There is one fundamental question that every single trade business owner should have sitting at the very front of their mind.

How can I make MORE cash!

Especially if you’ve just cracked that million-dollar sales mark, or you’re floating between 2-3 million looking to expand further…

So, today I want to talk about just that.

In this short article I’m going to run you through the 7 key levers that we personally use here at Trade Business Accountants to help trade business owners skyrocket their cash position by upward of 1200%, even if they’ve struggled with cash flow in the past.

But before we dive into how to make more cash, first I want to quickly touch on...

Why is cash important?

In my opinion cash is so vitally important, because whether it’s in your personal life or in a business environment cash equals opportunity.

Cash allows you to seize opportunities when and as they arise.

If it’s in your personal life, maybe it’s the ability to buy your dream home as soon as it hits the market, or being able to get that caravan or take your family on holiday 2 or three times a year. It could be buying up shares as the market dips or being able to send your kids to a fantastic school.

It's cash that will allow you to take advantage of these opportunities!

And in business, the luxury of more cash could be as simple as not having to worry about having no cash!

Being able to operate effectively, purchase the right gear, hire the right staff, take on bigger projects, pay all your bills on time, not spiral into a panic when clients extend invoices or you get smashed by delays and whether…

Without cash, you can’t capitalise on these opportunities. Because as much as some of us would like to, you just can’t pay for things with revenue or profit… it’s cash that matters most.

Now, fortunately for you, you’re a business owner.

And what that means is, there’s no limit to how much cash you can generate and how much money you can actually earn in any given year.

Now, unfortunately for you, you’re a business owner.

And what that also means is that limit goes both ways.

You can earn massive amounts of cash, or you can earn none.

We have clients taking home upward of $1.5M personally, and I’ve seen some business owners just getting by struggling to breakeven (while paying themselves an under fair market based wage).

Where the power lies in being able to take advantage of business ownership, is simply knowing what levers to pull and where to focus your time and attention to get the best results.

And that’s what I want to talk about today.

Making more cash fundamental comes down to doing two things.

Increase profit & decrease working capital.

If you’re unfamiliar with what working capital means, working capital is simply the amount of money needed to run your business over the short-term.

If you increase your profits and decrease the amount of money needed to fund your operations… you will generate more cash in your business.

And the faster you generate more cash in your business, the faster you can accelerate your ability to capitalise on opportunity in your business and personal life.

So, let’s cover exactly how you can increase profit, and decrease working capital.

Believe it or not, there are only 7 key levers that you need to do this and flood your business with more cash.

And these 7 levers sit in both your profit and loss statement and your balance sheet.

To increase profitability, we look at: Price, Volume, Cost of Goods Sold or COGS, and every item of Overheads…

Items all found on the profit and loss statement.

To decrease working capital, we discuss: Accounts receivable days, WIP or stock days, and accounts payable days…

Items all found on the balance sheet.

So, 7 levers, 4 on your profit and loss, and 3 on your balance sheet.

If you want to make more cash in your business, it’s only these 7 levers that need to change.

This is all you need to focus on.

And I think the best way to explain this and help demonstrate just how powerful these 7 levers are is through an example…

Real TBA Client Case Study.

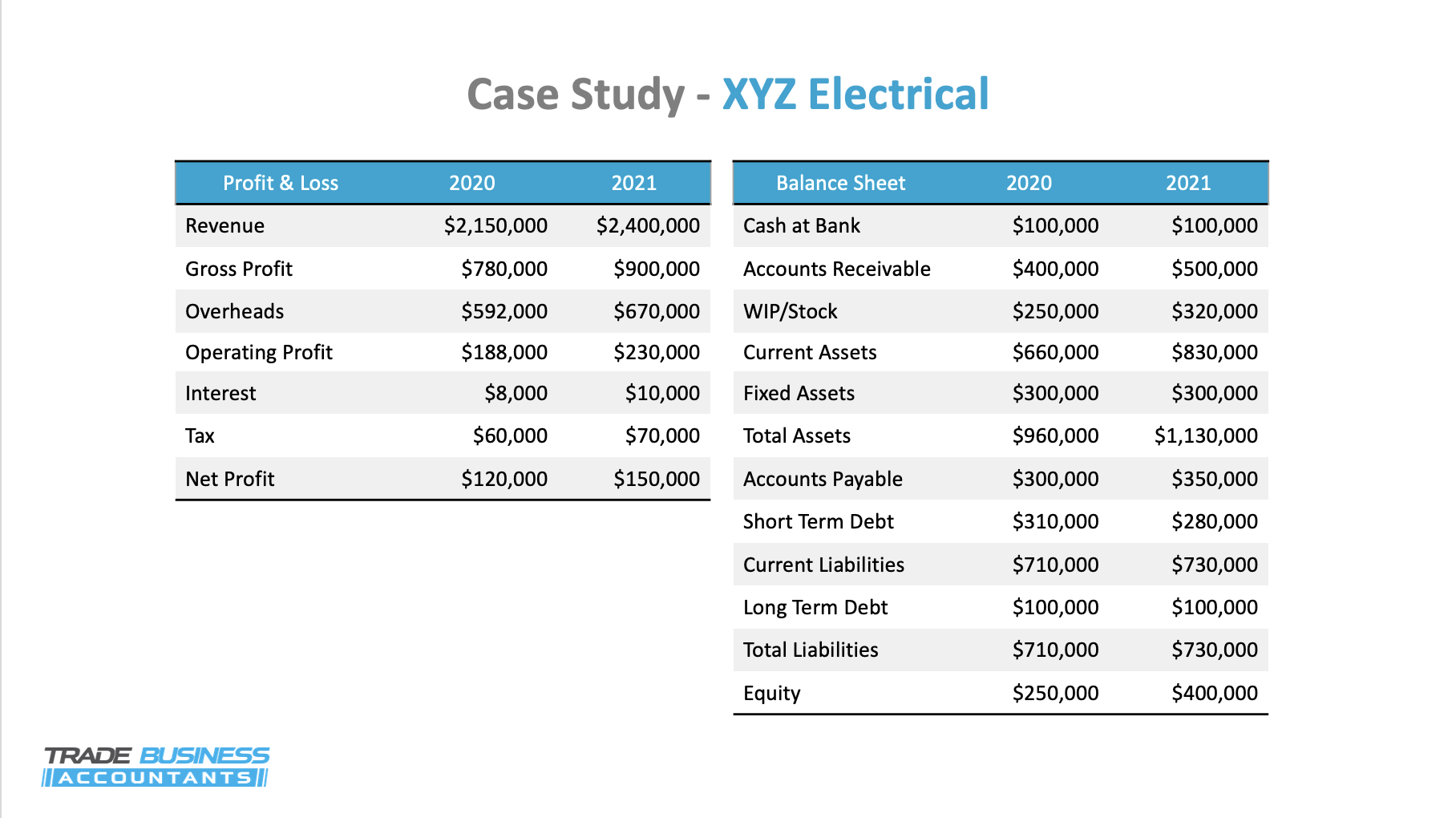

So, here we have a TBA client that for privacy reasons I’ll refer to as XYZ Electrical.

Now XYZ Electrical have a great business, they’ve been operating for many years now, and when they came to us, among wanting their bookkeeping, tax, and company structure handled better they simply wanted to know how to get a better ROI from their business.

So, I’ll run you through how we helped them pull this off using the 7 levers…

Like always, we first determine how much cash they made.

To do this, we identify how much they made in Net Profit, which was $150,000.

We then calculate how much working capital they invested in 2021, which was $120,000.

That is, $100,000 plus $70,000, minus $50,000.

Then lastly, we calculate how much other capital they invested in 2021, which was $0.

That is, $150,000, plus negative $30,000, plus $0, minus $120,000.

That means, in 2021 XYZ Electrical made $30,000 in cash.

So, after making $150,000 in Net Profit, they were only left with $30,000 cash!

Hence why they were looking to understand how they could improve their ROI…

The way they saw it, they were working really hard and taking on a lot of risk and aside from a good wage they didn’t feel like they were being rewarded for all their efforts.

And I agreed.

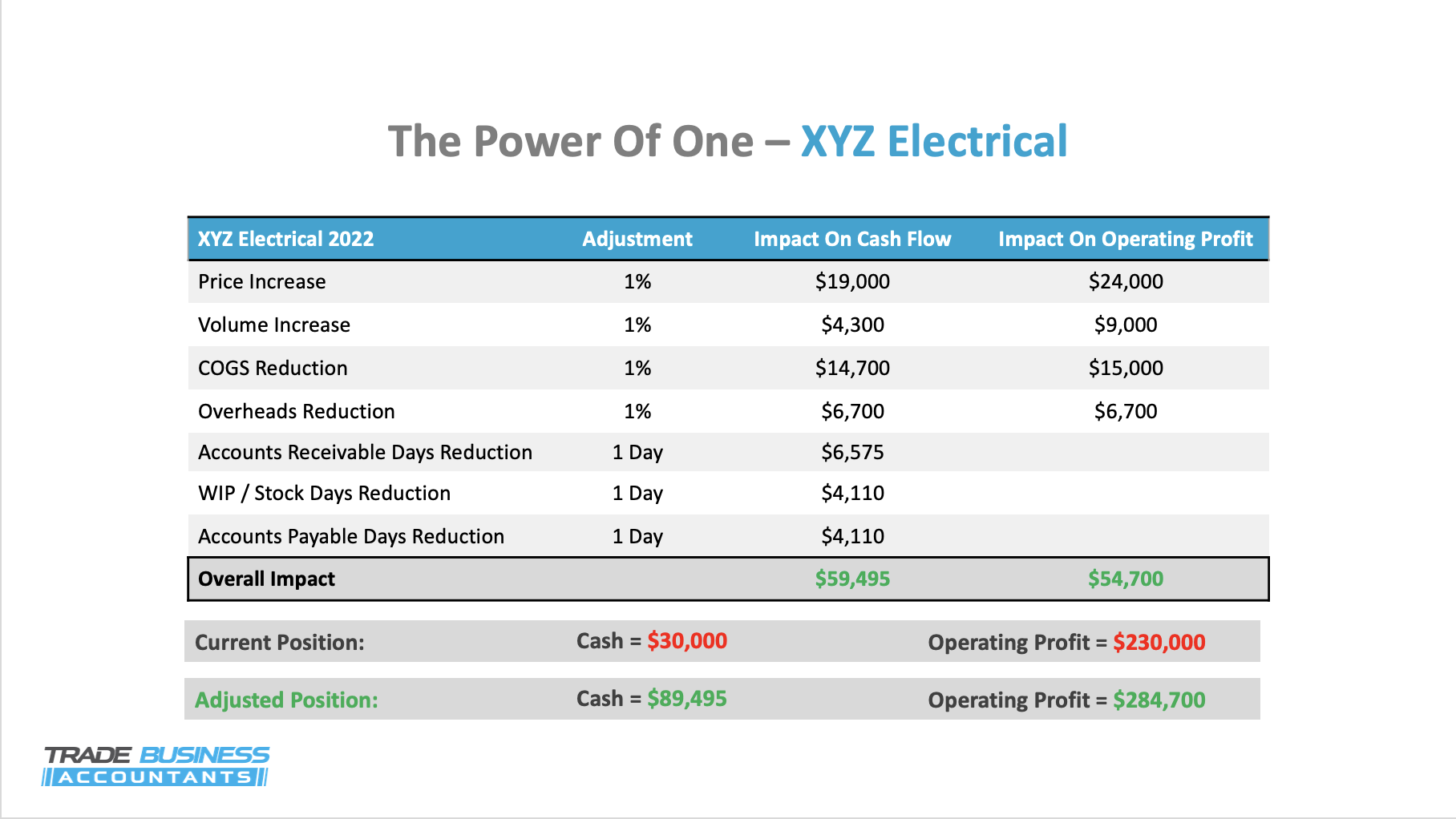

So, what we did was simulate what cash impact we could generate if we were to use these 7 levers, which looked a little something like this…

Looking at this table, based of XYZ Electrical's financials at the time, these were the impacts on profitability and more importantly cash from just 1% changes across the 7 levers.

Just by adjusting their 7 levers by 1%, they could put an extra $59,495 in cash in their bank account… Which is actually a 300% increase in cash!!!

But here’s what we actually did…

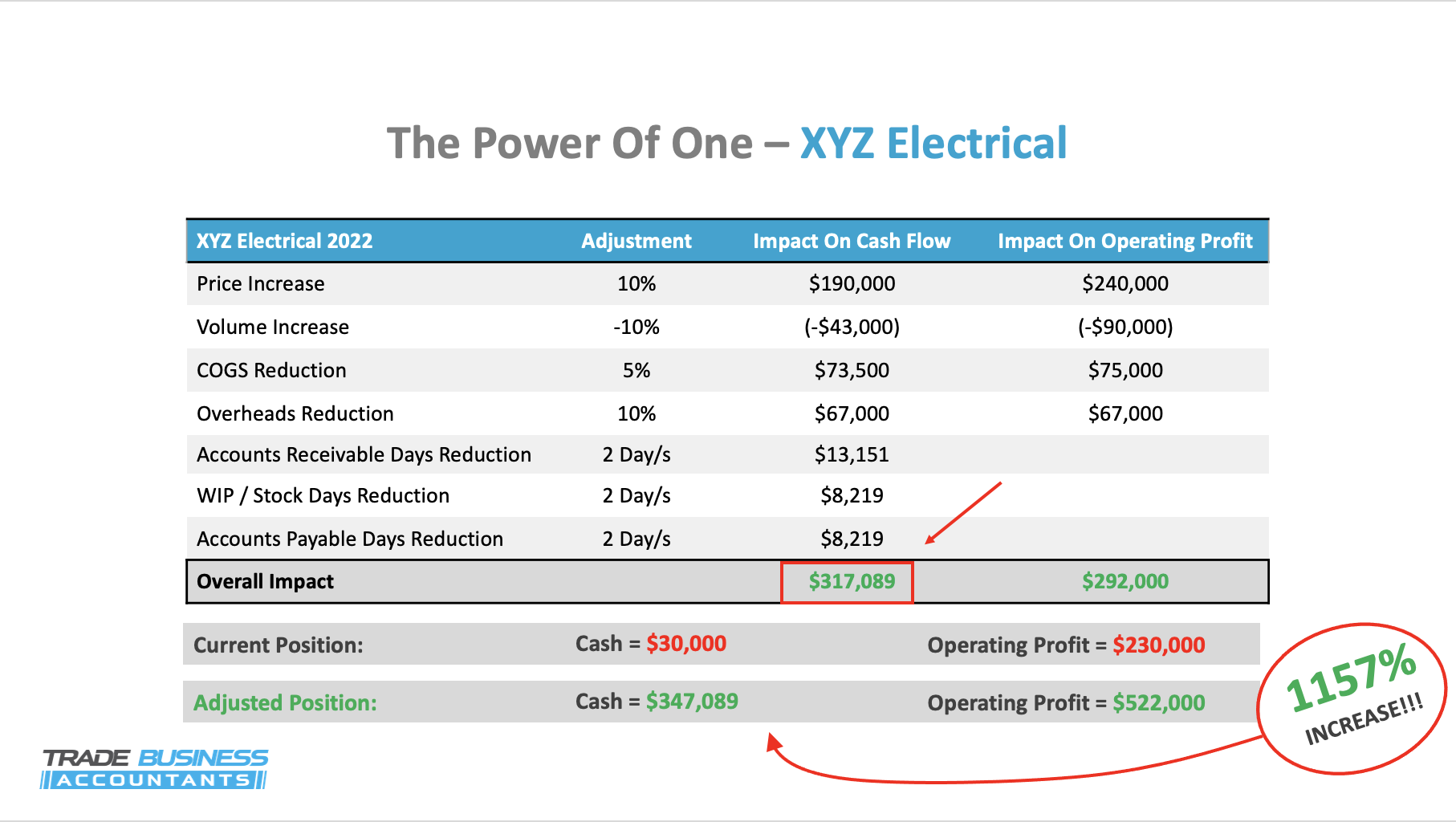

We actually helped them to increase their prices by 10%, which caused them to lose roughly 10% of their overall volume.

Now at this point, most business owners would probably be in complete panic thinking they’ve just ruined their business and they’d be on their knees yelling what have I done…

But when price is 4.5 times more sensitive to cash than volume is…

That is, every 1% increase in price equates to $19,000 in cash, whereas every 1% increase of volume was only $4,300…

The decision to increase their prices and drop some pain in the ass, price driven, headache clients was a no brainer…

And this 10% increase in pricing was a massive step in the right direction of a more profitable business model, with a pricing strategy that better matched the quality and experience they deliver!

And as another note, sales would have had to decrease 4.5% for every 1% increase in price for our client to be worse off from a pure cash perspective…

And I can confidently tell you right now, we’ve never had a client lose 4.5% of their workflow from a 1% increase in price… not even close!

So, investing $1 to get back $4.50 was again, a no brainer.

In this case, as I said, our client lost only 10% of their volume with a 10% increase in price…

And in the process, they made $147,000 in cash.

Outside of price and volume, we also managed to reduce their COGS by 5%... by being more efficient in delivery, having better structure and planning, and by sourcing better deals from suppliers.

We reduced their overheads by 10%... by cutting a bunch of unnecessary expenses where half had been forgotten about and they weren’t providing any value to the business…

They managed to lower their receivable days, payable days and WIP/stock days by 2 days…

So, they were able to collect money faster, invoice for works faster, and slow down and better maximise how they pay their suppliers…

And all up, using the 7 levers and making these small changes resulted in an extra $317,000 in cash… which is a massive increase of 1157% from the year prior.

That's an extra $317,000!

So, if you want to make more money, earn more cash, and get a much higher ROI from your business year on year, then it all comes down to knowing what levers to pull and where to focus your time and attention to get the greatest results.

You now have that.

You now have your 7 levers.

And just like our client XYZ Electrical, you too can get greater results in your business no matter what stage you’re at.

Because it really is as simple as this…

How many 1%- or 1-day changes do you want to make in your business?

Keep it simple, put your focus on these 7 levers and go get after it.

If you're an electrician, plumber, painter, carpenter, or any other tradie business owner turning more than $1M a year looking for assistance with your tax, accounting, bookkeeping, and business advisory - click here to learn more!