I learnt very early in my career…

That people don’t want to make money.

They want to have money.

And something I see standing in the way of this for many contractors is pricing.

But more on that later…

I recently sat down with a new client Carlos to talk numbers.

He ran me through a custom-built spreadsheet specifically designed for pricing his work.

This thing was jam packed full of inputs, automatic calculations, and all kinds of information.

Right down to the microscopic detail.

Which meant he could produce quotes within minutes of receiving an enquiry.

Heck, this thing would put many job management software’s to shame.

It was impressive!

But as he gave me the grand tour revealing all the ins and outs of each cell.

Alarm bells started screaming in my ears.

Something wasn’t quite right.

I noticed one little error in math costing him over 6-figures in profit.

What was it you ask?

He’d fallen victim to a cardinal pricing sin.

And it was the biggest culprit of em’ all.

Let me explain…

Like many in the industry, my client thought the percentage he marked his work up by was the percentage of profit he’d make on a job.

He’d calculate his raw costs, add a 30% markup and then expect to make 30% gross profit.

The real margin, however, was only 23%.

A 7% difference costing him over $175,000 every year.

Why?

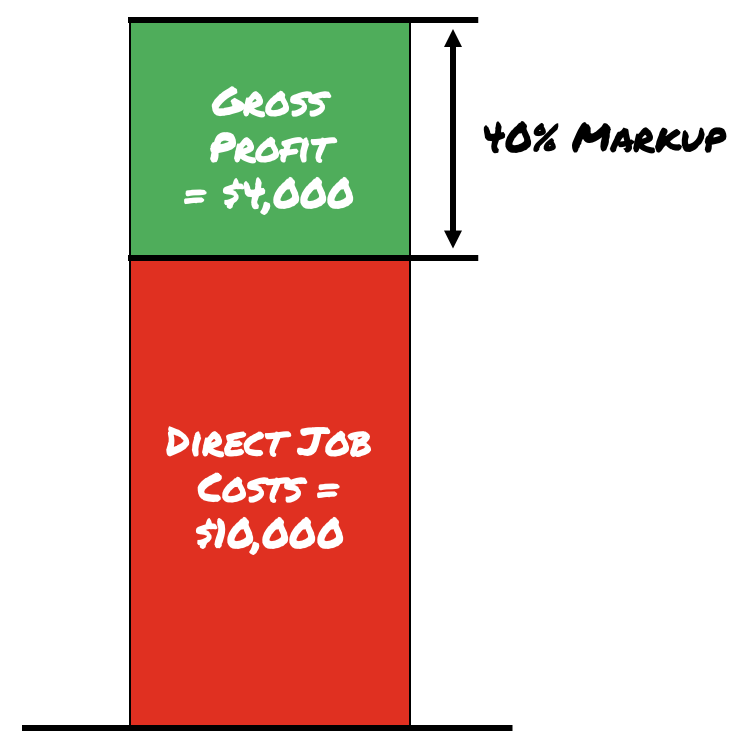

Let’s say you’re pricing a job and you estimate $10,000 in total job costs between labour and materials.

Then you decide to mark that $10,000 up by 40%.

This means your expected gross profit is $4,000 (40% of $10,000).

The final price is now $14,000 ($10,000 in costs plus $4,000 in gross profit).

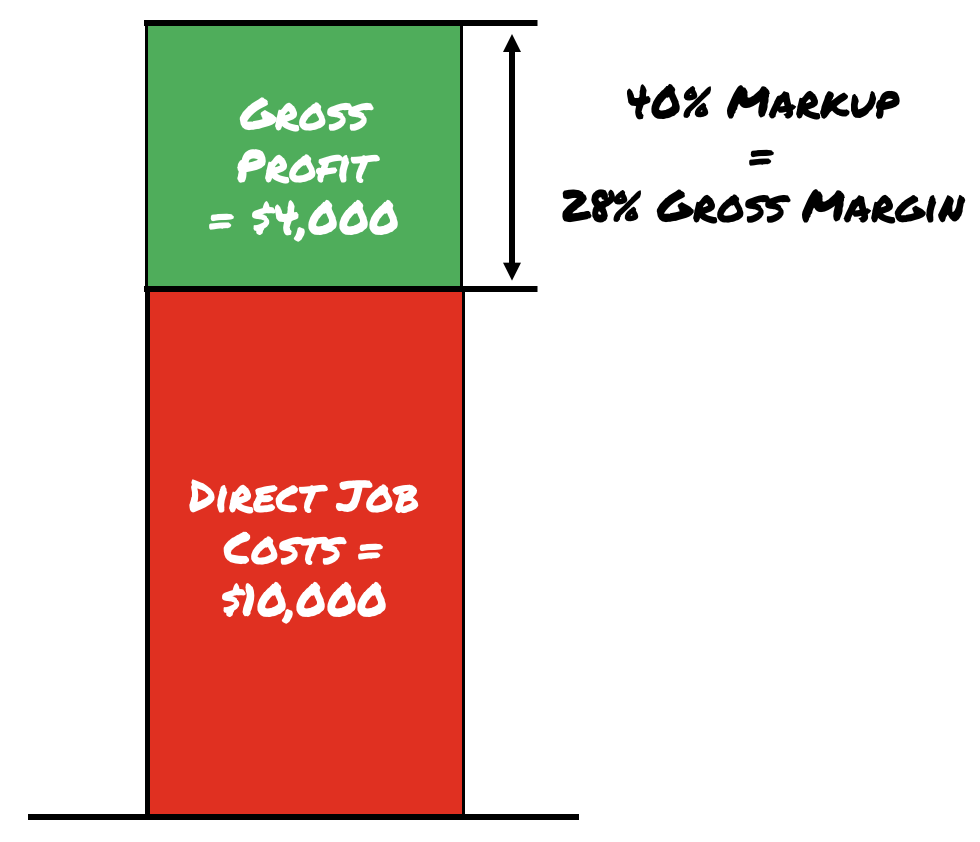

But $4,000 in gross profit is NOT a 40% gross profit margin.

It’s actually only 29%.

Because $4,000 in gross profit is 29% of the total $14,000.

($4,000 divided by $14,000)

That’s a drop of 11% in expected margin!

So what does this have to do with your business?

How can you benefit from this mistake??

By learning the lesson without the scar.

You cannot afford to confuse markup with margin.

MARGIN refers to the percentage of sales revenue that is gross profit.

MARKUP refers to the percentage you ‘markup’ your job costs to achieve a specific gross profit margin.

So, next time you’re in your quoting software or pricing up a job, pay attention to what percentage you’re marking up your costs by and what gross profit you're then expecting to make.

Otherwise you could be missing out on thousands of dollars’…

Across every. single. job.

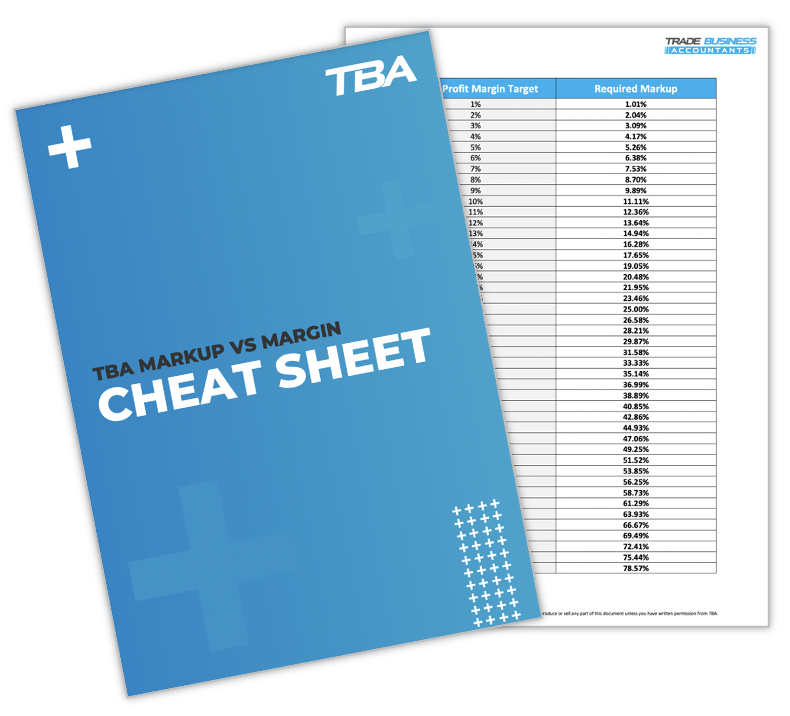

To calculate markup there’s two ways to go about it...

Option one:

Markup = Gross profit margin target / (1 - Gross profit margin target) * 100

For example, if you’re aiming for a 40% gross profit margin:

Markup = 0.4 / (1 - 0.4) * 100 = 66.67%

Or there’s option two:

To make life easier, I’ve made a simple resource with everything pre-calculated. Click here to get a free copy.

No personal information necessary.

(and no math required!)

Hope this helps.