If you’re a trade or construction business owner and you’ve ever asked yourself the question, “How much should I be paying myself?”, then this article is for you…

Because I’m going to breakdown the ONE simple rule that we use to help guide our clients on how much they should be paying themselves as the business owner, to make sure they’re (1) making the income that they need to be making to live comfortably, and (2) not damaging the health of their business because they’re either paying themselves too much or too little.

Owner compensation is such an important area to get right in business… yet rarely do I ever hear anyone talking about it.

That’s why, in this training, I’m going to cover this topic extensively, so no matter the size of your business, whether you’re just starting out, or about to crack 8-figures in revenue… This will be relevant to you!

Let’s dive in.

How Much Should You Pay Yourself?

So, the big question here is, as the business owner, “How much should you pay yourself?”

And it’s a great question, because knowing what to pay yourself is really, really important.

At the end of the day, a big reason why so many of us started a business in the first place was because we wanted to make more money than what a job could ever give us.

But, as much as we’d love to just make more money, the reality is, what we get paid as the owners of our businesses, needs to not only make sense for us, but also our business.

You shouldn’t just be paying yourself whatever you want.

Disclaimer: obviously we don’t know your particular situation, or how your current accountant has set up your finances. So, make sure you speak with them first before implementing anything that I’m about to discuss.

If you aren’t happy with your current accountant, or how they’ve got everything structured… then make sure you reach out, because we’d love to help you run a better business that makes you far more money.

What Do I Mean By 'Pay Yourself'?

Now, before I go can actually answer the question, “How much should you pay yourself?"... It’s important that we’re on the same page with what I mean by ‘pay yourself’.

Because depending on whether or not you’re a sole trader or the owner of a company, there can actually be multiple ways that you can pay yourself.

As a sole trader, paying yourself is pretty simple.

For tax purposes, you and your business are considered 'one in the same', which means you can just transfer money out of your business and into your personal account any time you like.

There are no wages or anything like that. You just take drawings.

So, the question of, “how much should you pay yourself?” just means, “how much should you draw from the business?”

Whereas, as the owner of a company, it’s not that simple.

And that’s because the government and the ATO no longer view your business as a single entity. They see you as two very distinct legal entities.

So, the money sitting within the business bank account is no longer your money, it’s the company’s! And even as the business owner, you can’t just use all the company’s money for personal use. Again, it’s not your money!

So, freely withdrawing money from your company for personal use can have damaging consequences if you’re not careful.

I’m not saying you can’t take money out of your business, I’m just saying you need to do it legally if you want to keep yourself out of hot water.

And to keep yourself out of hot water, as the owner of your company, there’s really only 4 ways to legally access company funds for personal use...

The 4 Ways You Can Access Company Funds?

And they are:

- Through a Salary, a Wage or Director’s Fees… where you run yourself through payroll…

- Through a Reimbursement… where you take back the money you initially invested in the business to get it up and running…

- Through a division 7A loan from your company… where you’re required to pay it back with interest… and

- Through a Dividend… where your company issues you a payment from its profits…

That’s it.

They’re the 4 ways that you can access company money for personal use.

Don't Confuse A Salary With Dividends

Now, it’s important that moving forward, you don’t confuse paying yourself a salary with paying yourself dividends from your company’s profits.

Because they’re actually two very distinct ways of paying yourself as the business owner.

Far too often, we see business owners mixing the two… where they either don’t pay themselves a salary and just live off the dividend payments from the business…

OR they keep their salary really low and pay themselves dividends on an ‘as-needs’ basis.

Either way, they’re both flawed strategies to paying yourself as the owner…

And that’s largely for one fundamental reason:

You’re muddying the water between getting paid for WHAT YOU DO versus getting a return on WHAT YOU OWN.

What You DO Versus What You OWN

If you were only an employee, you work IN the business and only get paid, or compensated for what you DO. And that payment would be in the form of a wage that runs through payroll.

Whereas, if you were only a shareholder, then you don’t work in the business, so you shouldn’t receive a wage.

You get compensated with a RETURN, because you own a percentage of the business. You get a return on what you OWN.

And that return would either be in the form of a dividend payment from the profits, or capital growth from the increasing value of your business; just like you would if you invested in shares or real estate.

You get rewarded, or compensated, through a RETURN, NOT a wage.

Pretty simple, right?

You get a wage for WHAT YOU DO and a return on WHAT YOU OWN.

You Have A Dual Role In Your Business

Now, for most of you reading this article though, you’re probably the owner of your business AND ALSO working in the business full-time, likely as the director.

In this case, you actually have a dual role.

You’re technically both an employee of the business AND a shareholder of the business.

So, it’s important that you’re getting compensated by the business for both these roles that you’re performing.

Which means, getting compensated through both a WAGE and a RETURN.

So, when I say, “how much should you pay yourself?” … What I’m talking about here is actually, “What should your wage be?”

Because you need to be paying yourself a wage. You need to be getting paid for the work that you’re doing IN the business.

And this isn’t just from a perspective of principle but also a perspective of keeping you out of hot water with the ATO.

As of July 2021 in Australia, by law, if you’re the director, you have to pay yourself a wage through payroll, just like any other employee. So, that means trying to live off dividend payments alone is now illegal by law.

You have to pay yourself a wage through payroll.

Pay Yourself A Fair Market Wage

Which brings us back to the original question… “How much should you pay yourself?”

Well, the answer to this question is probably a lot more straight forward than what you might think… and that is: Pay yourself a fair market wage.

Your goal should be to pay all the employees in your business a fair market wage, including yourself.

Now, there’s probably a lot of you listening right now that disagree with this answer for a number of reasons because…

Why wouldn’t you just keep your salary low and take out larger dividend payments more frequently??? Whether that’s to try and keep taxes down… or maybe conserve cash within the business…

And it’s a fair question… and it’s actually something that we see a lot.

But at Trade Business Accountants, it’s our belief that this approach is actually flawed for one fundamental reason...

You're Distorting Your Numbers

If you’re not paying yourself a fair market wage for the role that you’re performing in the business, then you’re exaggerating the true profitability of your business, which is distorting your business numbers, and making it way harder to drive improved performance and profitability within your business.

Sure, your profit and loss might look good, but the numbers you’re looking at aren’t accurate because they’re not truly reflective of actual market conditions.

And what I mean by that, is if you were to get hit by a bus today, and your family had to replace the role that you were performing in the business and pay them what you were paying yourself… would it be enough?

OR if you wanted to sell your business and exit it… would the wage you’re paying yourself be enough?

If the answer’s YES… fantastic! Chances are, you’re paying yourself a fair market wage.

But if the answer’s NO… then chances are, you’re underpaying yourself, distorting your numbers, and exaggerating the true profitability of your business!

Sure, it might feel good to have a fatter profit margin… But it doesn’t take away from the fact that the numbers you’re looking at are actually lying to you.

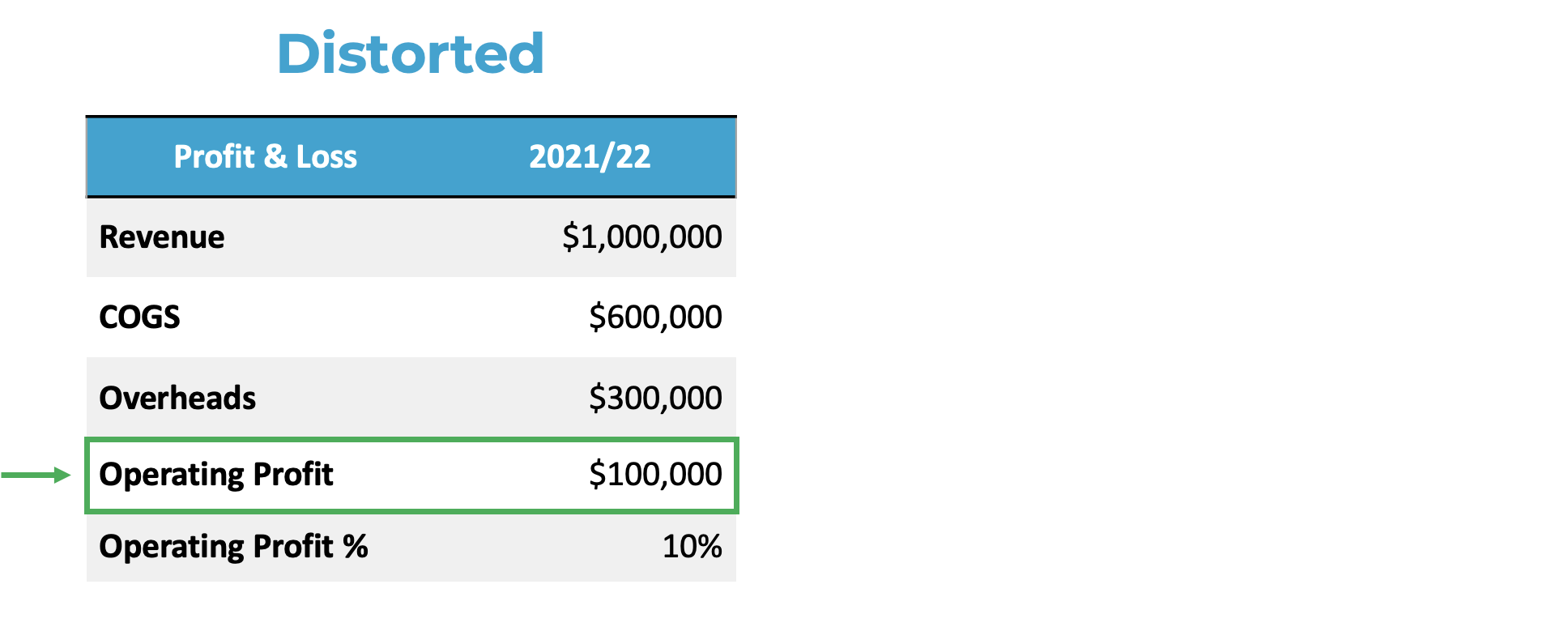

For example, let’s say you’re running a business with $1M turnover…

And over the past year, you’ve spent $600,000 in COGS, or job costs, like labour, materials, subcontractors and stuff like that…

And then on top of that, you’ve spent $300,000 in Overhead costs, to cover those business operational costs, like rent, subscriptions, ICT, accounting, legal, insurance and so on.

At the end of the day, this leaves you with $100,000 in Operating Profit, which is an Operating Profit margin of 10%.

Now, you’d probably be pretty happy about that because it’s not a bad effort. Most businesses never achieve an Operating Profit margin of 10%, so it looks like you know a thing or two about running a business!

But… there’s a problem.

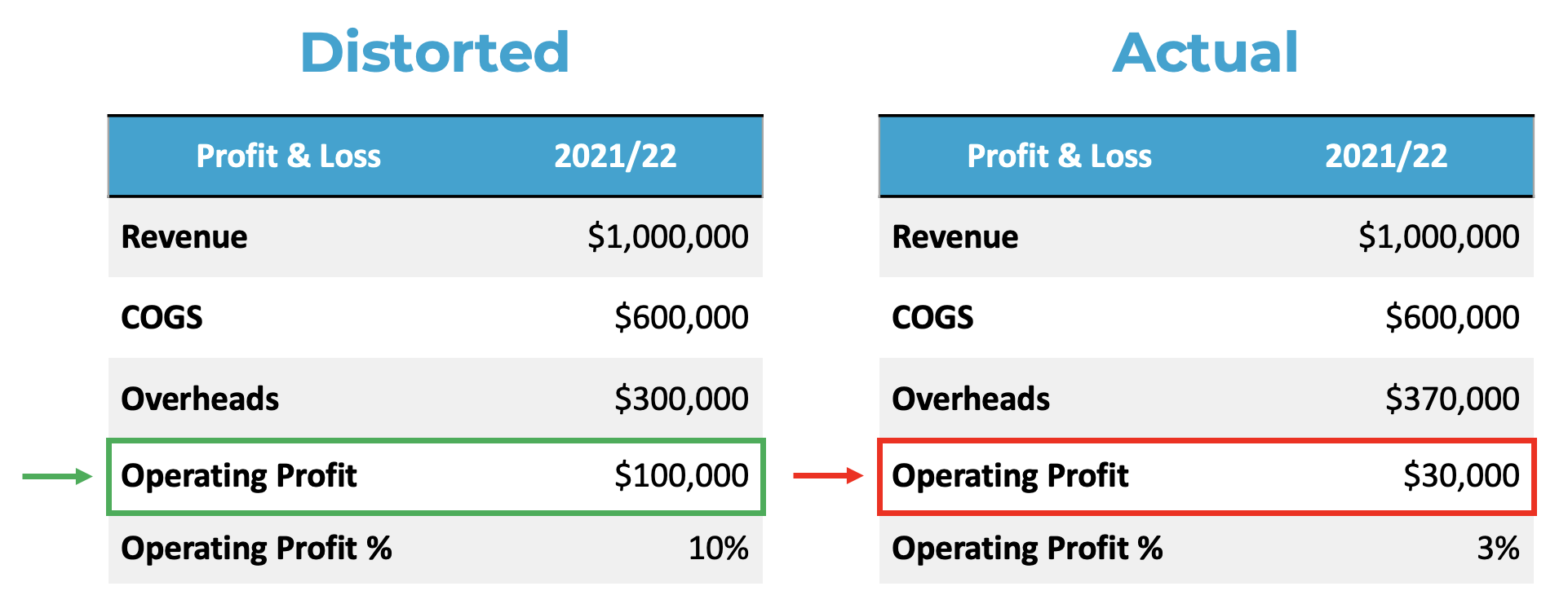

It turns out, you’re only paying yourself a $30,000 salary and taking dividends out on an ‘as needs’ basis on top of that, which is far from a fair market wage of someone running a $1M operation.

Realistically, you should be getting paid upwards of $100,000 as a fair market wage!

This means, you’re actually not achieving a 10% Operating Profit Margin, or $100,000 in Operating Profit because we need to factor in that extra $70,000 in your Overhead costs.

Because again, if you were to get hit by a bus and needed to be replaced, is someone going to fill that role on a $30,000 salary???

Of course not!

They’d expect no less than $100,000/year as a salary.

So, once we factor that $70K in, you’re actually only making $30,000 in Operating Profit, or a 3% Operating Profit Margin… which makes your performance for the year look much worse.

And the reality is, $30K Operating Profit for a $1M business just isn’t enough. You’re barely breaking even from a profit perspective!

And chances are, your cash flow looks a hell of a lot worse!

And to make matters worse, even though you’re in this dire situation, because your distorted profit and loss is telling you that everything’s fine, you just keep operating the way you already are, thinking you’re doing a great job... When in reality, you’re not!

And you really should be getting your arse into gear and starting to fix your profit problem.

This is why accurate, undistorted numbers is critical!

Without them, it makes it really difficult to drive improved performance and profitability within your business, because you’re not getting the data you need in the first place to be able to actually make well-informed strategic decisions to improve the performance and profitability of your business… which should be your #1 priority!

If you don’t get your compensation right, then you’re only making it harder for yourself to put points on the board.

Your numbers are lying to you, and you’ve got financial reports that are about as useful as a compass that’s 10 degrees off, and you’ll likely end up continuing down the path of false profits, poor wages and a business that never really creates the lifestyle that you’d hoped for in the beginning.

The solution to correct this distortion is to start paying yourself a fair market wage.

Now, obviously that distortion does decrease the larger you get, because your wage as a percentage of the business’s revenue shrinks the larger it gets.

But if you’re turning less than $5M a year in revenue and you aren’t paying yourself a fair market wage, then the impact is far greater!

"I Have It Setup For Tax Purposes"

We all want to reduce the amount of tax we pay.

BUT remember what I just spoke about...

Driving improved performance and profitability within your business should be your #1 priority!

So, by having owner compensation structured purely for tax purposes, you ARE implicating your ability to improve the performance and profitability of your business!

If there’s one thing that I’ve learned working in the business and accounting world, it’s that people get way too hung up on the expense side of the equation… particularly when it comes to reducing tax!

Don’t get me wrong. You shouldn’t pay any more than your fair share, And we will always advise our clients to be wary of expenditure.

But at the end of the day, expenses are, and always will be, second in importance to making more money.

So, if your sole focus on underpaying yourself is from a pure tax perspective, then it’s my belief that you’re focusing on the wrong side of the equation!

Your tax strategies should NOT implicate your ability to improve the performance and profitability of your business.

At the end of the day, tax is just a part of business.

The sooner you can accept that, the sooner you can start focusing on the right side of the equation and making more money for yourself over the short and long term.

Two Challenges To Walk Away With

Alright, so I’ve covered quite a bit here in the first half of this article and I hope you’ve already got plenty out of it.

But to really drive home everything I’ve spoken about up until this point, I want to give you two challenges that will ensure you start to pay yourself a fair market wage.

The first challenge is to be a more demanding employee.

No employee would ever accept a wage of $30,000 if they’re performing a role in the business that’s worth $100,000, or maybe even $120,000, a year.

So, why are you willing to work for such a low salary?

Be a more demanding employee and expect to get compensated fairly for the role that you’re performing in the business.

The second challenge is to be a more demanding shareholder.

Because as a demanding shareholder, if the business that you own, can’t turn a decent profit after paying everyone in the business a fair market wage, then you’d be looking to see some big changes happening.

You’d want to be seeing a decent return from your investment… otherwise what’s the point??? Why would you remain a shareholder of a business that gives you little to no return???

As a demanding shareholder, you need to push the company into profitability.

Because if your business can’t turn a profit, then you shouldn’t be rewarded with a return on WHAT YOU OWN… It’s that simple.

So, again, be a more demanding shareholder.

A healthy business pays everyone a fair market wage and gives the owners a fair return at the end of the day.

Your business should be able to pay you what you’re entitled, from both sides of the equation.

And if it can’t… then there are very real problems in your business that need addressing.

What Is Your Fair Market Wage?

At this point, you’re probably thinking, “what’s the fair market wage for the role that I’m performing in my business?”

Well, the best way to answer this question is by asking you the same question I asked you earlier…

If you got run over by a bus today and your family, or management team, decided they would keep the business going in your absence, what would they have to pay someone to do your job?

Now, obviously the answer to this question is going to vary significantly based on the size of your operation and the role that you play within it.

For example, if you’re a one-man-band, you’re going to be on the tools 100%. So, your wage might only be $90,000… because it’s the wage of a good tradesman!

Whereas, if you’re operating in more of a managing director capacity, with maybe a team of 10, where you’re 100% off the tools managing the business and also focusing on sales and client relations, then your wage might range from $120,000 to $150,000… which is going to be more appropriate for that role.

And on an even higher level, if you’re operating in more of a CEO capacity, with maybe a team of 30, then your wage is going to be more appropriate for that role and the size of that business – which might be, for example, $200,000 to $300,000.

Again, it all depends on what the market would be willing to pay for the role that you’re performing.

Now, if you want to get super specific with what your salary should be… there are plenty of salary survey sites out there that breakdown the salaries for specific roles… OR you can even ask industry peers what they think too, if you’re not really sure.

Should Be Able To Fund Your Personal Life

Now, on a side note, it’s also important that you try to set your wage to a point that it can comfortably pay for your personal life.

That way, you can strive to use any dividend payments to build your personal wealth outside of the business.

Now, of course, sometimes that might not be possible given certain circumstances, and maybe you’ll need your dividends to fund certain aspects of your personal life.

But as a general rule, try your best to live strictly on your fair market wage, even if that means living more within your means, so you’re able to build your personal wealth outside of the business.

Fair Market Wage For All The Owners?

Now, when it comes to figuring out fair market wages, a common scenario we stumble across in this industry, is when 2 or 3 people decide to go into business together, whether they’re mates, or former colleagues…

And here, they typically split the ownership of the company evenly between all of them… which is fine.

But where they go wrong is they also end up paying all the owners the exact same wage too.

Now, this might seem like a ‘fair’ way of doing things for all the parties involved, but it’s actually a flawed way of achieving fair… because fair does not mean equal!

Fair would mean everyone getting paid the appropriate salary for the role that they play IN the business – their fair market wages!

Yes, you all have equal ownership of the company, but remember that you have two roles to play!

So, you’ve got to look at the compensation of all the owners through two lenses… The RETURN they should get ON the business, and the WAGE they should get IN the business.

Again, they are both clearly distinct roles.

The best way to drive this point home is to compare the extremes, is if you had one shareholder who pretty much ran the entire operation, and another shareholder who did nothing in it, would you expect them to both earn the exact same salary?

Of course not! That wouldn’t be fair at all!

Well, the same goes for the lesser extremes too.

If one of the owners is acting as the managing director, and another as just a tradesman onsite, then they should both be earning different wages.

They’re performing entirely different roles that have a different market-based value, and therefore, different market-based wages!

Rarely are two separate roles within the business worth the exact same salary… let alone three!

Who Has The Highest Fair Market Wage?

Now, typically the managing director should have the highest salary in the business.

There are only really two positions that might get a higher salary, and they are:

(1) A salesperson who’s on an eat-what-you-kill incentive program, and

(2) A technical expert who gets a high salary at the early stage of the business when you have to build the whole business off of that one person’s technical skill set.

When you have just one technical person who is an expert, that isn’t the managing director, the business is not healthy enough to pay the managing director more than the expert.

However, once you have multiple experts on staff and support people, the managing director has a much larger business and can justify the largest salary.

You Shouldn't Have Multiple Managing Directors

Now, this naturally opens up another discussion on a HUGE mistake that so many multi-shareholder companies make.

And that is, 2 or 3 owners all trying to be the managing director.

You shouldn’t have 2 or 3 people playing the managing director role… It just isn’t feasible.

You all need to be playing specific roles within the business depending on your unique skillsets and strengths.

For example, one of you might be a technical expert, so maybe a supervisory role out in the field would be more appropriate.

And another might be great at building rapport, kicking the dirt with customers, as well as running the operations, so a sales or managing director role might be more appropriate for them.

Make the call based on each owners’ strengths and what they can bring to the table.

You can’t put everyone in the same position and pay everyone the same salary for the same role. It just isn’t realistic and you’re distorting your data!

I’m not saying you shouldn’t pay all the owners the same wage…

Maybe the fair market wage for each owner’s individual role is the same, which can happen.

What I am saying, is each owner should be playing a specific role within the company and getting compensated fairly based on that role, rather than 2 or 3 people performing the exact same role and all getting paid the same for performing that role.

This ensures everything is FAIR and you’re not distorting your numbers!

So, sit down, drop the egos, and have an upfront open and honest conversation about this.

This isn’t about you and your ego. This is about prioritising the business and making the best decisions for the business.

And this shouldn’t be a subjective discussion either. A fair market wage is a fair market wage.

If you get clear on the specific roles you’re supposed to perform and the expectations of those roles, then getting clear on an appropriate salary should be relatively easy.

Now, in saying that though, if you’re the only one out of all the owners who’s read this article, then I strongly recommend that you get the others to read it too.

This way everyone’s on the same page and it reduces the likelihood of dispute.

The people who have this discussion upfront are the ones who succeed.

You may want to answer salary and leadership questions over a period of time, but within a couple of years, you need to make these tough decisions.

The success of your business depends on it.

I Can't Afford A Fair Market Wage!!!

Okay, so at this point, you’re likely going to be thinking one of three things… they are:

- “I’m going to start paying myself a fair market wage, so my financials reflect the true profitability of my business, allowing me to improve and drive performance.”

- “I’m going to continue paying myself a below market wage” – to which I recommend you go back and listen to this lesson from the start! OR finally

- “My business can’t afford to pay me a fair market wage!”

Now, point number (3) may be some of you reading, especially those just starting out.

Your business just isn’t going to be in a position financially to support paying you a fair market wage for the role you currently perform in the business yet.

For example, if you’re a start-up and within your first 1 or 2 years and you’ve been trying to figure this whole business thing out, then there’s a good chance you’re probably not in a position to pay yourself a market-based wage. And that’s perfectly fine.

But the reality of the situation is, you don’t want to be in that period for too much longer.

Because at the end of the day, if you can’t pay yourself a fair market wage through the finances of the business, then you’re operating at a loss in the real world.

And to put simply, your business is sick.

If this is the case for you, I strongly recommend that you go and watch our cash flow masterclass training that we’ve provided for free on our YouTube channel.

Because in that training, we provide a super simple framework that you can use to flood your business with more cash, which is going to be super helpful if you’re struggling to get money through the door to pay yourself a fair market wage.

Until you can pay yourself a fair market wage and make a profit on top of that, then you will continue to have a sick business on your hands.

Yes, your profit & loss might be showing that you’re ‘technically’ making a few thousand dollars profit a month… But if you remember to what I was saying earlier, this is false profit because you’re not paying yourself a fair market wage, and therefore, your business isn’t truly representative of actual market conditions!

So, again, you can’t let this phase go on too much longer, otherwise you’re always going to face one really bad scenario…

And that is, a consistent below-market wage and no return on your investment!

Introducing 'Sweat Equity'

In the meantime, while you’re building yourself to that point, there’s a different way to pay yourself what you’re worth without taking cash out of the business.

And that way is called Sweat Equity… a term coined by Greg Crabtree.

Put simply, sweat equity is the capital that you create for your business through unpaid work.

For example, say you’ve been running a business for two years, that should’ve realistically been paying you a $100,000 salary for the role that you’re performing in it.

That means, over the past 2 years, you should’ve been paid $200,000. That’s your fair market salary over 2 years.

However, because you only started your business 2 years ago, you weren’t able to pay yourself that $100,000 salary. Instead, you only paid yourself a salary of $50,000, which over the 2-year period, totals $100,000 that’s been paid to you.

That means there’s $100,000 in fair market salary payments outstanding that are still owed to you (that’s the $200K that should’ve been paid, minus the $100K that actually got paid).

But rather than take that $100,000 out, you’ve kept it in the business.

Well, that means, you’ve just created $100,000 in capital for the business through sweat equity.

This is because you kept that money in the business rather than pulling it out to pay yourself a wage.

This is a very important concept to understand because it lets you calculate your lost opportunity to earn a fair market wage had you chosen to work elsewhere.

And it becomes even more important once you start diving into the complexities of multiple owners with different salaries, outside investors and so on, because sweat equity is your way of ensuring that you end up with ownership over that capital that you kept in the business, rather than it being unfairly distributed to all the shareholders of the business.

Now, that whole discussion can get quite complex, and needs to be considered based off your unique circumstances, so make sure you reach out because we’d love to help!

BUT as an overarching takeaway, just make sure you’re tracking your sweat equity.

Because when it comes to building capital in your business, there’s only two currencies that matter – money and effort.

Sweat equity is simply your way of measuring effort against money and getting them to play nice.

So, if you can’t pay yourself a wage right now, keep track of the wages that you’re giving up.

This is money that is owned by you. It’s your investment in the business.

So, you want to make damn sure that it stays that way, and that you continue to get a return from it long into the future!

Don't Fall Into 'Sweat Equity' Sink Hole

Now, if you are going to invest sweat equity in the business, it should only be a short-term strategy of 2 to 3 years at max, that you have a plan to get out of.

This is because a common pitfall that we find trade and construction business owners regularly falling in, is when they get complacent with sweat equity and don’t plan a roadmap out for themselves to start earning a fair market wage.

And in the end, they get stuck in the sweat equity sinkhole for 5, 10, 20 years and beyond – never achieving a full fair market wage.

But I strongly believe that if you can’t pay yourself a fair market wage within 2 to 3 years of starting your business, then it’s likely something is NOT right with your model.

But, as a key takeaway, just make sure you have a game plan to get yourself to a point where your business can actually afford to pay you a fair market wage.

And that’s a real salary running through payroll, NOT a dividend payment from your profits!

Again, like I said earlier, you need to try your best to not live off dividend payments!

It’s my belief that it’s far better to live off your savings account and a below market wage while your sweat equity builds a cash cushion in your business, then it is to fall into the trap that most trade business owners find themselves in when they start out, which is paying themselves a below market wage and living off the profits of the business.

Living on your savings account and a below market wage will ensure you don’t get complacent and kick your arse into gear, rather than getting stuck in the sweat equity sinkhole for 5+ years.

Dipping into your profits early on only delays your success because it gives you a false sense of security that everything is alright when it’s not, which is a dangerous path to go down!

So, again, if you’re in your early days of business, make sure you get a plan in place to know when you’re going to start paying yourself a fair market wage.

Alright, so that’s everything I wanted to cover in this article!

I hope it gave you plenty of insight into how much you should really be paying yourself as the owner of your business, and if your business can’t afford to pay that amount, the steps needed to turn your business around, so it can start to pay your fair market wage.

If you're an electrician, plumber, painter, carpenter, or any other tradie business owner turning more than $1M a year looking for assistance with your tax, accounting, bookkeeping, and business advisory - click here to learn more!