If you’re a trade business owner who’s grown a business from yourself as a one-man-band, to now having a team, purchasing more equipment, investing in a warehouse, taking on more and more cost burden, but you’re not sure how to bundle this altogether and charge it to your clients and your projects, instead of having to absorb it all yourself…

Then stick around, because in this article, I’m going to breakdown exactly how we go about helping our clients, trade and construction business owners just like you, to price their jobs, cover all their costs, and make the money they want to earn personally, even as they continue to grow in size.

Pricing for profit is a huge topic, one that I’m talking about all the time, so today I’m going to strip things down, keep it super simple, so you can walk away from this article knowing exactly how you need to price your jobs moving forward.

So, let’s dive in.

The Typical Pricing Model Evolution

Now, in my experience, when most business owners start out, their business model is pretty simple.

They have themselves, maybe a ute or a van, some tools and they get to work… which is fine when you first start out.

They’re trying to get some initial sales, build some momentum, and get more and more work through the door…

But as that momentum builds and they start to grow, this starts to become a problem.

They’re taking on more people, more equipment, more overhead, more cost… But they’re not really sure how to cover it all when pricing their jobs.

The Disconnect

And from what I’ve seen, this is typically where I see the disconnect between business owners and their understanding of how their pricing numbers bundle together with their business numbers…

And the problem is they’re using a bottom-up approach to pricing…

NOT a top-down approach.

And what I mean by that, is right from the very start of their business, they price from the granular level, whether that’s the breakdown of the cost associated with one man, one labour hour, or one material item…

And they get all these intricate details right on what it’s going to take to deliver the job… which is great.

But the problem with this bottom-up approach, is they end up having to answer one really important question right at the end… and that is:

What Gross Profit Margin do they need to achieve???

And this is typically where most business owners shrug their shoulders because they have no idea what the answer is...

The Importance Of A Gross Profit Margin Target

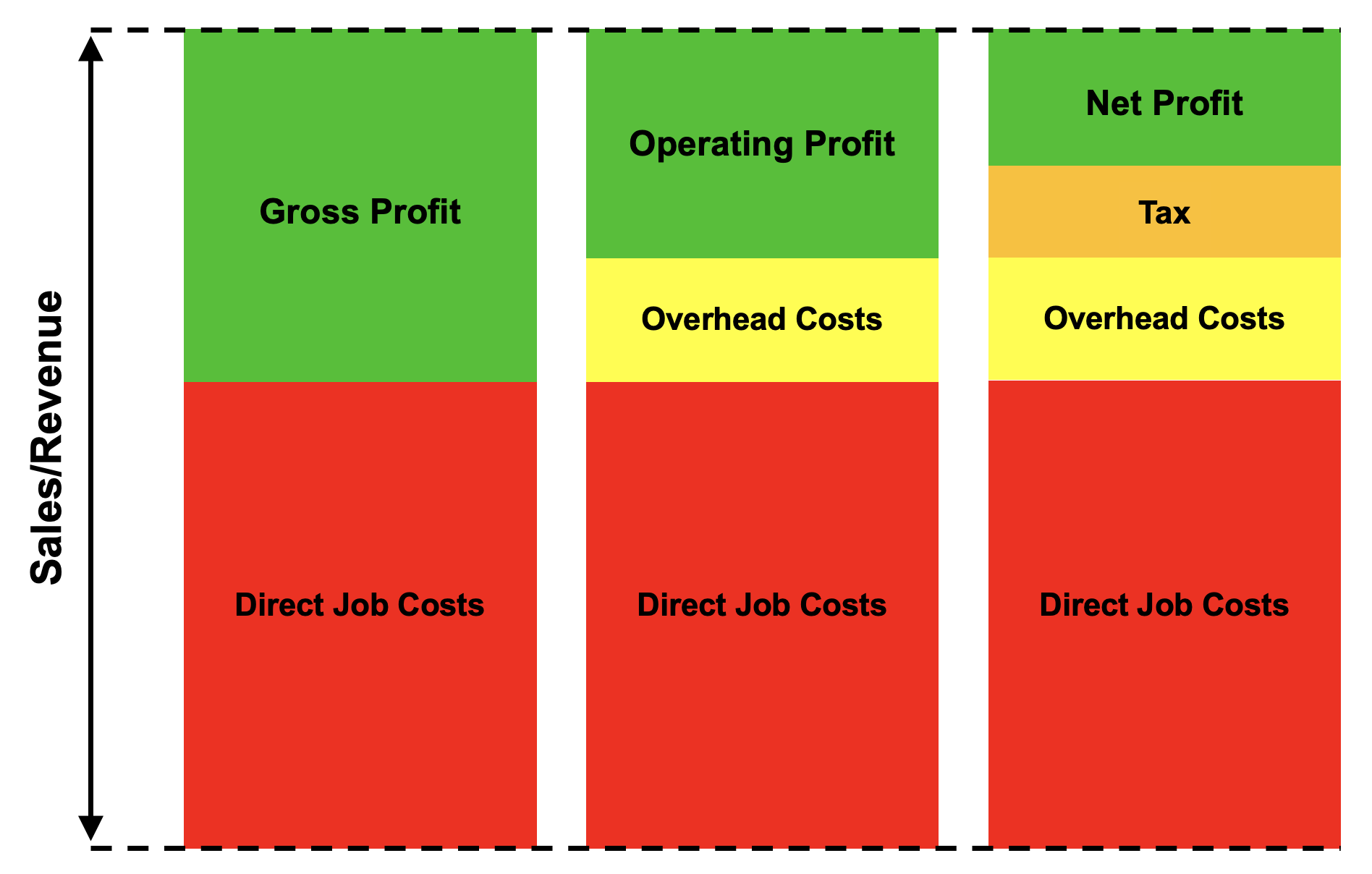

This is a HUGE problem because your Gross Profit Margin is the most important component of your entire pricing build up.

Because your Gross Profit is what…

(1) Covers your overhead costs, and

(2) Gives you a return in operating profit (which is what business is all about!)

So, if you don’t have a Gross Profit Margin Target that you’re trying to aim for across the board, then you’re pretty much pricing blind…

Yeah, you might’ve nailed the build-up of the costs to deliver an actual job… But you have little to no clarity on what it’s going to take to cover the costs of doing business and give you a return at the end of the day.

This is why you need to follow a top-down approach to pricing.

And what I mean by that, is you need to start with the high-level business numbers first.

Because only once you have that high-level 30,000ft birds eye view of what you’re trying to achieve from the business perspective, can you then begin to break it down into the micro granular details of prices and labour rates and so on, on an actual job.

If you start at the bottom in the granular level, you can get lost in the detail and the complexity of the job numbers… And understanding how those pricing numbers relate to the business numbers can get confusing.

Whereas, if you start from the top, and get crystal clear on the business numbers first, before you price a job, then you’ll have the clarity on the Gross Profit Margin you’ll need across every job to make sure you (1) cover your overheads, and (2) make the operating profit that you want.

It’s that simple.

Top-down, NOT bottom-up.

Profit shouldn’t be left to figure out at the end… It should be focused on from the beginning.

Focus on the numbers you want to achieve in the BUSINESS first, then look at what you’ll need to price each individual job or project at to make those business goals a reality.

That’s what I mean by top down.

How To Set A Gross Profit Margin Target

Now, you’re probably thinking, how do you calculate your Gross Profit Margin Target?

The simplest way to calculate your Gross Profit Target is to:

(1) Project how much you think your Overhead Cost will be over the next 12 months, and

(2) Set a target of how much Operating Profit you want to make over the next 12 months.

So, for example, let’s say you’re expecting there to be $800,000 in overheads over the next 12 months… And let’s also say that you want to make $300,000 in Operating Profit.

That means your Gross Profit Target is $1.1M (that’s $800K plus $300k).

So, you need to make $1.1M in Gross Profit over the next 12 months to (1) cover your overheads, and (2) make the operating profit that you want.

So, now that we have our Gross Profit Target… the next thing we need to do is calculate your Gross Profit Margin Target.

All we need to do here is project how much revenue we’re expecting to make over the next 12 months and divide your Gross Profit Target by that projected figure.

So, looking back at the example from above, let’s project that the business will make $3M in revenue over the next 12 months.

That means, to calculate our Gross Profit Margin Target, all we need to do is divide our $1.1M Gross Profit Target by our $3M revenue projection.

That comes out to be about roughly 37%.

That’s it. That’s your Gross Profit Margin Target that you need to try and aim for across the board… 37%.

For example, if we have a project that we estimate will take $63,000 in cost to deliver, then ideally, we want to be quoting that project at $100,000.

That’s a 37% Gross Profit Margin, leaving $37,000 in Gross Profit.

Now, of course, it’s not always that simple.

Chances are, you’re not going to be able to universally charge your Gross Profit Margin Target on every single job.

Typically, your margin shrinks with the size of the job. So, some work types will allow the margin, and some won’t.

That’s why you’re going to need to play a bit of a margin game across your different work types, and strike a balance, to try and achieve your Gross Margin Target across the board.

Your aim should be to average out at your margin target over the year.

For example, you could:

• Aim for 50% Gross Profit Margin for any job under $5k.

• Aim for 35-45% Gross Profit Margin for any job between $5 to $20k.

• And aim for 20-30% Gross Profit Margin for any job over $20k.

Now, whether or not you believe you can actually charge these prices is a whole other discussion… and that isn’t what this article was about.

The key takeaway I want you to take from this lesson, is that you need to approach your pricing from a top-down angle, NOT a bottom-up angle.

This will ensure you not only nail the build-up of costs to deliver the actual job, but also the build-up of what it takes to cover your overhead costs and make a profit for yourself at the end of the day.

If you at least have that understanding, you’ll be far better equipped moving forward to price in a way that is commercially viable for your business and makes sure that your business numbers are part of your pricing numbers.

If you're an electrician, plumber, painter, carpenter, or any other tradie business owner turning more than $1M a year looking for assistance with your tax, accounting, bookkeeping, and business advisory - click here to learn more!