Let me start by saying that if my accounts department knew I was writing this article they’d send me to a shrink.

But today I want to go off record and show you something people pay a lot of money to learn.

(because it MAKES THEM so much money)

But first, let me give you the backstory…

I believe success starts with understanding what game you’re playing.

Now in business, there’s really only two ways you can go.

Increase your volume or increase your margin.

But if you look at this through the lens of mathematical thinking it will completely change the way you see the concept of making money.

Like a magic trick, once you see and understand it, you’ll never be able to see business again in the same way.

Let me explain…

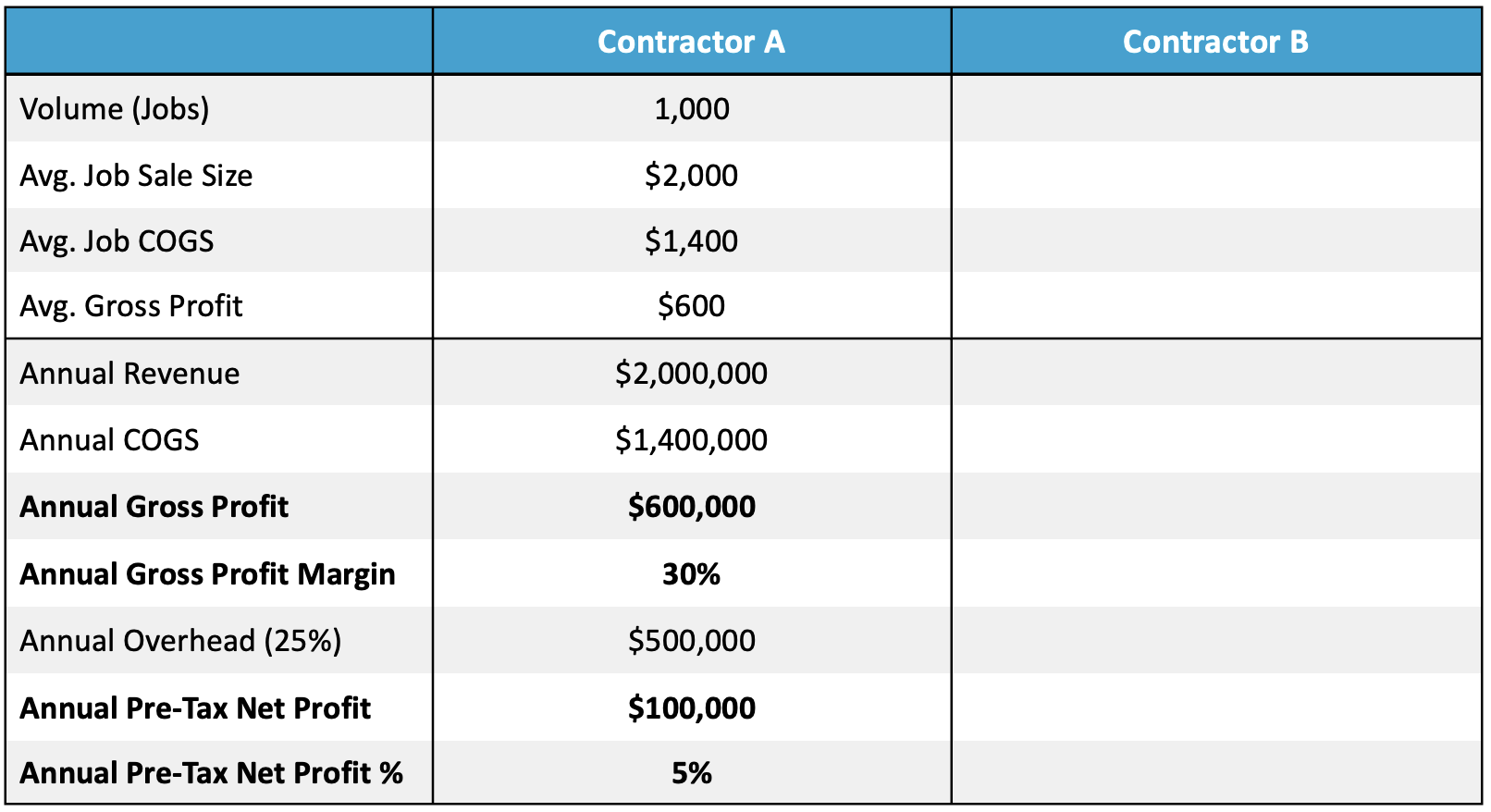

Say a business does 1,000 jobs a year. We’ll call him Contractor A.

His average job is worth a total of $2,000.

Job costs (labour, subbies, etc.) are $1,400. Which means gross profit per job is $600.

1,000 jobs x $2,000 avg. job value = $2M in total annual sales.

1,000 jobs x $1,400 job costs = $1.4M in total annual COGS.

$2M sales – $1.4M COGS = $600,000 in total gross profit every year, a 30% gross margin.

Now, being a healthy trade business, Contractor A spends 25% of their total sales on overheads (management, accounting, rent, software, subscriptions etc.).

25% x $2M in sales = $500,000 in total annual overheads.

$2M in sales – $1.4M COGS = $600,000 gross profit – $500,000 in overhead = $100,000 net profit, which is a 5% bottom-line margin.

Not too bad, right?

$2M in sales to make $100,000 in net profit on top of their salary?

You can see what that looks like here:

This is the industry average according to the CFMA.

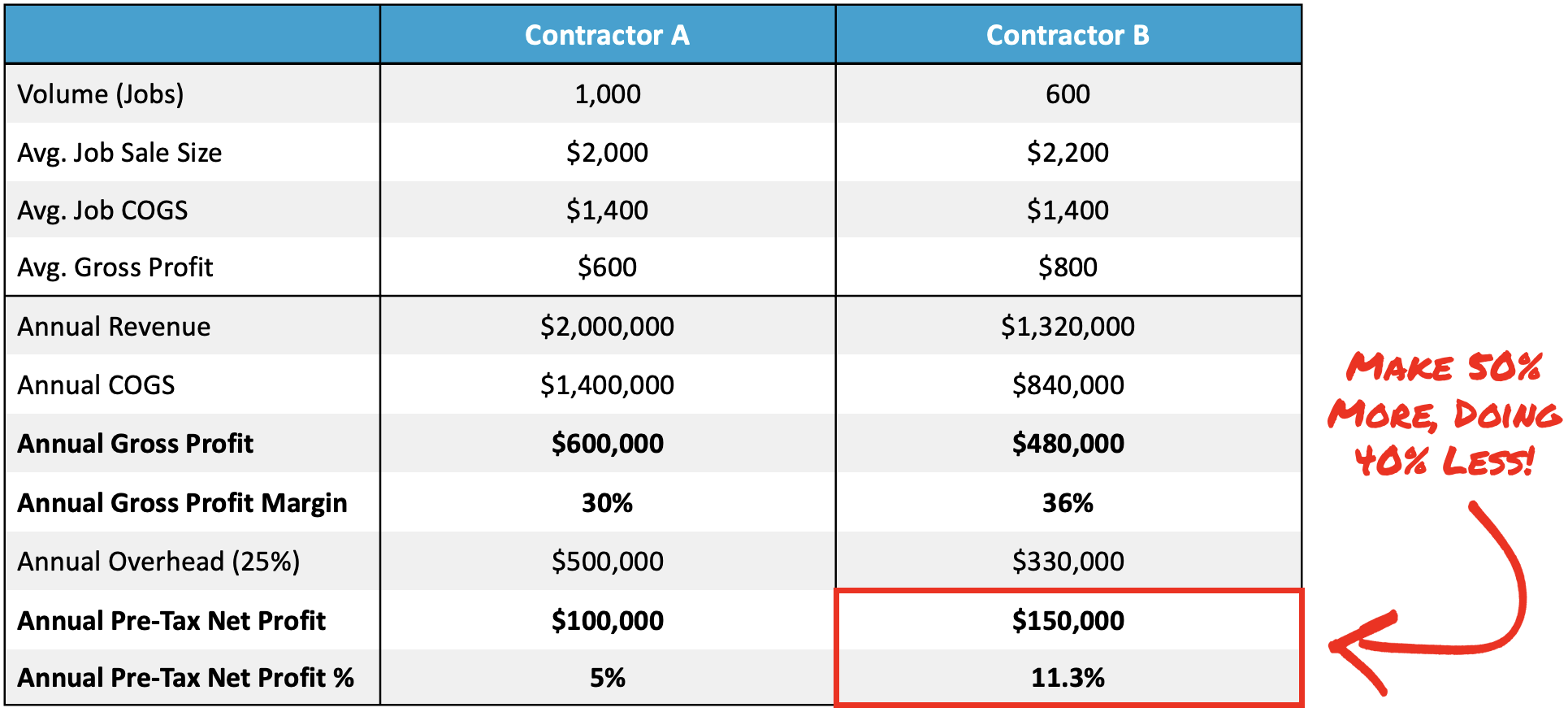

But now let me introduce you to his direct competitor, we’ll call him Contractor B.

Instead of charging $2,000 per job, he charges 10% higher with his avg. sale being $2,200.

Because of his higher prices, Contractor B has a much smaller business than Contractor A.

Instead of doing 1,000 jobs a year, he does 600.

It costs him the same $1,400 to deliver the work, which means he makes $800 in gross profit per job.

600 jobs x $2,200 = $1.32M in total annual sales.

600 jobs x $1,400 in job costs = $840,000 in total annual COGS.

$1.32M in sales – $840,000 COGS = $480,000 in total gross profit every year, a 36% gross margin.

He also spends 25% of his sales on overheads which comes to $330,000.

$1.32M in sales – $840,000 COGS = $480,000 gross profit – $330,000 in overhead = $150,000 net profit, which is an 11.3% bottom-line margin.

Notice the difference?

Because Contractor B provides a premium service and charges his clients 10% more than Contractor A, he’s able to do 400 less jobs a year.

But here’s the crazy part… he also makes 50% more money!

That’s $150,000 in profit instead of $100,000, doing 400 less jobs.

Isn’t that some interesting math…

Less clients, less work, less overhead, less headaches, and more than double the bottom-line margin.

If I offered you the choice between the two, which business would you rather operate?

“But Bayley… all people care about is the cheapest price!?”

Fear not...

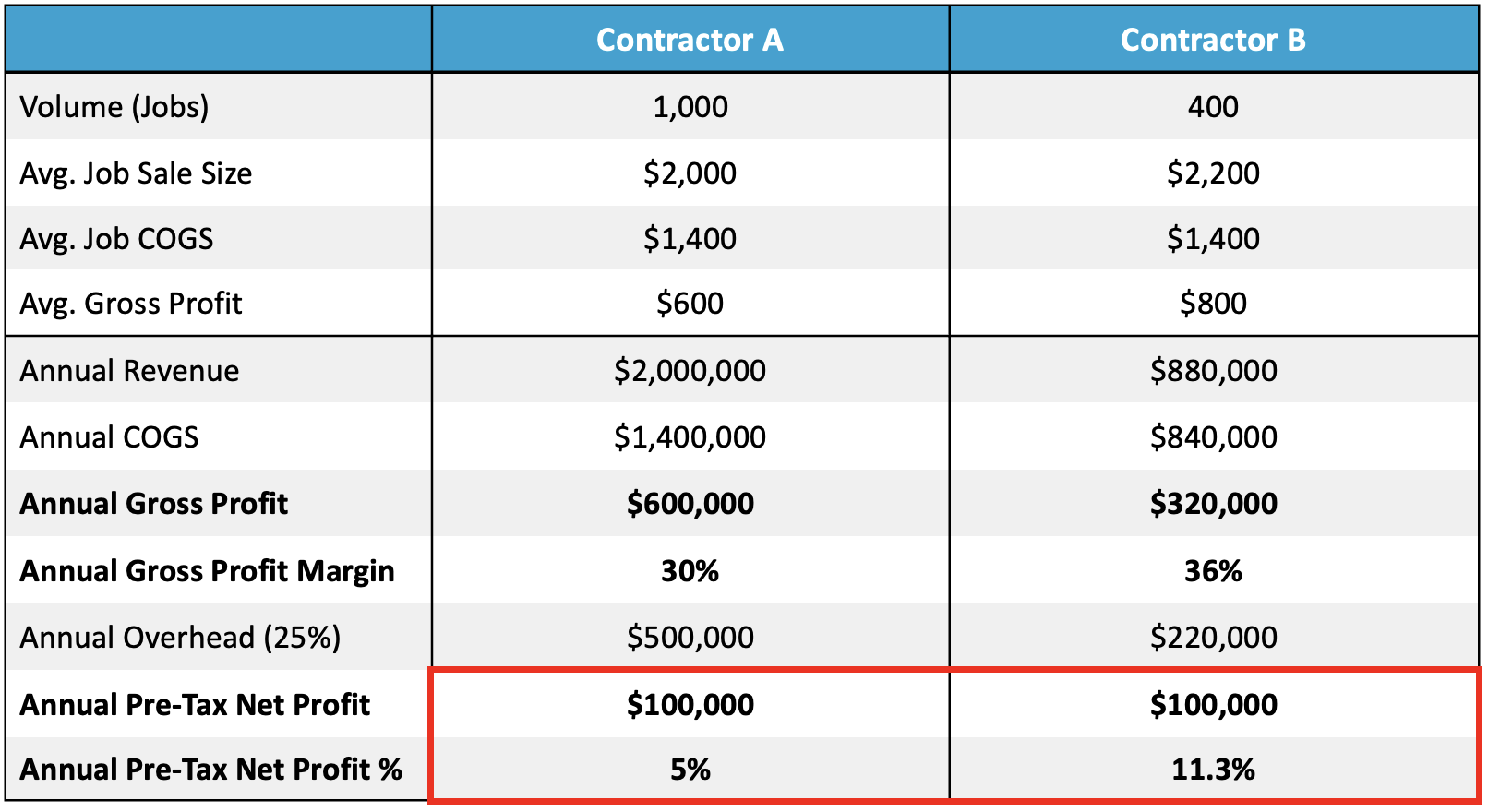

Contractor B would have to work 60% less than Contractor A before he’d make less money charging 10% more.

Really let that sink in for a moment…

1,000 vs 400 jobs i.e. 600 LESS.

$2,000 vs $2,200 avg. job price.

The same $1,400 in job costs.

$2,000,000 in total annual sales versus $880,000.

$600,000 in total annual gross profit versus $320,000.

A 30% margin versus a 36% margin.

$500,000 in overhead versus $220,000 (at a 25% recovery rate).

But the exact same annual net profit of $100,000.

This is what it means to be a profit-driven contractor.

Contractor B has fewer customers, a smaller team, less stress, fewer overhead, less debt, and less risk… but makes over double the bottom-line margin of Contractor A despite doing LESS WORK.

So what can we learn from this?

Margin before Sales. Profit before Volume.

I see so many business owners struggling simply because they don’t do the math.

Their model isn’t built around making money, it’s built around hard work and trying to lock in sales.

But this works on the assumption that more work equals more money, which just isn’t true.

A $2M business @ 15% net margin makes the same net profit as a $10M business @ 3% net margin.

This means more profitable work equals more profit.

So, the question then becomes, do you want to be Contractor A, or do you want to be Contractor B?

Volume-driven, or profit-driven?

There’s nothing wrong with being the ‘cheap guy’ if you plan on being busy and broke.

But if you want a great business that makes you a bucket load of money without costing you the most valuable assets you own – your health, happiness, and time…

Then you’re going to need a different strategy.

One that results in less work, more freedom, and more money in your bank account!

Click here to book a call if you’d like our help making that happen.

See you on the other side.

Bayley ‘Profit Driven’ Peachey