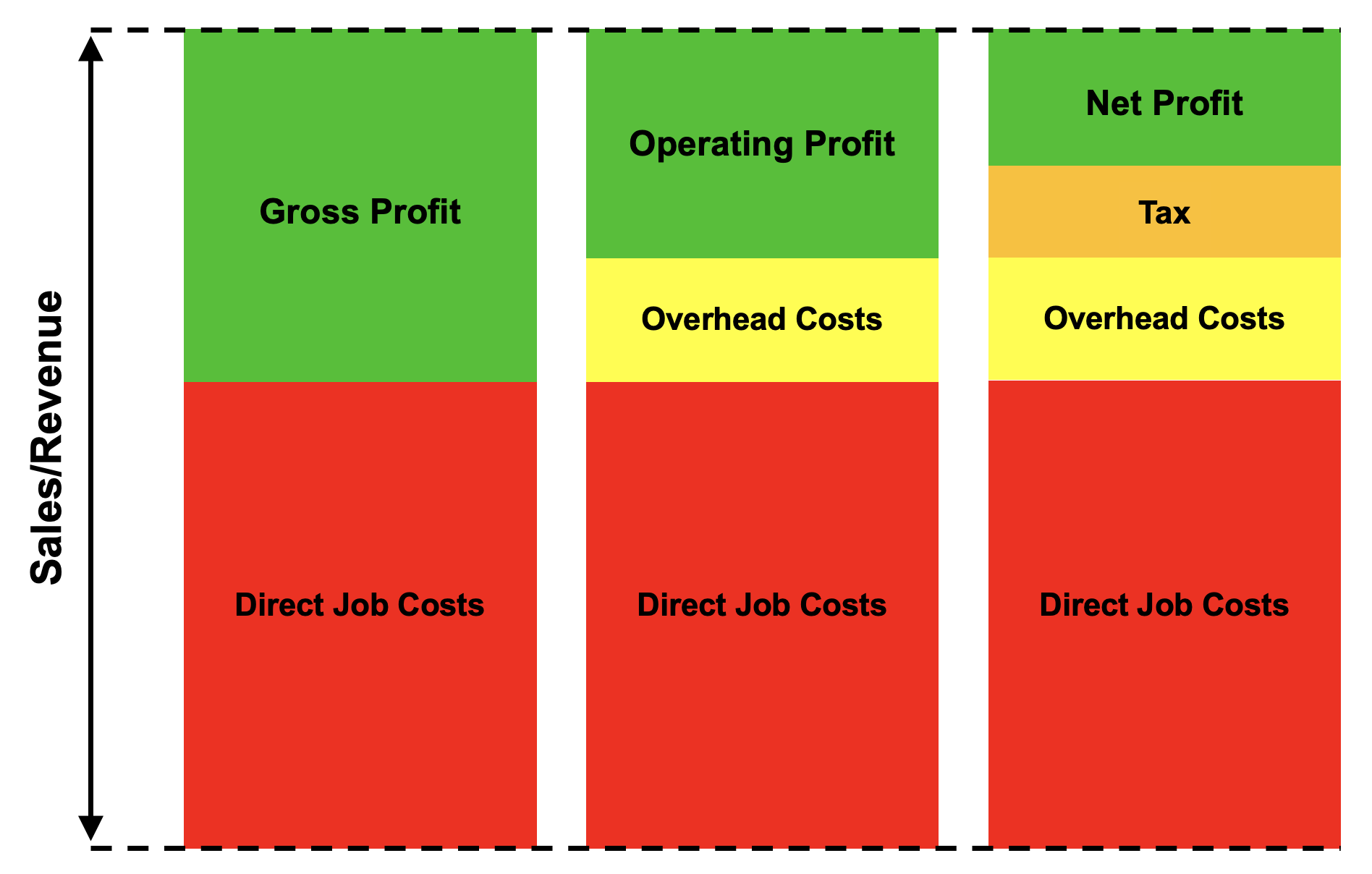

Now, in your business, there’s 3 main types of profits that exist.

They are, Gross Profit, Operating Profit and Net Profit.

But the one that I’m talking about here is Operating Profit.

This is simply the profit that’s left over after every single cost in your business has been accounted for, including your direct job costs, like labour, materials, subcontractors, equipment hire, and so on… as well as your overhead costs, like rent, accounting, subscriptions, insurance, IT and so on.

What’s leftover is your Operating Profit.

And your Operating Profit is critical for a business.

Not only from a perspective of principle, because you’ve invested blood, sweat and tears into building your business, so you should be getting a return on top of just your salary…

But also from a funding perspective.

You need cash to fund your business.

And operating profit is a critical element in helping you create more cash.

How Much Operating Profit Do You Need?

Well, from what I’ve seen over the years, most businesses that are profitable in our industry, achieve around a 5% operating profit margin…

And while this might sound all well and good because they’re making profit.

The reality is, it isn’t enough.

Sure, from a profit and loss perspective you’re making a 5% PROFIT margin… But the problem is, profit doesn’t pay the bills, CASH does.

You need cash to fund the business.

And your profit and loss statement tells you absolutely nothing about cash.

Profit VS Cash?

Profit is the result of your profit and loss… Cash is the result of your business.

So, while you may be making 5% in profit, it doesn’t mean you’re making 5% in cash.

And it’s because your profit and loss doesn’t factor in your receivables, your payables, your WIP or inventory, increases in assets, increases in debts and so on.

All influencers of CASH that sit on your balance sheet. And they all have a real dollar cost associated with them.

So, you can actually be profitable and run out of cash at the same time if you aren’t looking at what’s going on in your balance sheet.

The Hard Truth

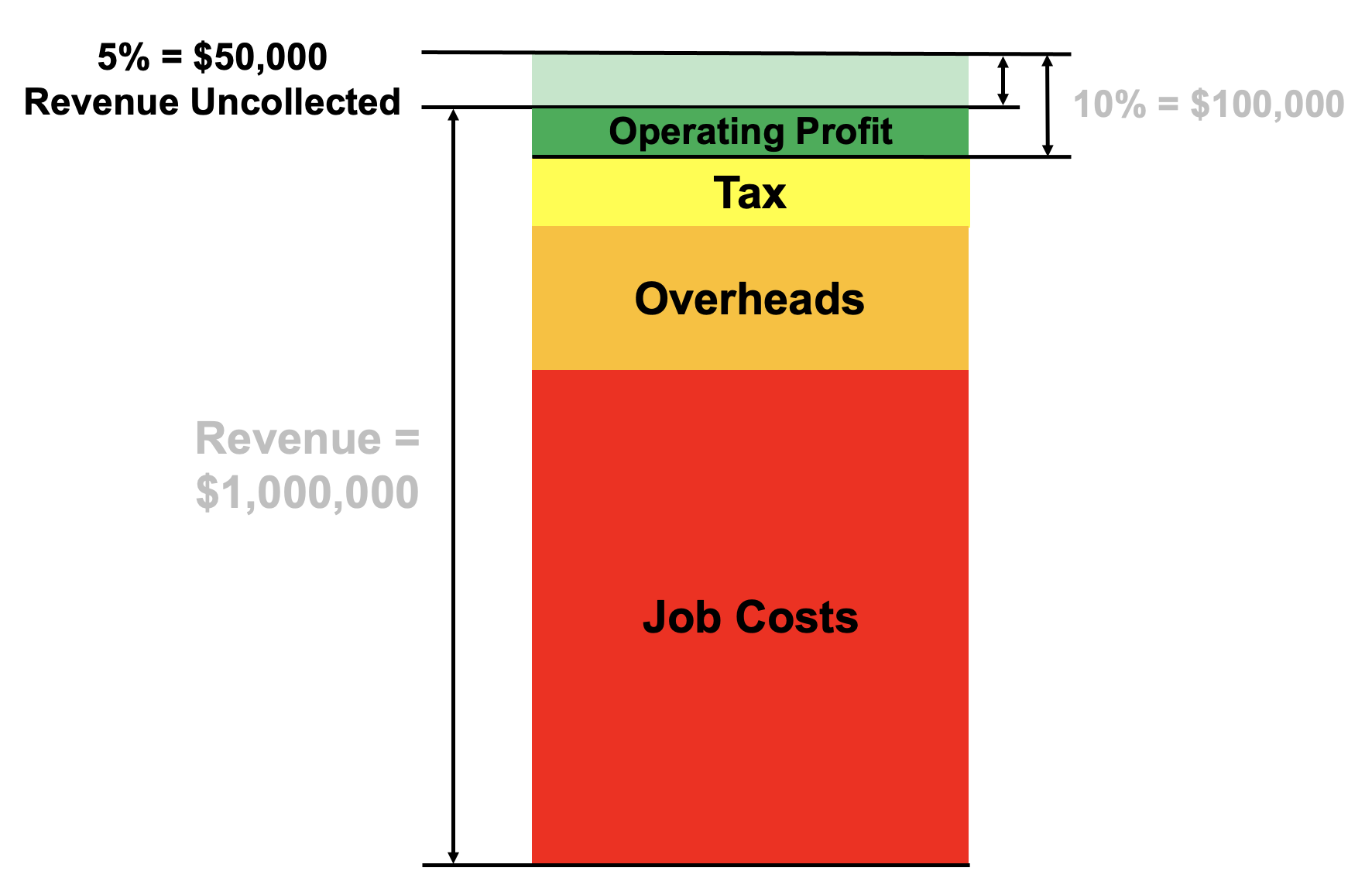

In fact, a recent report by Xero found that on average, 5 to 15% of revenue goes uncollected every single year.

So, with that one fact alone, it’s probably wise to assume that if you’re only making a 5% Operating Profit, chances are, you’re probably only just breaking even from a cash perspective… or even worse, you’re losing money.

Profit on paper does NOT mean cash in the bank.

That’s why we recommend that you strive for an operating profit margin greater than 10 to 15%.

Because based on that Xero report, and what we’ve seen first-hand, your breakeven point likely sits somewhere between 5 and 10%... NOT 0%.

Below is a rough guideline you can use to measure yourself against:

- 5% or less in operating profit means your business is likely on life support,

- 10% in operating profit means you likely have an okay business,

- 15% in operating profit means you likely have a good business, and

- 20% or more in operating profit means you likely have a great business.

So, if you’re turning $1,000,000 in revenue, you should really be aiming to generate $100,000 to $200,000 plus in operating profit.

Any less than $100,000 in operating profit and you’re entering the danger zone and you’ll need to make changes immediately because there’s likely $50,000 in cash not being collected.

But remember, these percentages are based off you not collecting just 5% of revenue.

If you’re not collecting upwards of 15% of revenue year on year, then your targets are going to look VERY, very different!

So, keep your receivables as low as possible and get the cash in the door ASAP.

The sooner you get cash in the door, the lower your TRUE breakeven point becomes.

If you're an electrician, plumber, painter, carpenter, or any other tradie business owner turning more than $1M a year looking for assistance with your tax, accounting, bookkeeping, and business advisory - click here to learn more!