I’m going to let you in on a little secret…

More secret than Houdini himself.

I’ve NEVER come across a single trade business owner who knows about it.

Which is a shame…

Because this ONE metric is like a guardian angel to your business.

Let me explain…

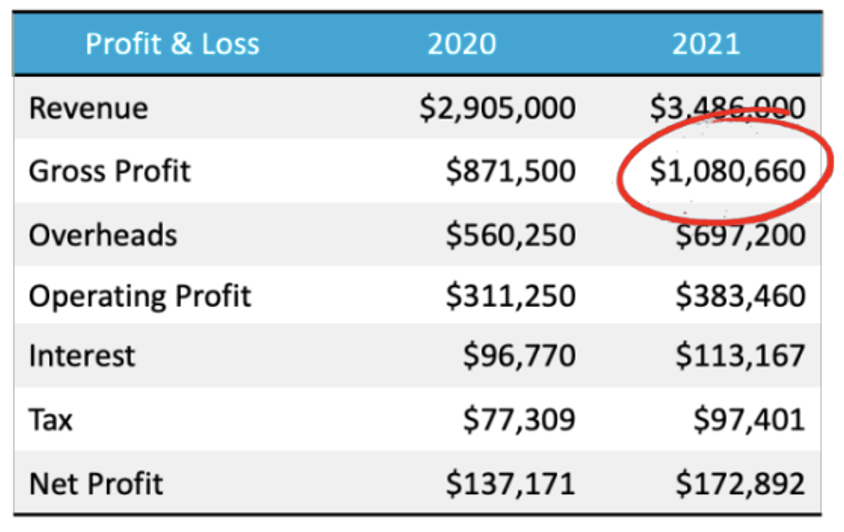

Say you’re turning $3.5M in revenue at a 31% gross margin…

That’s $1,080,660 in gross profit.

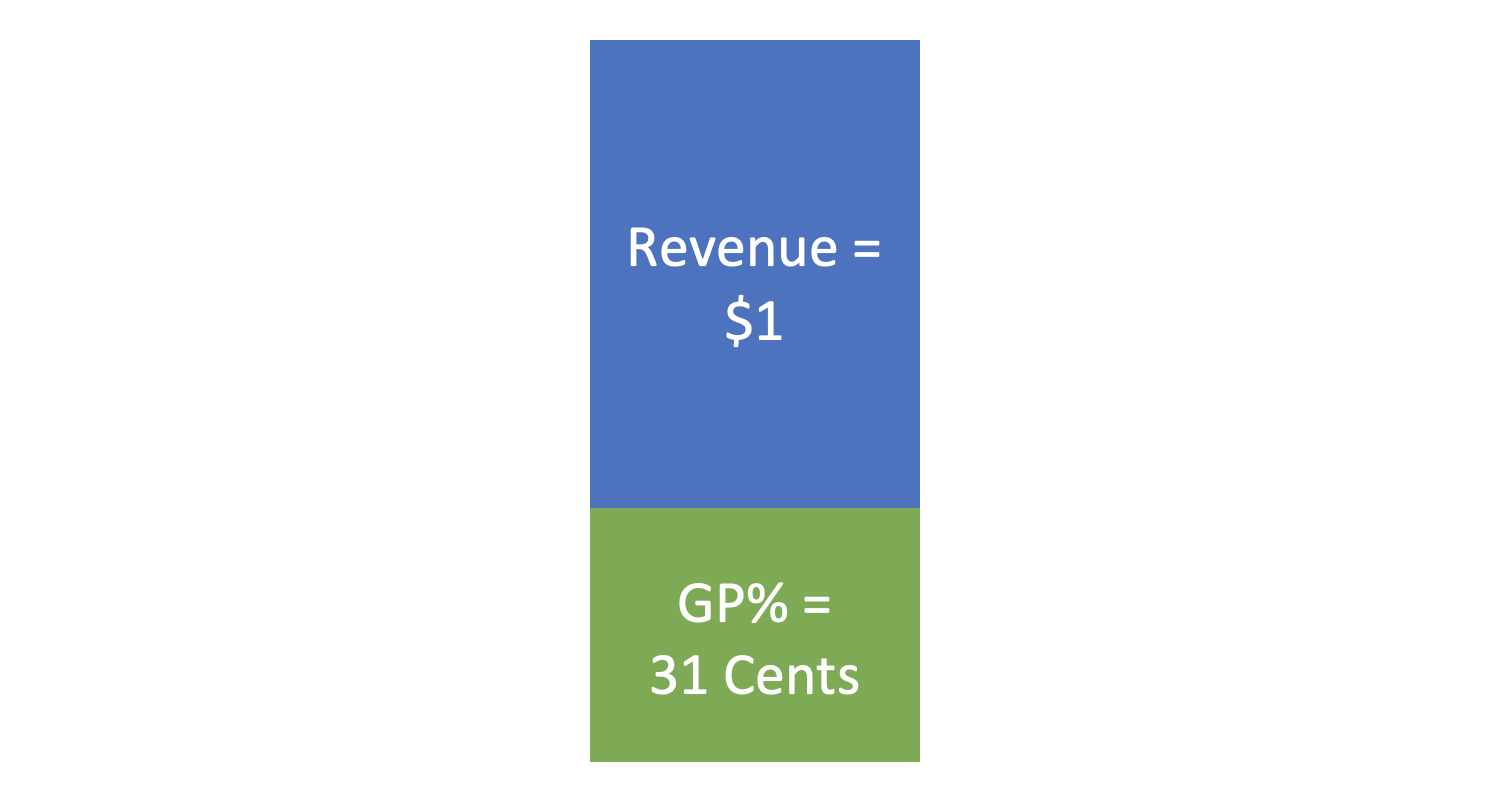

That means, for every $1 you sell, you’re making 31 cents in gross margin.

Not bad at all.

Your business is looking pretty good from a profit and loss perspective…

In fact, most business owners would be pretty happy about it.

But there’s something sinister going on here…

Can you see it?

Do you know what's missing?

Let me give you a hint…

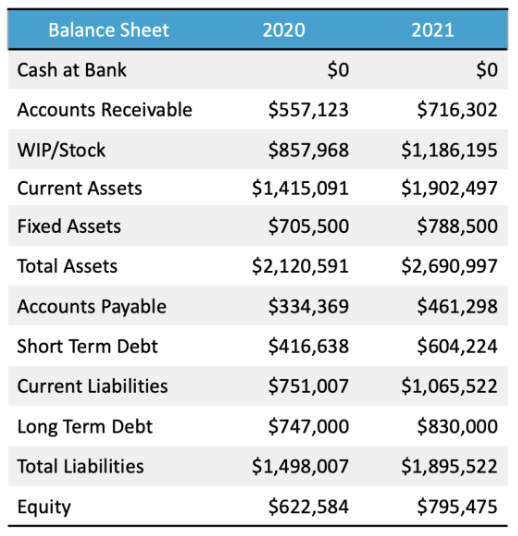

I’m a financial document used to track a company's wealth.

I list assets and liabilities.

And show the company's health.

What am I?

Answer: A balance sheet.

And if you’re not looking at one of these bad boys at least once a month, then you could be in trouble…

Because it'll tell you EXACTLY how much cash is needed to fund the day-to-day operations of your business.

AKA your ‘Working Capital’.

Which can be calculated by using the formula below:

Accounts Receivable + Works In Progress (or stock) – Accounts Payable = Working Capital

Where…

- Accounts Receivable is the money owed to you from your customers.

- Accounts Payable is the money that you owe your suppliers.

- Works In Progress is the work you've done at your expense that you've not yet invoiced for.

- Stock/Inventory is the supplies you've paid for but haven't yet been invoiced to a job.

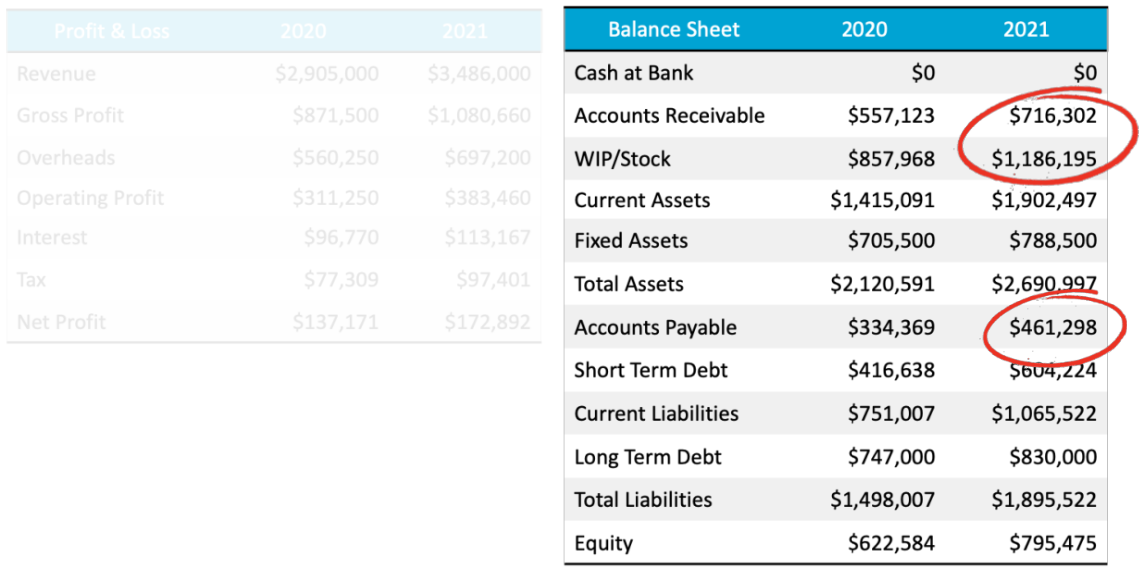

Looking at the balance sheet above, this comes to:

$716,302 + $1,186,195 – $461,298 = $1,441,199

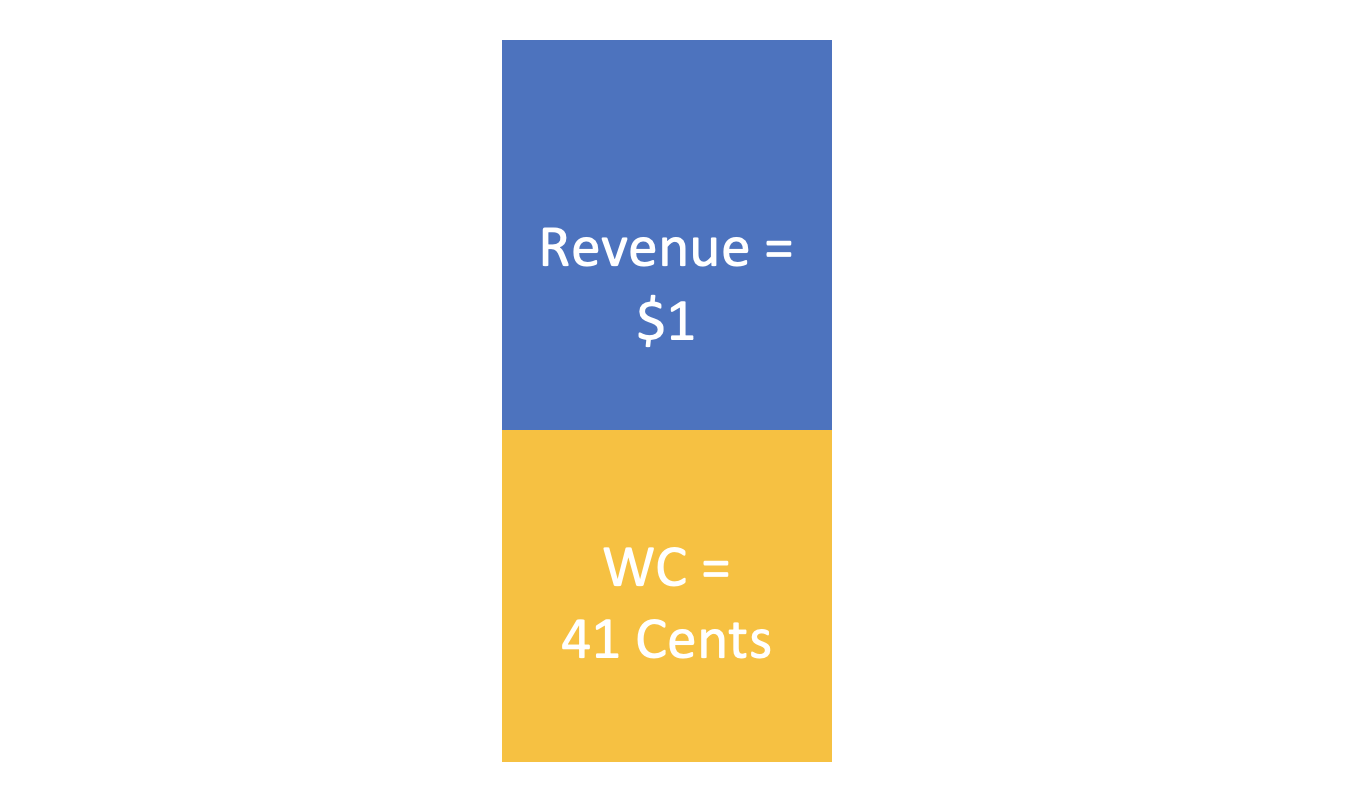

That’s 41% of your $3.5M in revenue.

So, for every $1 you sell, you need 41 cents in working capital to fund the operations.

Now, think about that for a second…

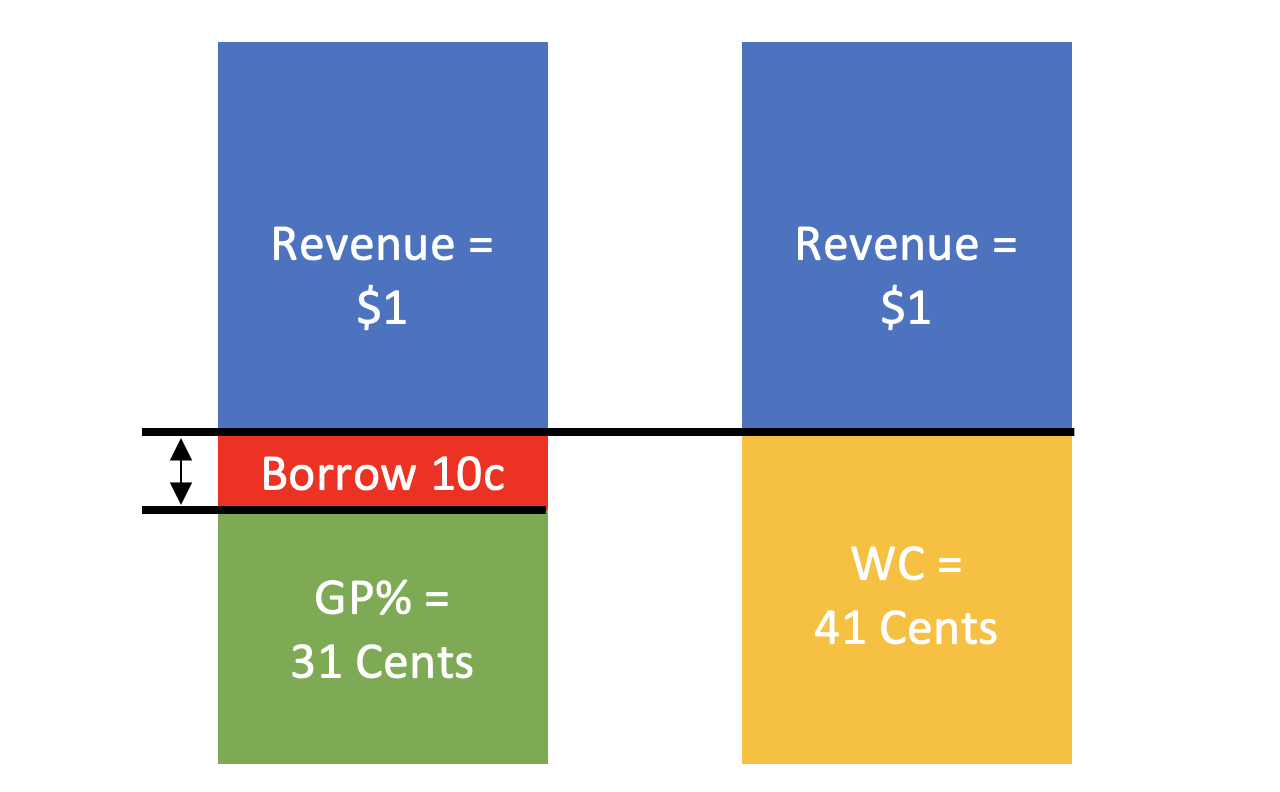

You need 41 cents in the dollar to fund a business that makes 31 cents in gross margin.

That means, for every $1 extra the business sells, it needs to borrow 10 cents to fund the work…

You’re having to borrow working capital in order to produce gross profit.

In other words, your business is growing broke!

It's spending more than what it’s making… which is a recipe for disaster.

(And what I believe to be the #1 killer of 7-figure trade businesses…)

And 60% of trade businesses experience this problem.

That’s why you need to calculate your ‘Marginal Cash Flow’.

It tells you, after the next dollar you sell, what will your cash flow be?

And in a matter of seconds, you’ll know if you’re growing broke.

So let me ask you this...

Do you know what’s going to happen the next dollar you grow?

If you don’t, then you’ve got a serious blind spot in your business.

A blind spot that can sink you if you’re not careful…

So, jump into your Xero, and have a look now.

If you find that you’re a part of the 60%...

Then there’s only two ways to fix your cash flow:

Increase profit, or

Decrease working capital.

That’s it.

And I’ve outlined EXACTLY how to do this in my latest report…

Which you can get by clicking here.