One of the biggest issues in any trade business that I see, no matter the size, is cash flow.

Cash flow single handily kills more trade businesses than ANY other factor.

Suppliers on your back, customers taking too long to pay (or not paying), tax obligations, payroll, project delays… it’s an endless list of potential cash related issues, right?

But it comes to cash flow, I like to explain to clients that it’s always there in any business…

Often times, however, it’s simply caught up in the wrong places…

It’s in…

Lost sales, because of poor sales skills, priority management or conversion tools…

Poor margins, because of incorrect pricing strategies or wrong markets…

Unprofitable jobs, because of terrible labour utilisations and efficiency…

Excessive costs and overheads, due to lack of number analysis and budgeting…

Waiting periods, from slow invoicing or failing to chasse payments from customers…

Excessive stock, due to lack of planning and poor material management…

High finance costs, due to lack of negotiation and poor understanding of contracts

Blown out taxes, due to lack of planning…

I COULD GO ON FOREVER!

The point being the money lost in these areas needs to spend more time in your bank account and less time in these places.

So, really, this all comes down to wastage… doesn’t it?

Wasted opportunities due to lack of clarity and time to manage it and head off these cashflow and profit leaks.

So, what if you could improve areas in your business?

I often speak about the 7 key levers that any tradie can pull in their business to improve their profit and cash – which you can learn more about here – so what if you could make even as small as 1% improvements to uncover cash hidden within your business?

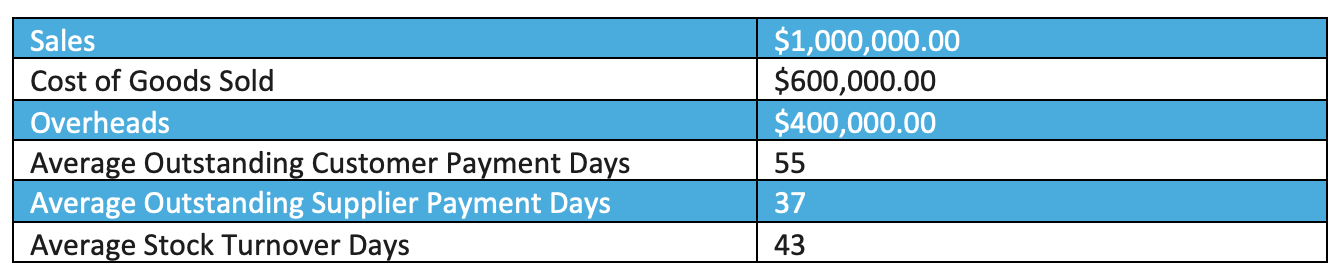

For illustration purposes let’s use an example of a business with:

The number of outstanding customer and supplier payment days is the number of days, on average, that all customers are taking to pay, despite your terms and conditions and what was agreed on.

Average stock turnover days is the number of days that all stock is sitting waiting to be used.

Now, as you can see, this business is barely breaking even – a typical scenario and reality for MANY small trade businesses…

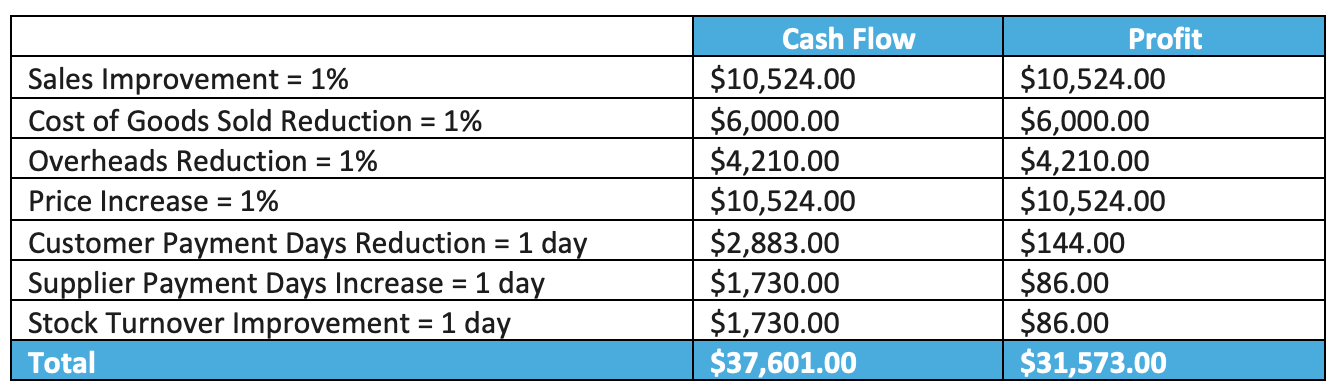

In this example if we change each of the above numbers by as small as 1% or 1 day, plus a 1% increase in price, look what happens to both cash flow and profit:

Now, the figures above don’t EXACTLY work out to be 1% because there is interest being paid on a business loan, but I digress…

The point here being, even just 1% improvements across the board can have an extremely positive impact on your cash flow and profit.

From breaking even to positive $31K – this is incredibly conservative.

But I’ve kept things this way to demonstrate my point.

How you go about achieving them in your own business comes down to coaching and the right support network in your corner, like for instance, Trade Business Success and Trade Business Accountants.

If you’d like me to calculate the impact that could be achieved in your business with 1% improvements across your own key business levers, then click here to book in a call with our team, I’d love to help.

If you're an electrician, plumber, painter, carpenter, or any other tradie business owner who is looking for assistance with your tax, accounting, and bookkeeping - click here to learn more!