If you’re a trade business owner and you’ve ever asked yourself the question, “When should I take money out of my business?”, then this article is for you.

Because I’m going to breakdown our simple 7-point checklist that you can use as a guide to whether or not you’re in a position to pull money out of your business.

Beware: Company Money And Personal Use

Before I can actually breakdown our checklist, it’s important that we’re on the same page here of what I mean by ‘pulling money out of the business’.

Because you need to be super careful here.

Just pulling money out of your business without first understanding the implications of pulling that money out, can leave you in a very, very dangerous situation; a situation that we find trade business owners in all the time.

And that’s treating their company accounts as an open ATM for personal use, coming from the idea that "it’s my business so I should be able to pay myself whatever I want… right?" Not necessarily…

Typically, business owners in this situation confuse the relationship between the money sitting in their business and their personal income…

They think their business is just an extension of themselves and their own personal income.

And this has some truth to it if you’re a sole trader, where legally, you and your business are considered one legal entity, which is likely the case for most smaller trade operations that have less than 1 or 2 employees.

But as soon as your business becomes a registered company, the government and the ATO no longer view your business as a single entity. They see you as two very distinct legal entities.

So, the money sitting within the business bank account is no longer your money, it’s the company’s!

And even as the business owner, you can’t just use all the company’s money for personal use. Again, it’s not your money.

So, freely withdrawing money from your company for personal use can have damaging consequences if you’re not careful.

Now, a quick disclaimer here: I’m not saying you can’t take money out of your business… I’m just saying you need to do it legally if you want to keep yourself out of hot water.

The 4 Ways To Pull Money Out

And there’s only really 4 ways to legally access company funds for personal use as the owner of your company… And they are:

- Through a Salary, a Wage or Director’s Fees, where you run yourself through payroll,

- Through a Reimbursement, where you take back the money you initially invested in the business to get it up and running,

- Through a division 7A loan from your company, where you’re required to pay it back with interest, and

- Through a Dividend, where your company issues you a payment from its profits.

That’s it. They’re the 4 ways that you can access company money for personal use.

So, when someone asks me “When should they pull money out of their business?” … in most cases, what they’re actually trying to ask me is…

“When should I pay myself a dividend?”

And it’s an important question to know the answer to.

Because paying yourself a dividend not only has an impact on your own personal finances, but it also has an impact on the health of your business too.

If you pull too much money out of the business too early, you could seriously erode the cash cushion that’s protecting your business from the tough times.

But on the flip side, if you keep too much money in the business for too long, you could risk losing it all if the worst was to happen, not to mention the fact that those cash reserves could’ve been better invested elsewhere, outside of the business, to build your own personal wealth.

That’s why it’s critical that you have a strategy in place to know when is the right time to pay yourself a dividend.

Dividends Aren't The Priority

As a business owner, paying yourself dividends is pretty important. It ensures that you’re getting a reward on top of your salary for taking on the risk of running your business.

It’s a large reason why so many of us went into business ownership in the first place... We wanted to make more money than what a job could ever provide!

BUT… the reality is, paying yourself dividends actually isn’t the priority.

Sure, they’re important. But from our perspective, when it comes to bettering your business and your personal life, it ranks at the bottom of the list.

So, what I want to go through now is the boxes that you need to tick BEFORE you pay yourself dividends.

If you tick all of these boxes in order, then you should be able to pull out whatever’s leftover.

Our 7-Point 'When To Pay Dividends' Checklist

So, what I want to do now is run through our simple 7-point checklist that you can use to help guide you in making the call on whether or not to pay yourself a dividend on top of your salary.

Disclaimer: Obviously we don’t know your particular situation, or how your current accountant has set up your finances, so make sure you speak with them first before implementing anything that I’m about to discuss. If you aren’t happy with your current accountant, or how they’ve got everything structured… then make sure you reach out, because we’d love to help you run a better business that makes you far more money.

1. Profitable

The first box you need to tick is the profitable box.

If you aren’t profitable, you shouldn’t be paying yourself a dividend.

And this is largely for two reasons:

- Dividends should be your reward for running a business that makes a return in profit, so if you can’t turn a profit, then you shouldn’t be rewarded. You’ve got work to do to make sure you start to make a profit! And...

- Your business likely can’t afford to pay you a dividend if you’re unprofitable.

And that’s because, if you haven’t made a profit, then you have no extra cash in your business to actually fund that dividend, meaning you’re taking cash from the business at a time when your business needs cash the most!

And that’s because profit is the only source of internal funding that exists in your business. And what I mean by that, is if, for example, you’re only breaking even and haven’t made any profit from last year to this year, then there’s no extra money left over. How could there be?

Your business made the same amount of money over the past 12 months as what it spent over the same period.

So, if you’re in this position and you pay yourself a dividend, then your business bank account is only going to shrink. And eventually, if you keep doing this, your business is going to run out of money, OR you’re going to have to fund the shortfall through debt, which is a VERY slippery slope to go down, and it’s only delaying the inevitable.

Now, the only exception to point number 2, is if you’ve been consistently profitable in the past and have plenty of cash in the bank account from retained earnings over those years.

In that case, you could be in a position to pay yourself dividends, assuming you tick all the boxes that I’ll be outlining throughout the remainder of this training.

But, as a general rule, if you aren’t profitable, don’t rip money out of the business!

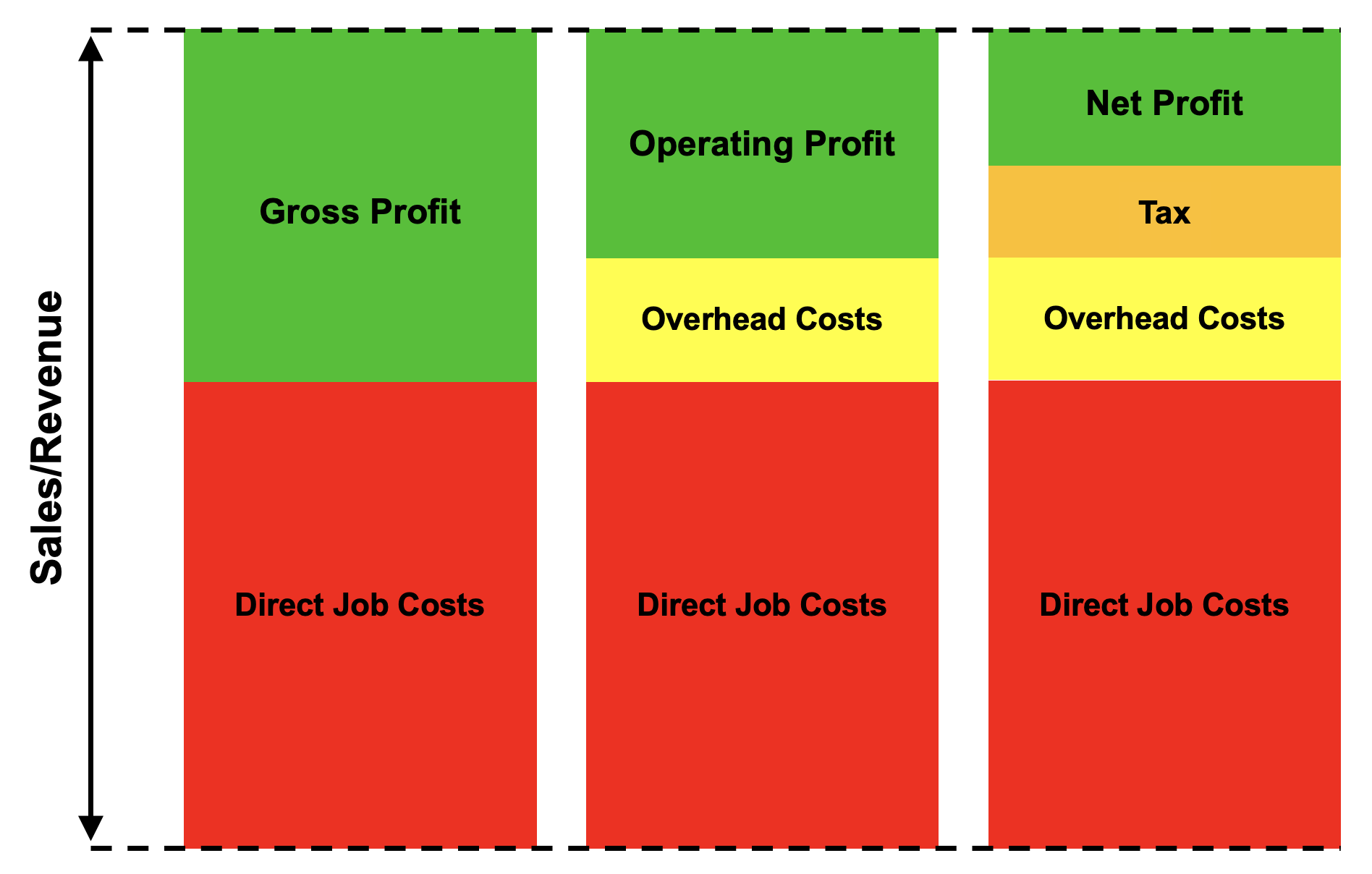

Now, the profit I’m talking about here is Operating Profit.

This is simply the profit that’s left over after every single cost in your business has been accounted for, including your direct job costs (COGS), like labour, materials, subcontractors, equipment hire, and so on, as well as your overhead costs, like rent, accounting, subscriptions, insurance, IT and so on.

What’s leftover is your Operating Profit.

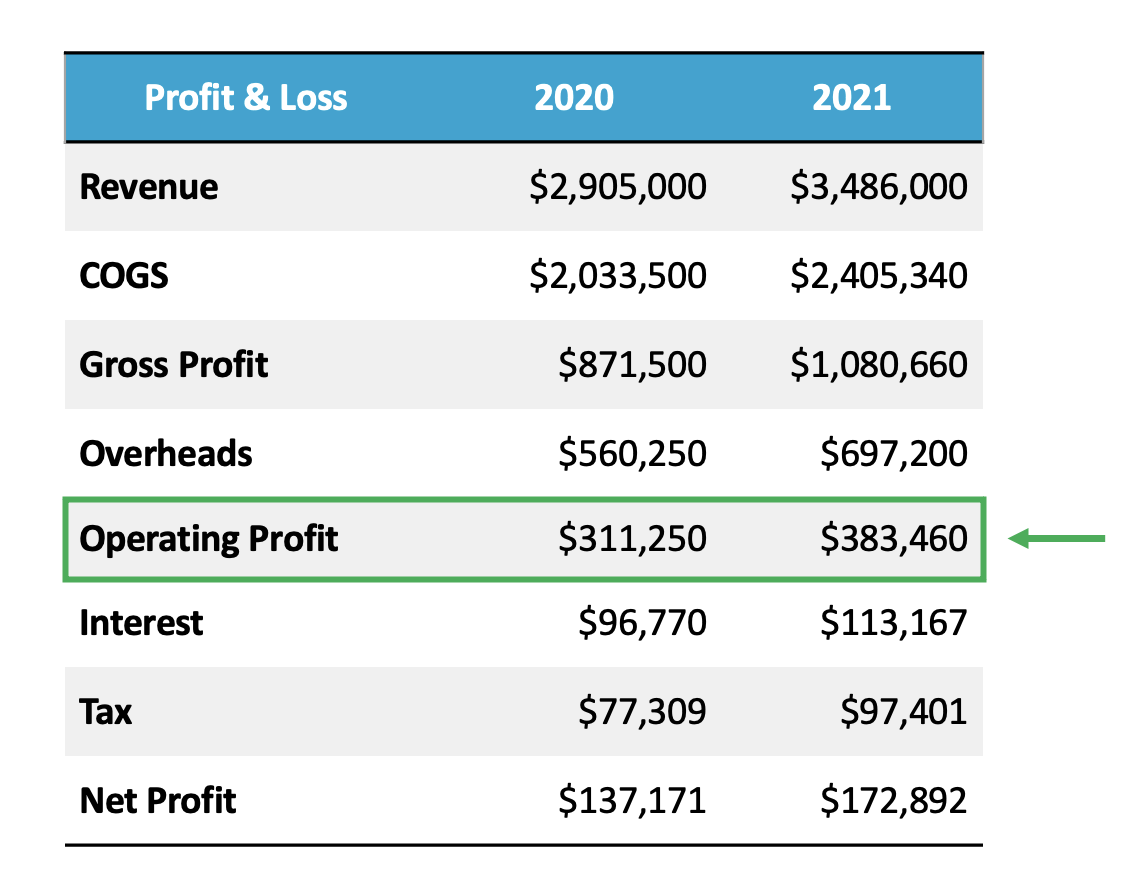

On you profit and loss statement, this is where you would find your Operating Profit sitting.

Now, your accountant might not have your profit and loss structured like this. For example, Operating Profit might actually be called Net Profit on your P&L.

But to make it simple, again Operating Profit is the profit BEFORE tax and interest.

So, to wrap up the first rule...

If you aren’t making any Operating Profit, then in my opinion you probably shouldn’t pay yourself a dividend. It’s that simple.

Alright, so that’s the first checkbox… let’s move to item number 2 on the list…

2. Pay Your Company Tax

If you run a profitable business, you’re paying company tax.

And as simple as this sounds, this is where many go wrong and where many begin their relationship with the ATO debt department.

We’d all love to flip taxes to the bottom of the list… I get it.

Because we want the profit our business makes to be ours.

But the reality is, in the real world, it’s not.

Even if you aren’t profitable, you’re still paying tax... whether it’s Goods and Services Tax, Capital Gains Tax, Payroll Tax, and so on.

Tax is just a part of business.

In this case though, I’m talking purely about company tax.

Because again, if your company’s profitable, then you need to pay company tax.

That’s why, you need to prioritise putting a portion of your profits aside to pay for your company tax.

This ensures that you don’t end up on the ATO debt treadmill that many trade business owners find themselves on because you’re spending money that actually isn’t yours.

The key is to get that profit out of your financial equation and get it out of your calculations... it isn’t yours to spend. It’s the governments.

You’re playing with the government’s money, and they make the rules.

So, make sure you set aside that profit from the start, so you can comfortably pay your company tax.

"I Won't Pay Tax If I Spend My Profits..."

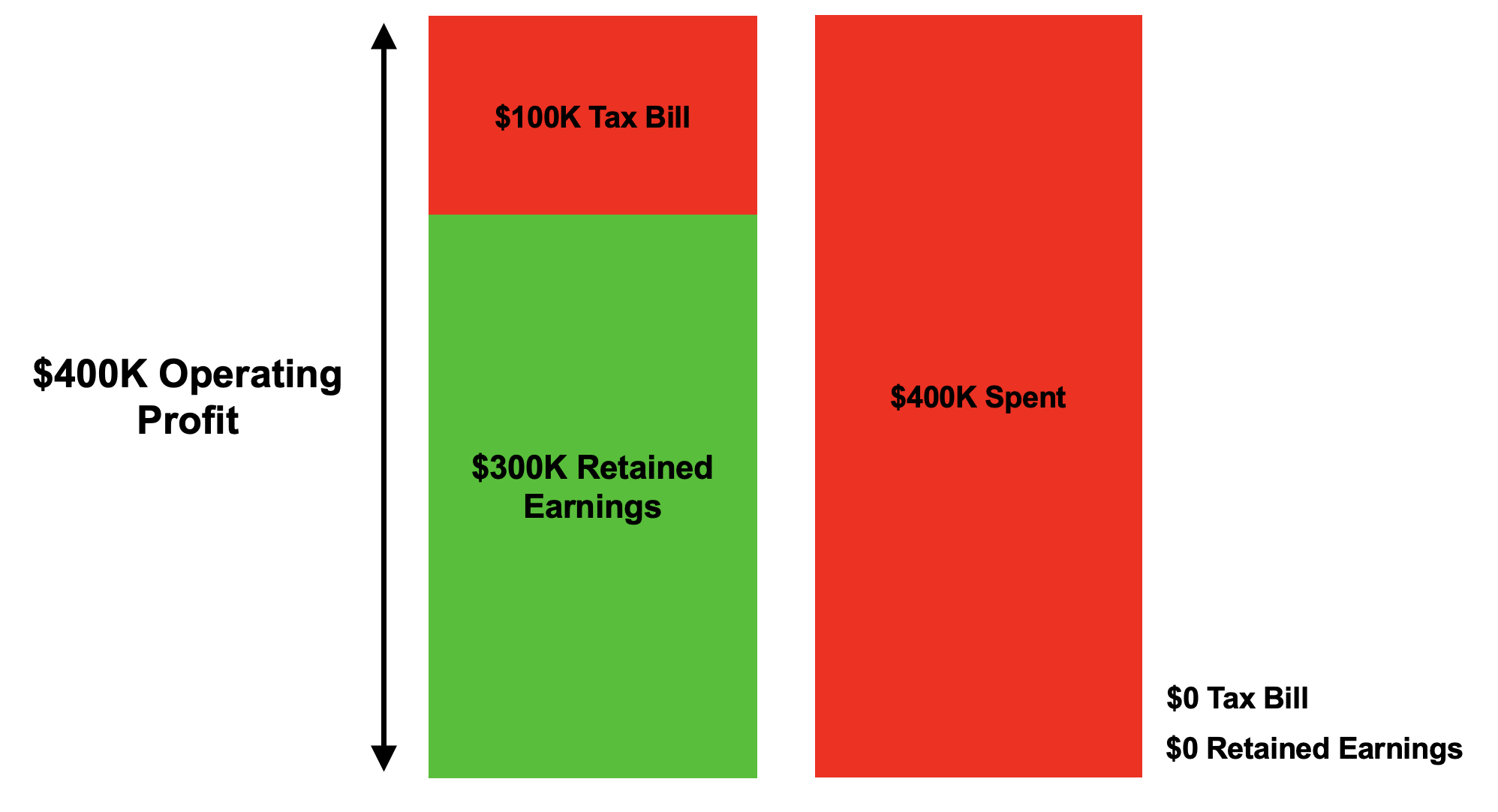

Now, some of you might be thinking, “well, if I spend my profits, then I won’t have to pay any company tax…”

And you’re right, you won’t.

But you also won’t be able to pay yourself a dividend anymore, because you’re unprofitable now.

You’ve spent the profits, and now, your business can’t afford to pay you a dividend. A dividend that you could’ve used to build your own personal wealth outside of the business!

I’m not saying that spending your profits is a bad thing. Sometimes it is the right things to do to help grow the business to give you greater return down the line.

But what I am saying, is if you’re spending these profits (on stuff you don't really need) to purely just reduce your tax bill, then you’re focusing on the wrong side of the equation!

Focus on MAKING MORE PROFIT... not reducing taxes!

Not to mention the fact that you’re spending a dollar to save 25 cents in company tax!

I don’t know about you, but if for example, I made $400K in Operating Profit, I’d much rather spend $100K in company tax to make $300K in retained earnings that could be used to build greater wealth… than spend $400K in profit, to save $100K in company tax and have nothing leftover the build personal wealth with because you’ve eroded 100% of your retained earnings!

It’s such a flawed tax strategy.

You’re prioritising tax reduction over wealth creation… which is just insane!

Alright, so once you’ve set aside the cash to pay your company tax, you can then move to item 3 on the list.

3. Repay Bad Debt

Debt in general isn’t bad. In fact, it can be a really powerful tool that you can use to protect your existing cash cushion.

For example, fix-term debts for vehicles, equipment or buildings can be really, really important, because most of the time, you don’t want to fund those kinds of investments upfront in cash.

The debt I’m talking about here is mostly debt associated with credit cards and lines of credit.

Because those kinds of debts CAN be bad if you aren’t keeping tabs on them, because you can start to rack up interest on them really, really quickly.

And these interest repayments can be detrimental to cash flow and your ability to build your personal wealth outside of the business, because large chunks of your Operating Profit are having to be used to pay back this interest.

That’s why you want to pay off any aged credit card debt or line of credit debt, as well as keep on top of it moving forward.

Struggling To Pay Back Your Bad Debt?

Now, if you can’t pay it back because your business doesn’t make enough cash, then you’ve got bigger problems that need to be resolved as soon as possible.

If this is the case for you, I strongly recommend that you go and watch our cash flow masterclass training that we’ve provided for free on our channel.

Because in that training, we provide a super simple framework that you can use to flood your business with more cash, which is going to be super helpful in getting your credit lines under control first, before you start to even think about paying yourself a dividend.

Click here to watch Cash Flow Masterclass.

Your business should be able to fund itself.

Don’t fall into the trap of falling deeper and deeper into debt to fund a business model that just isn’t working. You’re leading yourself into a really, really dangerous situation.

Again, debt can be a great tool in business.

But if you’re using debt to mask the issue of an unprofitable business, that’s where you’ll run into trouble because in those circumstances I can almost guarantee that throwing more money at your business won’t get you better results… it will just dig the hole deeper.

Alright, so once you’ve paid off all your bad debt, you can then move to item 4 on the list…

4. Build Your Emergency Cash Cushion

Your Emergency Cash Cushion is simply the minimum amount of cash that you need to fund your business’s operations in the short-term if things were to go wrong, because you never know what’s around the corner.

You should always try to find ways to limit the troughs in business.

But in most instances, there’s usually nothing you can really do to prevent them. So, what matters is how you prepare, that’s why you want an emergency cash cushion.

It’s your safety net. It’s your protection and buffer against the financial hits that are destined to happen in business.

It allows you to weather yourself against the storms, and it gives you some cash reserves to invest in critical business assets that allow you to continue delivering the work that you do in tough times.

You should be able to fund these shortfalls with your own internal cash for quite some time without a line of credit.

If you have to immediately jump to a line of credit when things get tough, then you’re likely in a really dangerous position where your business could spiral into a really bad debt situation, really quickly – which is why you want the cash there!

So, how much should you have in your emergency cash cushion?

Well, how much cash do you need to support your business should sales take a dive? A big client delaying their payments? Or you’re unexpectedly struck by an illness?

There’s a range of different things that can go wrong, that you need cash to cover.

But in my experience, the worst downstrokes from these kinds of events seems to be roughly two to three months of overhead costs.

This is why, a good rule of thumb is to have enough cash reserves on hand, and nothing drawn on a line of credit to cover your overhead costs and salaries for at least 2 months’.

That means you can cover all the costs in your business that’ll keep eating away at your bank account even when you don’t sell anything… like salaries, rent, subscriptions, vehicle repayments, and so on… for two whole months.

So, for example, if your monthly overhead cost and salaries average around $150,000, then you should aim to have $300,000 in the bank account AT A BARE MINIMUM.

That’s 2 months of costs covered, even if you weren’t to sell anything.

Now, a business with $150K in operational costs per month, is probably turning over $3M in revenue.

At a 15% Operating Profit Margin, this business could probably bank that in 2 years.

So, start building this cash cushion today and don’t pay yourself a dividend until you do!

And once you have your 2-month cash cushion, don’t touch it. It’s there for tough times ONLY.

Look at it as if it’s your new zero point in your bank account. This will ensure that you never have to stress about not having enough cash to run the business during a downturn... something that happens far too often in our industry.

Alright, so now that you’ve built your emergency cash cushion, you can then move to item 5 on the list…

5. Build Your Growth Capital

Growth capital is simply the cash on top of your emergency cash cushion to fund growth.

Whether that’s to cover a new hire that needs time to be brought up to speed, investing in equipment needed to grow, or funding the natural increases in money owed to you by customers when you start to grow.

These are all elements of growth that need to be funded with CASH.

Now, this step is optional, because if you don’t want to grow anymore, then you don’t need growth capital and you can jump straight to the next item on the list.

However, if you do want to grow, ticking this box is critical.

Sure, you’ve got a cash cushion there, but that’s purely for emergency situations. Funding for growth should not come from your emergency cash cushion. It should come from growth capital.

So, how much should you have in Growth Capital?

Well, this one’s a bit harder to answer, because it really does depend on the rate that you’d like to grow at, because the faster you grow, the faster you’re going to need cash.

So, I’d really have to sit with you 1-on-1 to breakdown what this would need to look like for you personally.

But as a rough guide, you should aim for an extra month or two in cash on top of your emergency cash cushion.

This means, all up, you should have enough cash to fund your current operation for at least 3 to 4 months.

So, thinking about the same example from earlier, you’d need at least an extra $150,000 in growth capital on top of your cash cushion… which is $450,000 all up!

Now, I’m not saying you can’t grow until you save that extra months’ worth of cost. It’s just important that you’re aware that while you’re growing, you should be continually focused on banking the profits leftover, to ensure you stay in the clear with cash as you grow.

But again, it really is dependent on how fast you grow. Because if you want to double your business over the next 12 months, then you’d need at least an extra 2 to 3 months growth capital on top of your cash cushion at a minimum.

So, again, just use this as a rough guide.

For most of you though, an extra month in reserves on top of your emergency cash cushion should be more than enough to fund your own growth comfortably.

And the reason why I stress this point is because just as many businesses go under from overtrading as they do under trading…

And it doesn’t take much to cripple a business that’s overextended without enough cash to fund itself should something happen like delayed payments, or promised contracts falling through or accidents on sites and so on.

6. Look For A Better Return On Investment

Alright, so at this point, you’re profitable… you’ve set aside your tax… you’ve repaid bad debt… you’ve built your emergency cash cushion… you’ve built your growth capital if you’re looking grow… and let’s say you have $100,000 leftover…

Before you look to take this $100K out in dividends, there’s one final question you should ask yourself:

Is there something I can spend this $100,000 on for the business that will get me more than $100,000 back?

Like I said earlier in the training... don’t even consider spending the $100,000 just to save 25 cents on the dollar in taxes. That probably isn’t a smart move.

Focus on what’s going to make YOU more money. Look to invest to get better returns.

Now, if the answer’s no to this question, then is there something that you should build towards that costs more than $100,000?

Maybe you want to buy a competitor, spin off a new business? Or purchase a big piece of equipment that would really change the markets you can get into? Or invest some of that $100,000 into necessary gear or staff or tech to drive better efficiencies?

Whatever it is, you can keep saving until you hit the number that will help you reach a big goal.

Always be looking for opportunity on the horizon.

And at the same time, make sure you’re banking cash. Opportunity loves cash.

7. Pay Yourself A Dividend

Now, if there isn’t a goal, then this is likely the time to pay yourself dividends.

When it comes to paying yourself a dividend, there’s no set amount or percentage that you should be taking out. It really just depends on the circumstances.

If you’ve built yourself to a point where you’ve ticked all the boxes, then you’re likely in a position to pay yourself 100% of the after-tax profits.

But if you’re wanting to continually grow, or even depending on how big your receivables are, how much inventory you have to fund, or how many assets you have to buy, you might be building capital forever, so you can only take a much smaller portion of the profit, or in some cases none at all.

Your business needs that retained profit to fund ongoing growth.

But either way, if you’re planning on paying yourself dividends, as a golden rule, take dividends on a structured basis at planned times throughout the year.

If you’re having to take dividends frequently at random times throughout the year, it likely means you’re either not paying yourself a fair market salary... so what you’re earning month to month from your wage isn’t actually enough to fund your lifestyle.

You want to get this under control, so you can start taking dividends formally, and ideally, living off your wage and using those dividends to invest and start building your own personal wealth outside of the business.

Too often, we see business owners try to live off the dividends of their business, leaving nothing for wealth creation.

Feeling Disheartened?

Now, some of you might be disheartened to hear all of this, because it sounds like you’ll never be able to pay yourself dividends with all this other stuff you have to pay for first with your profits.

And while yes, there’s some work that needs to be done before you can reap the rewards of your business. The key here, is to reset your mindset to have a longer-term perspective.

Sure, you could pull more money out earlier for yourself… but what’s the longer-term impact of that?

The reality is, you can build far greater wealth with a little bit of delayed gratification.

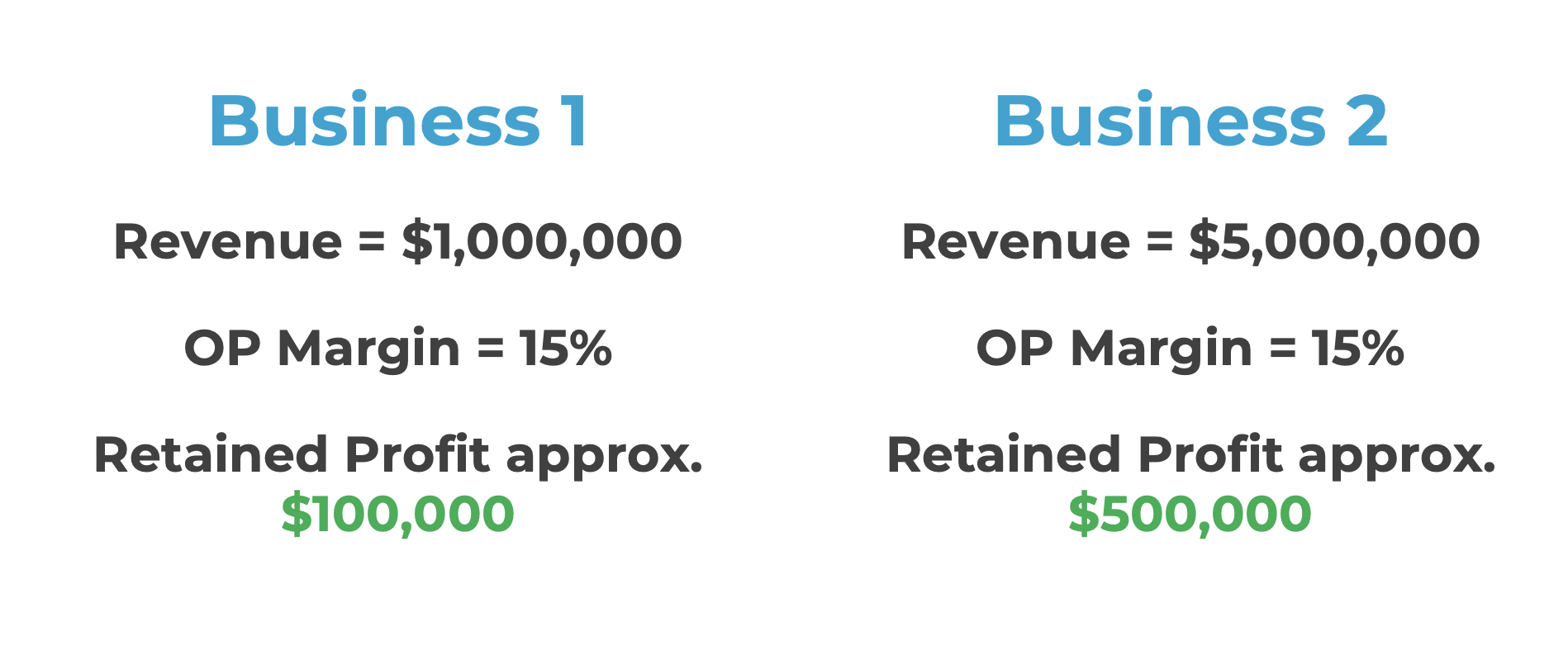

For example, let’s say you’re running a $1M business at a 15% Operating Profit Margin.

So, after tax and interest, you might have $100,000 in retained after-tax profits that you can pull out on top of your salary. That’s pretty good.

But what if you sacrificed that income and chose to reinvest it back into the business to grow it to $5M in revenue over the next 3 to 5 years?

Sure, you might’ve missed out on $300K to $500K of potential personal income over those years…

But with a $5M business at a 15% Operating Profit Margin, you’d be making roughly $500,000 in after-tax profits every single year!

That means, in a single year, this $5M/year business can pay you the same amount of dividends as what it would take the $1M/year business to pay you over 5 years. That’s a massive difference!

And at that point you can either choose to grow beyond the $5M and make an even better return, OR maintain the business at that size and pull out $500,000 for yourself every year.

So, rather than paying yourself $100K in recurring dividend payments, you’re paying yourself $500K year on year in dividends!

You’ve pretty much 5X’d your ability to build wealth!

Even if you took that original $100K dividend payment from the $1M business and reinvested elsewhere (whether that’s property, shares, etc.) there’s a very, very strong chance you would not get that same return on investment.

They average around 5 to 10% return on investment year on year.

A business that is setup right and performing well can easily achieve a return of 50 to 100% year on year.

In fact, that example I just went through is a business easily making more than a 75% return.

Yes, it takes time. But if you build the foundations of your business correctly, from the start, then you too can build a business that gives you returns like this.

And once you have a rock solid business that has become a cash producing machine, you’ve ticked all the boxes, and you’re free to take money out on a structured basis, then you can look to other areas such as real estate or share and so on to diversify your income and wealth basis, because you have the cash producing business to support it all.

If you want help making this kind of business a reality, then make sure you reach out because we’d love to help.

If you're an electrician, plumber, painter, carpenter, or any other tradie business owner turning more than $1M a year looking for assistance with your tax, accounting, bookkeeping, and business advisory - click here to learn more!