If there’s one thing business owners hate more than anything...

It’s tax.

But can anyone blame us?

Company tax, capital gains tax…

Payroll tax, fringe benefits tax…

PAYG…

You name it, there’s a tax for it.

*shakes fists at the sky*

But there’s another tax you should know about.

One your accountant likely hasn’t mentioned.

(even though you’re paying it every year)

Let me explain…

Grab the nearest piece of paper and write down your current annual income.

Let’s say for examples sake, it’s $160,000.

Now minus that figure from $1,000,000 and underline the answer.

$1,000,000 - $160,000 = $840,000

Did you know you are paying life $840,000 every single year, not knowing how to make $1M dollars?

THIS my friend is what we call the ‘ignorance tax’, and it’s the worst tax of all.

In fact, right now our entire industry is paying an enormous debt daily.

Don’t believe me?

By age 65, only 5% of trade business owners are financially secure.

And between 2018 and 2022, close to 1 in 4 trade businesses turning 1M to 5M went under.

But it’s no wonder why…

Businesses in our industry just aren’t that profitable.

According to the CFMA, the average net profit margin is only 4%!

This is why knowledge is power.

Because ignorance may be bliss, but it's also expensive…

Imagine if you could relive the past decade with what you know now?

Would it make up for the 25% you paid to government?

The biggest cost in your business right now is what you don’t know.

So would it make sense to spend money acquiring knowledge?

i.e. the skillsets you don’t currently have.

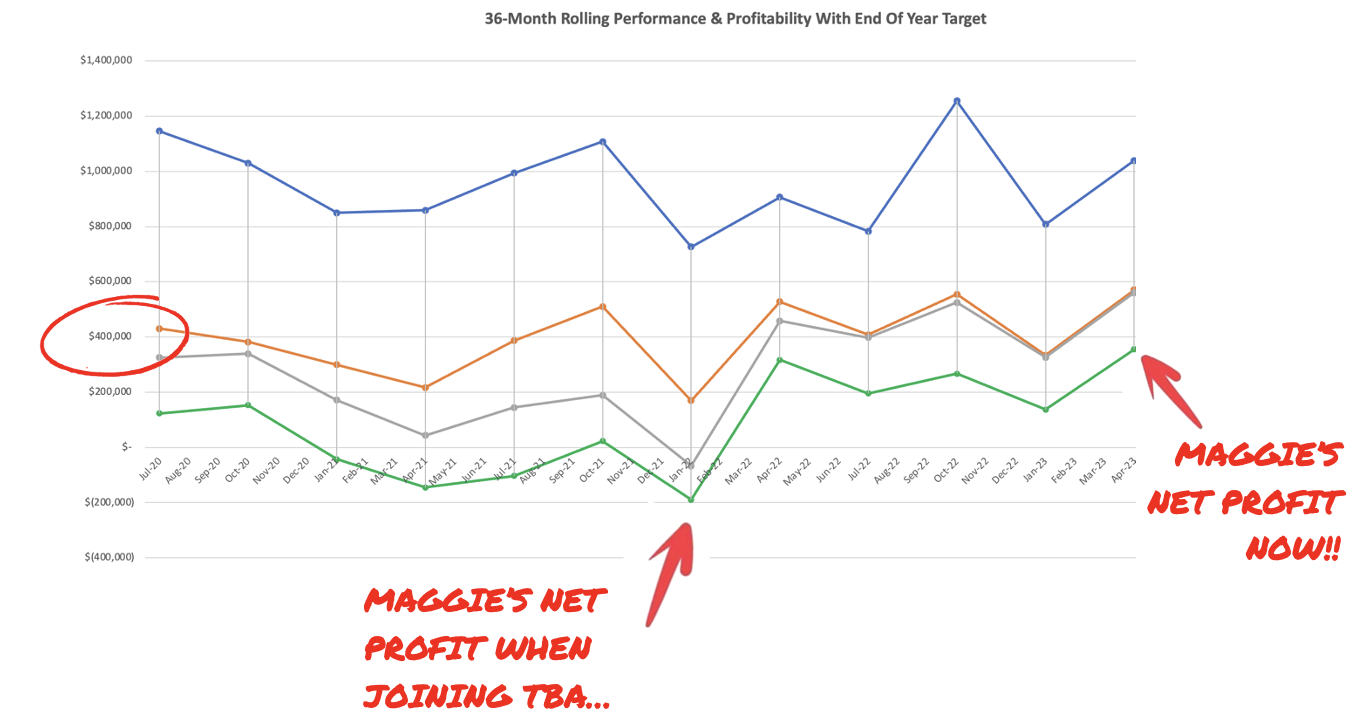

That’s how our client Maggie completely transformed her business.

Over a 3-year period she’d built a team of about 20 staff.

Turning over $5M per year, she had more work than she could handle.

But ignorance tax is a heavy debt to carry.

From a lack of understanding of her numbers, growth came at a devastating cost…

6-figures in ATO debt. Little money in the bank account.

Paying wages with credit cards. Overextended suppliers and subbies.

2 years’ worth of unsubmitted BAS returns.

High blood pressure, sleepless nights, and straining family relationships.

Because she didn’t know how to fix her cash flow…

She didn’t understand how to combat works in progress…

She didn’t know how to take back control of her scheduling…

She didn’t know WHAT TO DO.

Every job she won only sent her further and further down the hole.

So how’d she climb out?

She paid down her ignorance debt.

Simply put, she BOUGHT the skillsets to not only turn her business around…

But also increase her cash flow by 236%...

And net profit by 746%...

In her own words:

“We weren’t fully in control of our finances and numbers.

Surprise tax bills, profit up and down, and it seemed to get worse the bigger we got.

With more money coming in the door than we’ve ever had, our bank account was keeping less and less money for our efforts until we found Trade Business Accountants.

I needed somebody who could help me, who could look at my business and tell me how to turn it around.

Since working with TBA, our business has completely transformed.

The little changes they put in place had a big impact.

Not just in the business but in my personal life too.

Just being able to talk to somebody who knows exactly what we needed to do has been wonderful.

I tell everybody, you want a good accountant, go and see them.

The investment we are making doesn’t even amount to what we are gaining.

I just don’t know what would’ve happened with us if we didn’t get what you brought to the table.”

So listen… every day you make decisions from a place of “not knowing” is a day you pay the ignorance tax.

My advice is to pay for any shortcut possible to reduce that debt.

Sound silly? It’s not…

Imagine your business was running at a 20-30% net profit margin.

Growing 150% year on year.

Where else would you get a return like that?

Property? Shares? Not likely… more like 6-10%....

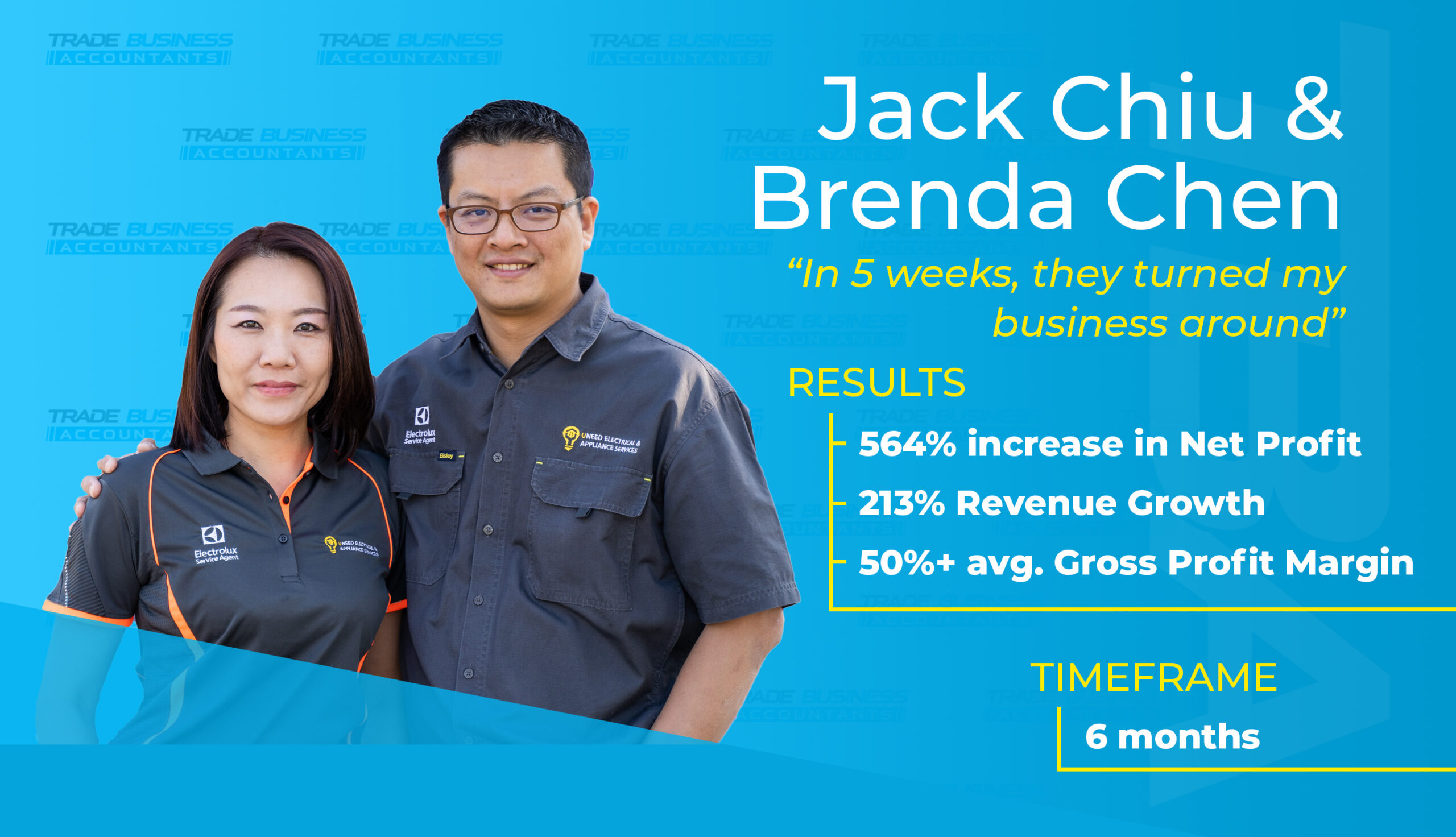

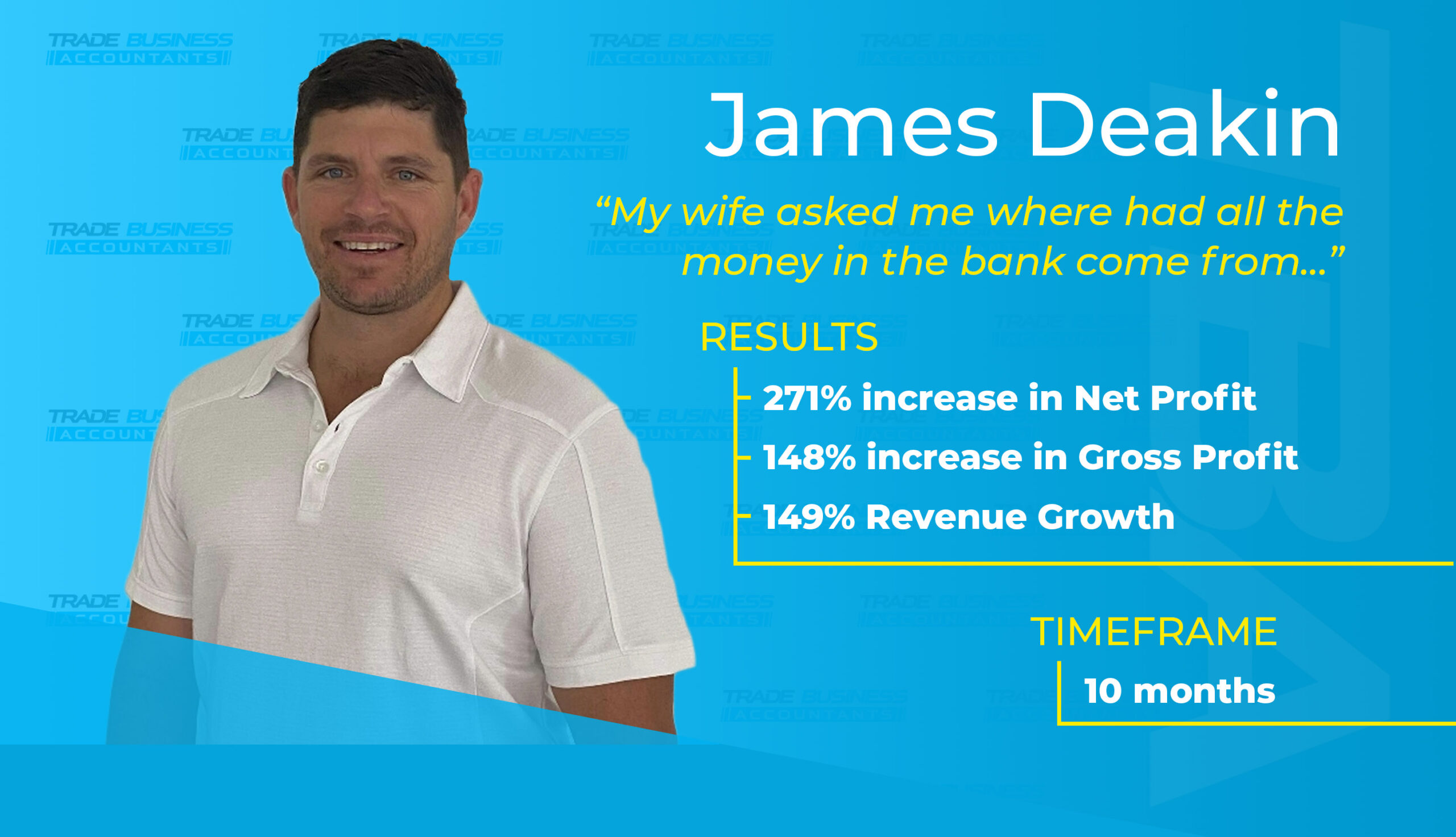

But these are the kind of results our clients are getting RIGHT NOW:

Believe me when I say this...

Ignorance is the most expensive cost we EVER have in our lives.

It’s costing many of us a small fortune every single year.

So my advice is invest in learning. Pay for skillsets. Plug the gaps.

You’ll watch your business (and your income) thrive!

If you want help paying down your debt, simply click here to book in a call with my team.

For every day you don’t know what you don’t know.

Your bank account and future net worth pays the price.

To your success,

Bayley ‘Pay it down’ Peachey