Have you heard the news?

There’s been an industry wide press release surrounding an outrageous new scandal.

A QLD-based plumbing contractor has been caught by the ATO for not paying their staff.

By how much you ask?

Five to fifteen percent of their entire wage!

Seriously.

Suspicious activity relating to super payments flagged an initial audit of the company.

Which later revealed the large discrepancy in staff members payslips!

Employees under the impression they were earning $100k were being robbed of up to $15,000 every single year…!

Can you imagine that?

Putting in all the hard work, effort and sacrifice to earn an agreed upon amount.

Only to have such a large percentage of it stolen right from under your nose!?

Even though you’re legally entitled to it??

Okay, okay, look…

This isn’t really a true story… or at least one that I know of…

But I’m seeing something just like this in trade businesses all over the country…

Let me explain…

Research shows that on average, 5-15% of revenue goes uncollected every single year.

The result?

Busy, exhausted business owners with empty, starving bank accounts.

Which is just as ridiculous as my story about an employee not being paid everything they’re owed!

So what does this have to do with you?

Well thousands of your freedom buying dollars could be left sitting in your customers back pockets without you even realising.

IF… you don’t have a simple system put in place to prevent this.

So in the spirit of providing value to you, regardless of whether or not you’re a client, or ever become one…

I’ve just worked some numbers that are sure to knock you off your feet.

Here’s what I mean…

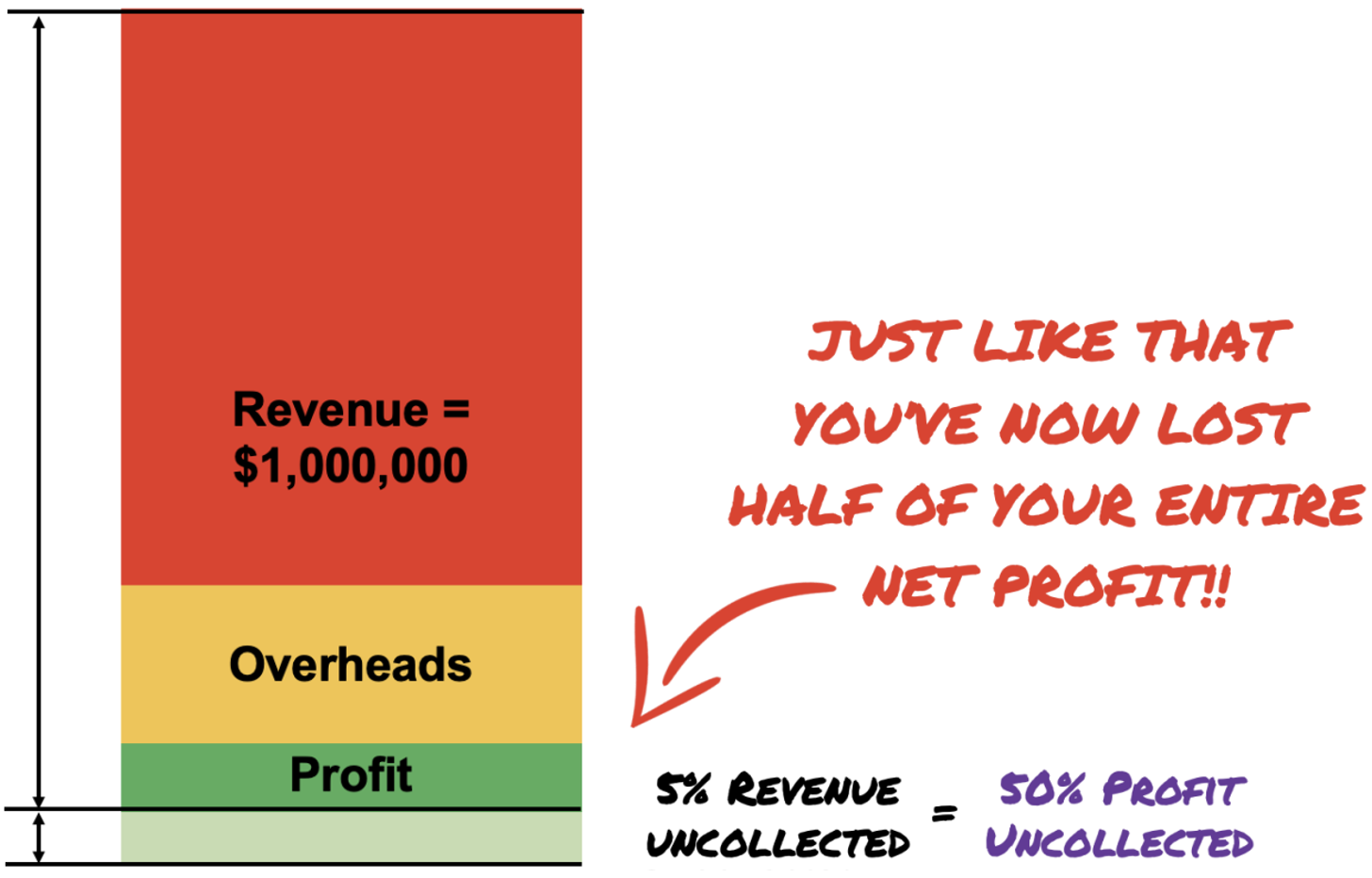

Let’s say you do $1,000,000 in sales.

And just 5% of that goes uncollected… that’s $50,000.

Sometimes things happen, if you missed $50k across $1,000,000 in work, maybe you can live with that.

But let’s break it down.

Say you have a gross profit margin of 25%.

25% of $1,000,000 is $250,000.

‘Woah woah woah… you’re telling me $50k is 20% of my entire gross profit!?’

You betcha… but the uncollected $50,000 now makes this $200,000.

Suddenly it seems like a lot of money right?

You’d need to do another $200,000 worth of work just to make that profit back.

But here’s where things get really scary...

Say in this same scenario... $1,000,000 in sales... with just 5% uncollected...

You have a net profit margin of 10%.

(according to the CFMA the industry avg. is only 4.8%)

This means $100,000 of that $1,000,000 SHOULD be profit on top of your salary.

But because of that uncollected $50k you’ve now lost 50% of your bottom-line profit.

To get that back you’d need to do another $1,000,000 worth of work!

i.e. you’d have to double your business to make up for that original 5% loss.

Sound unrealistic?

Believe me… it’s not.

I know an electrical contractor who at the time turning $6.5M was so busy growing his business that he wasn’t keeping track of how much money was owed to him.

Over a two-year period there was over $700,000 he hadn’t collected for work completed!

So my question for you is this…

How often are you checking the heartbeat of your business?

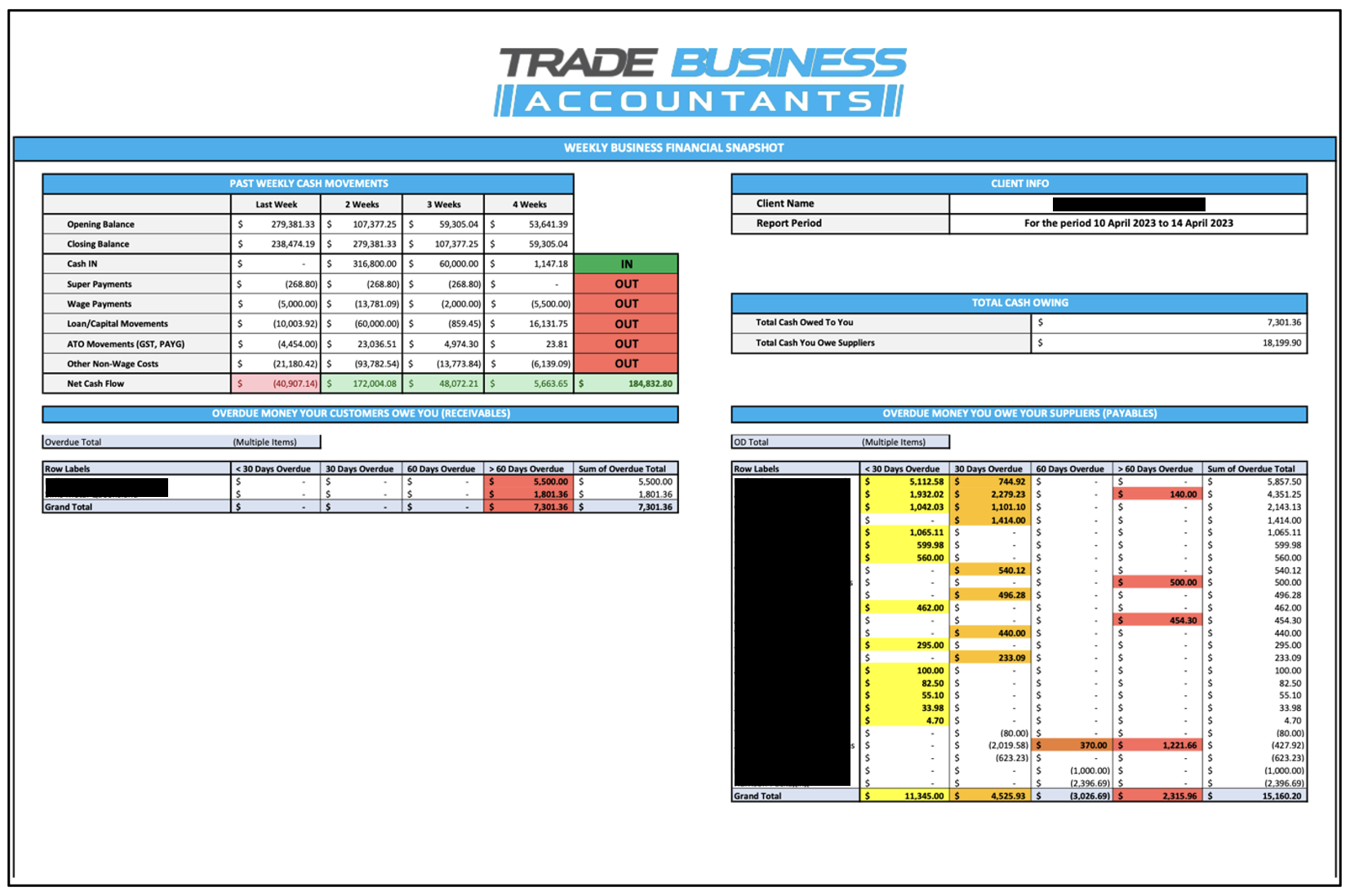

First thing every Monday morning all our TBA clients receive a rolling report outlining their cash movements over the past 4 weeks.

We call this our 'Weekly Business Financial Snapshot'.

This report shows a list of every dollar owed to you, by who, and over what timeframe so you can gauge whether it’s overdue, and the same for money you owe to your suppliers.

Once you know how much cash you have, you can make informed decisions about how to manage it.

Maybe you need to collect outstanding payments from customers…

Maybe you need to not overspend or overcommit…

Whatever the case may be, having a clear picture of your cash flow every week can help you do 3 things:

- Manage your money more aggressively

- Avoid financial shortfalls

- Make smarter decisions

Remember, the number one rule in business is to get paid.

And a sale only ends once money exchanges hands.

So if you want more cash make sure you collect the money owed to you!

The more you reduce the amount of time it takes to collect money owed to you, the more you’ll increase the chances of that collection happening.

If you want better insight into where all your money is going, ask your accountant for a weekly cash report just like this.

It could make all the difference.

Stay dangerous.

Bayley Peachey

P.S. Unfortunately, most accounting firms are only really interested in filing tax returns.

Meaning their business isn’t set up for proactive reporting and advisory – they just don’t have time!

So if it’s ‘too much work’ for your accountant to help you understand your numbers or if you’re unable to get a hold of them long enough to get the answers you’re looking for…

Click here to speak with our team.

Uncommon results come from uncommon action.

Our service is unlike any other in the industry, and so are our clients results.

Don’t hold back your income any longer. Go ahead and click here to book in a call now.