cash.

Expenses are outpacing the rate and volume of which he can bring real cash through the door.

A 1% reduction in COGS = $24,053 in profit and $31,302 in cash flow.

A 1% reduction in overhead = $6,972 in profit and cash flow.

Reducing accounts receivable days by just 1 day = $9,551 in cash flow.

Reducing WIP or stock holding days by 1 day = $6,590 in cash flow.

And increasing payable days by 1 = $6,590 in cash flow.

All up that’s $85,097 from small, realistic 1%- or 1-day adjustments across the 8 levers.

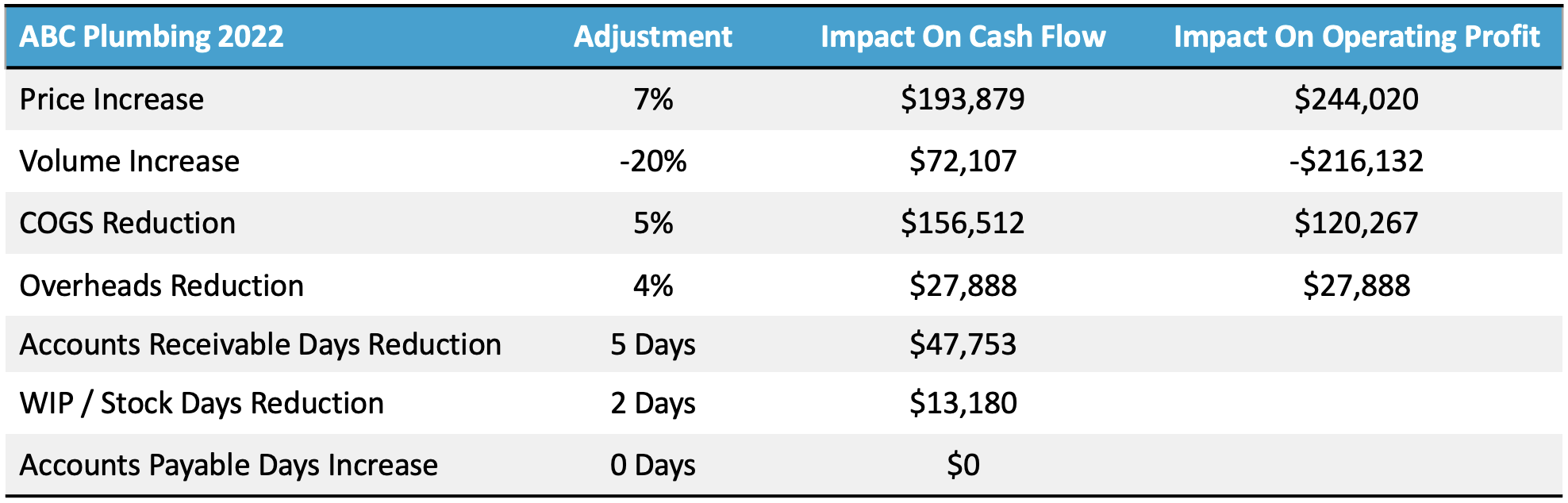

But now let’s look at another scenario…

Say Ben increased his prices by 7%.

If his avg. job was $600, that’s an extra $42. Or if it were $1,500, an extra $105*

Across the board this would = $244,020 in profit and $193,879 in cash flow.

But say because of this price increase, he lost 20% of his work.

Most business owners would panic if their sales dropped by 1 fifth, but remember what I told you?

Volume is detrimental to cash.

While losing 20% of his work would mean losing $216,132 in profit, cash flow would improve by $72,107.

That’s right, Ben would actually MAKE more money.

Because every 1% increase in price makes over $27,697, whereas every 1% increase in volume loses $3,605.

So the math makes sense…

Increase prices and lose the bottom 20% of clients who create 80% of the headaches.

Then say he reduces COGS by 5%, this would = $120,267 in profit and $156,512 in cash flow.

He cuts overheads by 4% which = $27,888 in profit and cash flow.

Reduces accounts receivable days by 5 days which = $47,753 in cash flow.

Drops WIP or stock days down by 2 which = $13,180 in cash flow.

And say that’s it…

Overall that’s a $511,319 increase of potential cash flow from small, realistic tweaks across the 8 levers.

Seriously.

Don’t believe me?

A 7% increase in price… He’d make that change in a week.

Sales drop 20% because of it? He makes more money!

COGS drop 5% from better supplier rates and labour productivity.

4% of unused overheads get cut due to wastage.

He collects money 5 days faster by following up invoices the moment they become overdue.

Payment terms get shortened and stock better allocated to jobs to reduce WIP by 2 days.

And BOOOM!

Over $511,319 worth of cash flow printed, just like that.

That is the power of the 8 levers.

So with all the noise and confusion around profit, cash flow, and how to make more money.

The game really is as simple as this:

How many 1% or 1-day changes can you make in your business?

That’s the secret to engineering cash flow on demand.

Now I ask you, is this something you could do within your own business?

What impact could 1%, 2% or even 3% changes make to your bank account?

Could you buy that dream car…

Finally get that house you’ve always wanted…

Take an overseas holiday with the family…

Send your kids to a better school…

Purchase an investment property…

Get more toys to enjoy during weekends and time off…

This is the power of understanding the genetic makeup of your business, AKA your numbers.

You can make decisions based off data and facts to take back control of your cash flow.

So if you’re ready to rewrite your financial story, click here to book in a call with my team.

We keep things sesame street simple when it comes to making more money.

Click here to find out for yourself.

Bayley ‘cash flow’ Peachey